By Michael Kuser

NRG earned $171 million ($0.53/share) last quarter, compared with $402 million ($1.27/share) in the same period last year. Revenues were down 10.9% to about $3 billion.

Gutierrez said during a Nov. 2 earnings call that although the company is “on track” to transform itself through cost-saving measures, the third-quarter results led the company to lower its full-year earnings before interest, tax, depreciation and amortization (EBITDA) guidance to $2.4 billion to $2.5 billion from the previous $2.56 billion to $2.76 billion.

“In Texas we saw both a major hurricane and the coolest August since 2004, with cooling degree days 13% below normal, and in the Northeast, cooling degree days were on average 8% below normal for July and August,” Gutierrez said. He noted that ERCOT summer wholesale prices fell 43% below expectations. Mild weather across the East and in Texas eliminated any opportunity to benefit from scarcity pricing.

NRG attributed one-time financial impacts of $40 million to Hurricane Harvey, evenly divided between its generation and retail operations in Texas. About 80% of the company’s baseload generation on the Gulf Coast was available during the worst part of the storm, and 95% has been restored to date.

Brighter Side

NRG’s retail business continues to improve its operating efficiencies, customer acquisition and retention, which partially offset the impacts of milder summer weather, especially in ERCOT, Gutierrez said.

He said certain cost and margin enhancements will start impacting the company’s bottom line next year, as well as the sale of subsidiary NRG Yield and its renewables assets, which is expected to be completed this year and return up to $4 billion. The company continues to use excess cash to deleverage itself, he said.

“Since our second-quarter call, we have taken another $600 million of debt out of our capital structure, completing our 2017 capital allocation,” Gutierrez said.

He also pointed to improving market conditions in Texas as a particular bright spot for the company.

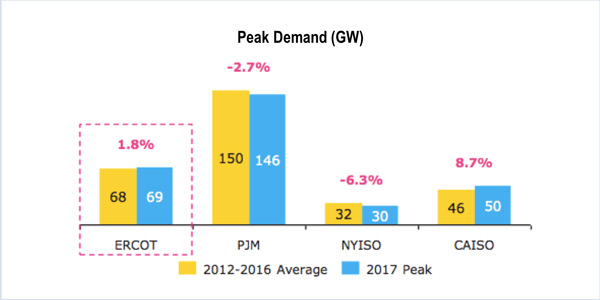

“Despite the absence of extreme weather this summer, ERCOT fundamentals remain strong. ERCOT’s 2017 peak load of 69.5 GW was up nearly 2% over the five-year average and came in just shy of the 2016 peak,” he said.

The recently announced retirement of more than 4 GW of generating capacity in ERCOT puts further pressure on a market with already strong fundamentals, Gutierrez said. Vistra Energy on Oct. 6 announced plans to retire three aging coal-fired units in East Texas with a combined capacity of 1,880 MW, rendered obsolete by ERCOT’s record low prices. (See Vistra Energy to Close 2 More Coal Plants.)

“For summer of 2018, these new retirements and asset delays alone will put ERCOT at the lowest reserve market on record, which is suspected to be somewhere between 10 and 11%,” Gutierrez said. “Other changes, such as delayed new builds and new industrial demand, could lower these numbers even further.”

But while the retirements are nudging up forward markets, prices are still below what is needed to justify new builds, he pointed out.

Calls to Action on Market Reform

In response to an analyst question about whether NRG would consider selling parts of its Texas portfolio, Gutierriez said, “Right now we’re very comfortable with our Texas portfolio.” He said the capability of NRG’s generation fleet aligns well with its retail loads.

But while the recent retirements are improving market health, ERCOT must do more to strengthen markets and should recognize the locational value of power plants, he said.

“Reliability and resiliency are important attributes to the grid, and we will continue to work with ERCOT to ensure that generators close to load centers are compensated for all the benefits they provide.”

Beyond the positive developments in ERCOT, Gutierrez said NRG sees several other “calls to action” occurring for market reform.

“As the power grid continues to undergo significant change — low gas prices, renewable penetration and attempts for out-of-market subsidies for uneconomic generation — regulatory bodies and other stakeholders are taking note,” Gutierrez said. “These have led to several significant catalysts, from the [Department of Energy] staff report on competitive markets and [Notice of Proposed Rulemaking], to PJM’s proposed market reforms. I cannot recall another time when there has been such urgency and reach across ISOs to improve competitive energy markets.” (See Market Summit Tackles Ongoing PJM Changes.)

Gutierrez said NRG has been optimistic about market developments in PJM, especially around the introduction of Capacity Performance.

Asked to rank the most promising areas for growth, Gutierrez responded that NRG aims to balance its generation and retail businesses and is focused on perfecting an integrated platform.

“A lot of the generation is going to be driven by our retail needs and how we grow retail, and a lot of our retail will be driven by where we have generation,” he said. “We’re still long in generation in PJM. We have a ways to go before we have a balanced portfolio like we have in Texas. … Just in terms of market structure, I would put PJM No. 1, New England No. 2 and New York No. 3.”