By Rory D. Sweeney, Jason Fordney and Rich Heidorn Jr.

PHILADELPHIA — PJM and reliability coordinator Peak Reliability announced Thursday they will explore the development of markets and other services in the West, creating a potential competitor to the expansion ambitions of CAISO and SPP.

Peak Reliability, the NERC-designated reliability coordinator for most of the Western Interconnection, announced the agreement to “explore reliability services and markets in the West” with PJM Connext, a non-regulated subsidiary of PJM Interconnection LLC, operator of the world’s largest wholesale electricity market and North America’s largest grid.

“Peak and PJM Connext will begin review of potential reliability services, market design, governance, product suites, rules, technology and organization,” they said in a press release, promising to report on their finding by the end of March 2018. “We believe that our partnership will lead to a viable and credible alternative structure in the West,” the release quoted PJM CEO Andy Ott.

“I think it’s a good fit,” Ott said in an interview after a meeting of the PJM Members Committee Thursday.

Ott said the initiative resulted from requests Peak had received about whether it could provide more services. “They’re geared toward reliability services. We could provide the market-oriented and operational services,” he said.

“At this point, it’s exploratory,” Ott added. “The notion of having this separate company allows us to do that and keep risk off of PJM members.”

“PJM has an established track record as an innovative and cost-effective provider of system operations and market services,” Peak CEO Marie Jordan said in a statement. “Our partnership seeks to leverage Peak’s West-wide system model, PJM’s markets expertise, and our combined processes, people and tools. Both Peak and PJM share a strong commitment to developing solutions, tailored to the Western Interconnection.”

The two said their research will include an “outreach program” to Western Interconnection “industry leaders and stakeholders.”

The announcement led Montana regulator Travis Kavulla to tweet Thursday afternoon that PJM and Peak “just sent a letter to regulators announcing they’re exploring how to form a new RTO in the West.”

“Big stakes here,” added Kavulla, a member of the Montana Public Service Commission and former chair of the National Association of Regulatory Utility Commissioners. “If Peak against the odds pulled this off, it’d be a huge coup. But Peak’s funders (including those championing rival RTO efforts) probably aren’t going to be very warm on this.”

Kavulla told RTO Insider: “I took the liberty of describing it as an RTO because I figured they are using a euphemism to avoid that description.”

Asked about Kavulla’s interpretation, PJM spokeswoman Susan Buehler said “The agreement allows PJM and Peak to explore opportunities in the West. We are looking at market services but it’s too early to predict anything else.”

Later, Kavulla tweeted a quote from Gary Ackerman, executive director of the Western Power Trading Forum, who weighed in with a report in the Friday Burrito, his weekly newsletter.

Ackerman said he spoke with Jordan and asked her “if the new venture was contemplating a full market including day-ahead, real-time energy and ancillary services? She assured me it was.

“She also said although no anchor balancing authorities have yet come forward, she has been in discussions with many … and there is widespread interest,” Ackerman wrote, according to Kavulla.

Kavulla also shared a portion of the letter to regulators, in which Peak called the announcement “an exciting opportunity to address challenges facing the West and the issues we have been hearing about as we’ve met with many of our stakeholders. We believe that Peak and PJM’s complementary strengths can lead to a viable and credible alternative option at the time when the West is looking at markets to reduce costs.”

RTO Requirements

Any effort to create a full-fledged RTO would require PJM and Peak to meet the requirements of FERC Order 2000. The order sets four minimum requirements for an RTO: “independence from market participants; appropriate scope and regional configuration; possession of operational authority for all transmission facilities under the RTO’s control; and exclusive authority to maintain short-term reliability.”

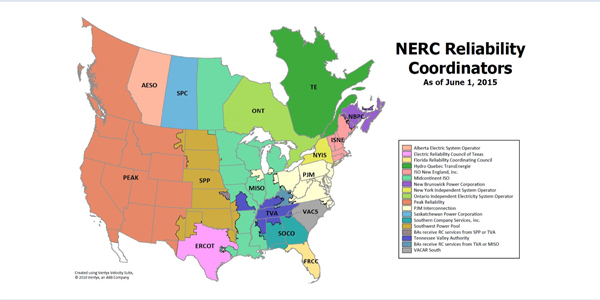

Headquartered in Vancouver, Wash., Peak runs reliability coordination offices there and in Loveland, Colo., which provide situational awareness and real-time monitoring of all or parts of 14 western states, the Canadian province of British Columbia and a small, northern portion of Baja California, Mexico. Its region totals 1.6 million square miles and includes 110,129 miles of transmission and a population of 74 million.

The venture is the latest development to indicate the West is warming to the notion of organized markets.

Eight members of Mountain West, including Xcel Energy’s Public Service Company of Colorado, are considering joining SPP. (See Col. Regulators Talk Governance with SPP, Mountain West.) Peak Reliability is Mountain West’s current reliability coordinator.

SPP Chief Operating Officer Carl Monroe did not seem concerned about the prospect of competition. “We’re supportive of markets and collaboration between reliability coordinators in the West and welcome the opportunity to work with PJM and Peak Reliability to bring reliability and economic benefits to ratepayers in the west, just as we have been successfully doing in the east for many years,” he told RTO Insider.

California enacted a law in 2015 that requires CAISO and state energy agencies to explore expanding the ISO to help the state meet its 50% renewable energy mandate. CAISO’s Western Energy Imbalance Market (EIM), which includes PacifiCorp, Arizona Public Service, Puget Sound Energy and NV Energy, has produced more than $213 million in gross benefits since commencing operation in November 2014.

But governance concerns have hampered efforts to build the EIM into a full-fledged RTO. One contentious issue for coal-burning states is California’s requirement that its utilities track carbon emissions from generation serving their loads to ensure compliance with emissions caps. (See CAISO Expansion in Question as EIM Grows.)

The Western Electricity Coordinating Council (WECC) said it had no comment on Peak’s plans. CAISO did not immediately respond to a request for comment.

Peak Reliability was formed in 2014 when WECC bifurcated, with it becoming a NERC Regional Entity and Peak Reliability becoming the reliability coordinator. FERC approved the bifurcation in February 2014, making Peak independent of WECC. WECC was formed in April 2002 from the merger of the Western Systems Coordinating Council, and two regional transmission associations.

NERC regional entities are responsible for reliability compliance monitoring and enforcement activities, while reliability coordinators maintain reliability in real-time, coordinating or directing actions to mitigate system issues.

WECC is in the midst of a separate rebranding and restructuring to focus more on its core reliability mission.

Evolution of PJM Technologies

PJM Connext, formerly known as PJM Technologies, was formed in 2000 under PJM’s “other activities protocol,” Ott said.

“We were one of the first RTOs, so some of the concept back then was if we were to monetize any of that intellectual property or groundbreaking ideas, then that feeds back to the membership. That would lower the stated rate,” Ott said.

PJM Technologies includes PJM EIS (Environmental Information Services), which operates the Generation Attribute Tracking System for tracking renewable energy credits. PJM is also looking to license its Dispatcher Interactive Map Application (DIMA) to transmission owners. (See “TOs Must Approve PJM Licensing of DIMA,” PJM Operating Committee Briefs: Nov. 7, 2017.)

In October, PJM announced the unit had signed a contract to help the Chinese province of Zhejiang develop a real-time energy market. That effort will involve three to four full-time equivalent PJM staffers for 18 months. The province, south of Shanghai, has a load equal to almost half of PJM’s.

PJM is consulting with the Chinese on market design, whereas the deal with Peak is for market operation, Ott said.

“There’s more opportunities presenting themselves” now, Ott said “In this case, we see several popping up at once. Just so happens there are more of them, and we’re being more transparent” about announcing the work, he added. “It’s an opportunity for us to further the advance of competitive markets around the world.”

Tom Kleckner contributed to this article.