By Jason Fordney

CAISO is floating a proposal that would extend many of the features of its day-ahead market into the footprint of the Western Energy Imbalance Market (EIM) while possibly averting some of the thorny governance issues related to regionalization of the ISO.

The proposal is part of a broader plan focused on improving CAISO’s day-ahead market to better deal with emerging trends in resource procurement and planning, the ISO said. CAISO is including the plan in its Draft 2018 Policy Roadmap, which will guide the ISO’s many ongoing initiatives over the next three years related to grid operations, markets, new resources and generator retirements.

But a proposed expansion of the ISO’s day-ahead market could face competition from other corners. Reliability coordinator Peak Reliability and PJM announced last week they will explore the development of markets and other services in the West. (See PJM Unit to Help Develop Western Markets.) Farther inland, Mountain West Transmission Group is advancing on plans to integrate its member utilities into SPP.

California’s efforts to regionalize CAISO’s operations have twice stalled in the State Legislature in the last two years over concerns the state would cede too much oversight of its grid to other Western states less friendly to its ambitious environmental policies. Those states, in turn, have been wary of submitting control of their transmission systems to an entity controlled by their much larger neighbor.

An industry source, who wished to remain anonymous because they were not authorized to speak publicly, told RTO Insider that several present and future EIM members were gathering in Phoenix this week to discuss changes to the ISO’s day-ahead market. But Idaho Power spokesperson Brad Bowlin could not confirm the meeting.

“Unfortunately, we are not able to respond to your questions about this,” Bowlin said. “Any information will have to come directly from CAISO.” Idaho Power is scheduled to join the EIM next spring.

ISO spokesman Steven Greenlee said he was not aware of the meeting.

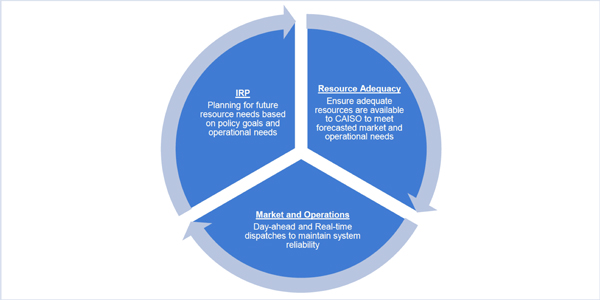

The ISO’s proposal would create something like an “RTO-lite,” allowing for each EIM balancing authority (BA) to retain its reliability responsibilities and assuring that states could maintain control over integrated resource planning. Under the plan, resource procurement would remain under the authority of local regulators that — along with BAs — would continue to direct transmission planning and investment decisions.

CAISO said its effort would target better load management, more integration of distributed resources and enhancements to the EIM. Primary among the challenges the ISO faces is a shift toward more renewable and distributed energy resources, and conflicts between resource planning and reliability planning that are driving an increased need for out-of-market reliability-must run contracts for natural gas plants. (See Board Decisions Highlight CAISO Market Problems.)

“Recent grid operations challenges [point] to [the] need for day-ahead market enhancements to better manage [the] net load curve in real time,” the ISO said in a presentation prepared for a Dec. 14 call about the roadmap.

Extending the day-ahead market to the EIM would improve scheduling efficiency and integration of renewables, and allow EIM participants to take advantage of enhancements to the market, the ISO said. The ISO re-prioritized its initiatives to focus on the day-ahead market changes as well as deferring development of some other market products.

CAISO is proposing changes to the day-ahead market to “address net load curve and uncertainty previously left to [the] real-time market.” These include 15-minute scheduling granularity and a “flexible reserve” product that pays resources for must-offer obligations in the real-time market to address load uncertainty. Also being contemplated is combining the integrated forward market and the residual unit commitment process.

Extending the day-ahead market to the EIM would require market members to align transmission access charge models, according to the ISO. It would also involve expanding congestion revenue rights across the expanded footprint and analyzing day-ahead resources so balancing areas don’t “lean on” each other for capacity, flexibility or transmission.

The ISO is also planning collaborative programs with the California Public Utilities Commission to better align resource adequacy planning with reliability planning and the changing grid.

The policy initiatives catalog lists CAISO’s many ongoing updates to market rules, the EIM, distributed resources, generation retirements and changing conditions on the grid. Part of the roadmap process is the February updating of the catalog.

The final roadmap is due to be posted on Jan. 10, and more stakeholder calls will be held prior to review by the CAISO Board of Governors on Feb. 15. The ISO will accept comments on the draft roadmap until Jan. 4.