By Jason Fordney

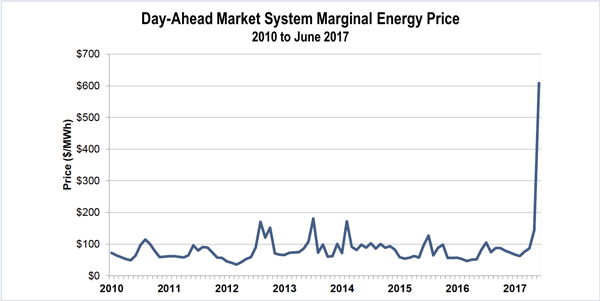

CAISO’s internal Market Monitor on Tuesday provided more details about rising energy prices in the second quarter and extreme day-ahead price spikes occurring over a three-day period during a June heat wave in the West.

Day-ahead energy prices increased each month in the quarter because of high temperatures that drove up electricity demand, the ISO’s Department of Monitoring said during a stakeholder call Tuesday. The Monitor announced the second-quarter results last week. (See Monitor: CAISO Q2 Prices Hit Record Despite Mitigation.)

“We generally saw them increasing in terms of just seasonal conditions. It wasn’t out of the ordinary,” DMM Market Analyst Kyle Westendorf said. “With the higher temperatures, we saw the higher prices.”

Westendorf did shine more light on events that occurred over several days leading up to June 21, when day-ahead prices hit $600/MWh. His presentation showed that each day over June 18-21 saw less generation bid into the market below $100/MWh, with June 21 wind energy supply coming in below average and down from the previous day. Traders also bid significantly fewer virtual supply offers below $100/MWh into the market between June 20 and 21.

“One of the things that was happening here, was participants engaging in convergence bidding were shifting away from virtual supply and more towards virtual demand positions in anticipation of higher real-time prices,” Westendorf said.

Convergence bidding refers to financial positions taken in the day-ahead market and liquidated with an opposite transaction in real time. It includes “virtual supply” that looks like a dispatchable energy resource to the market and “virtual demand” that looks like load.

Virtual demand, which is charged the day-ahead LMP, is considered a long position in the market, while virtual supply is paid the day-ahead LMP and is considered a short position. There is no physical transfer of energy in virtual bidding, which is a financial instrument.

Imports into CAISO also significantly declined between June 18 and 19, Westendorf said, and again between June 20 and 21.

“You start to see a pattern now,” he said, adding that the lack of imports was because of extremely high temperatures across the West, creating tight supply conditions across the region, affecting intertie activity and driving some of CAISO’s market results. The stress on the system of heat and high demand pushed the market software solution to a higher day-ahead price, he said.

The ISO and DMM are also investigating why energy prices increased on June 21 after mitigation was applied through computer software. The Monitor has said that, generally, prices should not rise after mitigation.