RENSSELAER, N.Y. — NYISO year-to-date monthly energy prices averaged $35.34/MWh in September, a 3% increase from a year earlier, Michael DeSocio, senior manager for market design, said Wednesday in presenting the ISO’s market operations report to the Business Issues Committee.

Locational-based marginal prices (LBMPs) averaged $29.57/MWh for the month, down 3.3% from August and 4.3% from September 2016.

The ISO’s average daily sendout was 437 GWh/day in September, down from 477 GWh/day in August and 458 GWh/day a year earlier.

New York natural gas prices gained 5% in September, averaging $2.27/MMBtu at the Transco Z6 hub. Prices were up 72.2% from a year ago. Distillate prices gained 32.3% year-on-year, with Jet Kerosene Gulf Coast averaging $13.40/MMBtu, up from $11.53/MMBtu in August. Ultra-Low Sulfur No. 2 Diesel NY Harbor averaged $12.80/MMBtu, compared with $11.65/MMBtu in August.

The ISO’s local reliability share was 16 cents/MWh, one-third higher than the previous month, while the statewide share “is trending lower at -50 cents/MWh,” compared with -31 cents/MWh in August, DeSocio said. Total uplift costs were lower than in August.

In speaking about the Broader Regional Markets report, DeSocio only highlighted that FERC last month accepted NYISO’s proposed Tariff revisions regarding cost recovery for the Ramapo PARs, as filed by the ISO in June. NYISO foresees negotiating with PJM by year-end the cost sharing for the replacement of PAR 3500.

Proposed Tariff Changes for Energy Storage

The committee approved proposed Tariff and Ancillary Services Manual changes to define the role of inverter-based energy storage in providing synchronized reserves.

Daniel F. Noriega, NYISO associate market design specialist, presented the BIC-proposed Tariff changes that would allow generators and demand-side resources that use inverter-based energy storage technology to provide spinning reserves.

The ISO last year asked the Northeast Power Coordinating Council (NPCC) to clarify whether such resources can provide synchronized reserves. The NPCC responded that “a storage resource with inverter technology complies with the original intent of the synchronized reserve requirement and therefore shall qualify towards a [balancing authority’s] complement of synchronized reserves.”

NYISO in January presented its Market Issues Working Group with proposed Ancillary Services Manual revisions to reflect that clarification. Stakeholders provided feedback on the wording, which NYISO incorporated in the updated proposal presented Wednesday. NYISO intends to bring the proposed Tariff and manual changes to the Operating and Management committees for action this month.

Fuel Cost Adjustment Calculation to be Refined

The BIC also approved a proposal that would more closely align the real-time and day-ahead impact tests and penalty calculations used to identify generator misuse of fuel cost adjustments (FCAs). The current day-ahead process is considered more precise because it tests the impact on real-time LBMPs based on market reruns.

NYISO Mitigation Reference Analyst Nicholas Shelton explained that FCAs allow generators to submit a fuel type or fuel price — or a combination of both — along with their energy offers. Once the ISO validates the FCA is within posted thresholds, a generator can update its incremental energy and minimum generation reference levels to reflect the new information. The ISO’s Market Mitigation & Analysis unit reviews all FCAs, and those that fail the conduct and impact tests may be subject to penalty.

The ISO has found that reviewing FCAs from only the prior seven days does not ensure enough data are available to draw conclusions about tendencies toward an upward bias in prices. The proposed changes would combine the day-ahead and real-time market penalties into one section and lengthen the FCA review period to 90 days from the previous seven days.

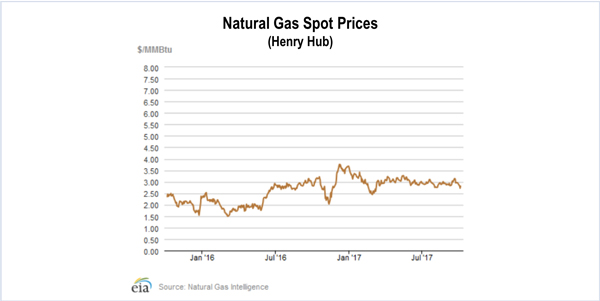

According to the proposal, the 10% threshold used in screening for bias has become increasingly restrictive with the decline in natural gas prices, so that a $2/MMBtu price translates into a very tight threshold. Rather than using a 10% threshold to identify bias, the proposal would rely on the greater of 10% or 50 cents/MMBtu.

The proposed changes will go to the Management Committee in October and, if approved, be submitted to the Board of Directors in November prior to filing with FERC.

— Michael Kuser