By Rory D. Sweeney

PJM on Wednesday released a proposal for revising price formation rules in its energy markets, teeing up stakeholder deliberation on changes that staff estimate could increase market costs by as much as $1.4 billion.

The two-part plan focuses on reducing out-of-market payments and changing shortage pricing to “accurately reflect the value of energy and reserves during reserve shortages.” PJM expects to present the plan to members through a problem statement and issue charge proposed at a Dec. 7 Markets and Reliability Committee meeting. It hopes stakeholders will approve a motion to examine the proposal through the stakeholder process at a second MRC meeting two weeks later.

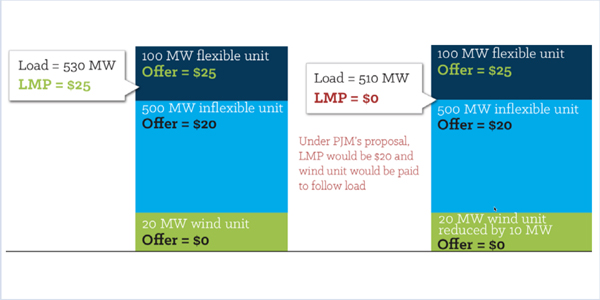

An example presented by PJM highlights how its current LMP-calculation method fails to represent true incremental cost. When a flexible unit is on the margin, the LMP is its offer price, but when it is an inflexible unit, the LMP drops to the next flexible unit’s offer. The inflexible unit receives uplift as an out-of-market payment to compensate for its costs. PJM’s proposal would set LMP at the inflexible unit’s offer and pay flexible units lower in the stack to follow the reduction in load. | PJM

“Getting prices right is of growing importance, anticipating a continued increase in the penetration of intermittent resources,” the report says.

LMP Changes

PJM plans to reduce out-of-market payments, such as uplift, by allowing inflexible units — which can’t change their output incrementally — to set LMPs and paying flexible units to better follow load changes.

Bresler | © RTO Insider

Speaking during a media briefing Wednesday, PJM’s Stu Bresler said that when the RTO implemented LMP, it knowingly included several “simplifying assumptions” that the algorithm wouldn’t consider units’ fixed costs in the market optimization or allow inflexible units to set prices. The assumptions “served very well,” but some of the “downsides … were masked … often enough” by flexible resources on the margin and setting prices with higher costs than inflexible units, he said.

“In the past, higher-cost flexible units set price often enough to ensure that all needed resources could earn sufficient revenues in the energy market, when combined with capacity revenues, to drive efficient resource investments,” the report says. “Today, the continuing penetration of zero-marginal-cost resources, declining natural gas prices, greater generator efficiency and reduced generator margins resulting from low energy prices have resulted in a generation mix that is differentiated less by cost and more by physical operational attributes.”

Allowing inflexible units to set LMPs and incentivizing flexibility will reduce out-of-market uplift payments and increase the value of flexible units with higher LMPs and flexibility compensation, PJM argues. The extended LMP method, which PJM had told FERC it was “actively exploring,” would bifurcate its security-constrained economic dispatch into separate dispatch and pricing runs, as is already done in MISO, ISO-NE and NYISO.

Shortage Pricing

To address shortage pricing, PJM proposes to create a 30-minute operating-reserve product to supplement its current 10-minute reserves and to revise its operating reserve demand curve to more accurately value granular amounts of reserves.

“Improved shortage pricing would substantially enhance market performance,” the report said, through incenting demand response and distributed generation “when it is most needed,” reducing the “‘missing money’ problem” that creates generators’ reliance on capacity market revenues and providing better signals for transmission investment.

“PJM believes that it is critical that … the shortage-pricing mechanism be reviewed and enhanced,” the report said.

Costs

Bresler noted that other grid operators, including MISO and ISO-NE, have already implemented portions of these proposals. He said either element would be “beneficial,” but that “we think the maximum benefit would be achieved by implementing both.”

The changes would affect both the real-time and day-ahead markets and come at a cost. PJM estimated the energy market changes will likely reduce capacity market costs but still increase overall costs between 2 and 5%, or between $440 million and $1.4 billion, annually.

Bresler said it isn’t possible to determine how the proposals would interact with any decision FERC makes on the coal and nuclear price supports suggested by the U.S. Department of Energy or if they would create any instances of double compensation.

“It’s very difficult to answer that question in the hypothetical,” he said.

Timing

PJM included the proposal in its comments to FERC on the DOE request, arguing that the commission should ignore the department’s ideas and instead give the RTO a deadline to present for approval its own solution. PJM had previously floated its proposal at a FERC technical conference on price formation. Members have criticized the RTO’s actions as attempting to bypass its stakeholder process.

Bresler said PJM is “very much looking to engage our stakeholder process with the proposal” but declined to rule out filing the revisions unilaterally if they don’t receive stakeholder endorsement.

“It’s too soon to answer that question,” he said. “We did suggest to FERC that putting some time bounds around that discussion and … requiring something back from PJM by some date in 2018 would be beneficial, and I think we’ll probably suggest [to stakeholders] … that we get in front of FERC [for approval] sometime in the fall of 2018.”

PJM included in its proposal the same letter of endorsement from Harvard economist William Hogan that it submitted with its FERC filing, but the RTO referenced none of the criticism that accompanied the proposal. (See NOPR Reply Comments Bring More Criticism of PJM Proposal.)