By Jason Fordney

CAISO day-ahead prices hit all-time highs for the second time this year during the third quarter, and the frequency of price spikes in the 15-minute and five-minute markets increased, the ISO’s Department of Market Monitoring said in its quarterly market performance report.

High temperatures in California drove up demand at the beginning and end of August and into September, according to the report. Load peaked at 50,116 MW on Sept. 1, just short of the 50,270-MW peak record set in July 2006. Trading that day also saw day-ahead system marginal prices soar over $200/MWh during a four-hour period and hit $770/MWh in one interval.

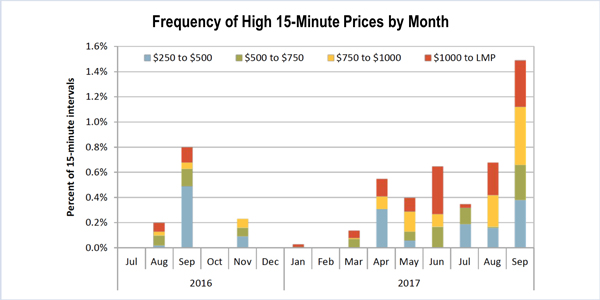

“These outcomes were primarily driven by tight supply conditions as a result of a number of factors in combination with high demand while a significant amount of solar production is ramping down during sunset hours,” the report said. Average 15-minute market prices increased during every month of the third quarter from about $34/MWh in June to more than $45/MWh in September because of higher temperatures and loads.

The Monitor also confirmed that software problems had caused day-ahead prices to hit record highs in the second quarter even after being mitigated. In its second-quarter report, the department had noted that prices should not rise after mitigation and said it was investigating the cause. (See Monitor: CAISO Q2 Prices Hit Record Despite Mitigation.) The third-quarter report said the error was fixed on July 22.

“The ISO has determined that a software error introduced in 2016 resulted in infeasible energy and ancillary service awards for resources in the market power mitigation run but not the binding market run in the day-ahead market,” the Monitor said in the third-quarter report. “The software error resulted in an erroneous increase in supply available in the market power mitigation run, causing prices in that run to be lower than they would have been had all awarded schedules been feasible.”

CAISO is “currently evaluating the impact of this error on the market power mitigation process on affected days,” the report said.

Day-ahead prices appeared to be competitive in most hours, the Monitor said, and total year-to-date wholesale energy costs are close to 2016 totals, after the prices are adjusted for natural gas and greenhouse gas prices. Higher gas prices resulted in larger overall energy costs for 2017.

Transmission congestion was low in the day-ahead market in the Pacific Gas and Electric and Southern California Edison service areas but caused prices to drop about 2% in San Diego Gas & Electric’s area. Congestion in the 15-minute market pushed up prices in PG&E and SCE and decreased SDG&E prices. Frequent congestion on the Doublet Tap-Friars 138-kV constraint created an export-constrained area, undercutting prices in San Diego.

The Monitor said its analysis of natural gas price volatility shows a limited need for increased bidding flexibility created by raising commitment cost and default energy bid caps. CAISO followed the department’s recommendation and reduced the Aliso Canyon real-time gas scalars to zero beginning Aug. 1, raising them again temporarily Aug. 4-7 because of hot conditions.

Congestion revenue rights auctions took in $9 million less than payments to entities purchasing those rights, increasing year-to-date ratepayer losses to $38 million and to more than $680 million since the market began in 2009. The Monitor for more than a year has been calling for CAISO to eliminate CRR auctions. (See CAISO Monitor Proposes End to Revenue Rights Auction.)

The Monitor will discuss the third-quarter report with market participants during a Dec. 20 conference call.