By Tom Kleckner

ERCOT’s reserve margins may be tightening, but executives on Monday assured reporters that all is well with the Texas grid.

The ISO’s year-end Capacity, Demand and Reserves (CDR) report projects a 9.3% planning reserve margin for 2018, half of what it was in the May report and 4 points below the 13.75% target ERCOT established for itself in 2010. But during a conference call with media, staff described the CDR report’s reserve margin projections as a “snapshot in time” and detailed a list of tools available to handle any emergencies.

“The reserve margin that comes out of the CDR is a snapshot,” said Warren Lasher, senior director of system planning. “Reserve margins are expected to fluctuate in the current market design.”

The May CDR reported an 18.9% reserve margin for next summer. Since then, Vistra Energy has said it would retire about 4 GW of coal resources and ERCOT has reported a year’s delay in completing construction of almost 4 GW of planned capacity. (See Vistra Energy to Close 2 More Coal Plants.)

Lasher pointed out that since 2010, the Public Utility Commission of Texas has directed ERCOT to develop a new standard for determining the planning reserve margin, similar to a 2014 Brattle Group study on estimating “economically optimal” margins that minimize total system and operating costs. The ISO is currently conducting its own study, which it intends to complete in the third quarter of 2018 before reporting back to the PUC, Lasher said.

“I wouldn’t call [the CDR] cause for concern,” he said.

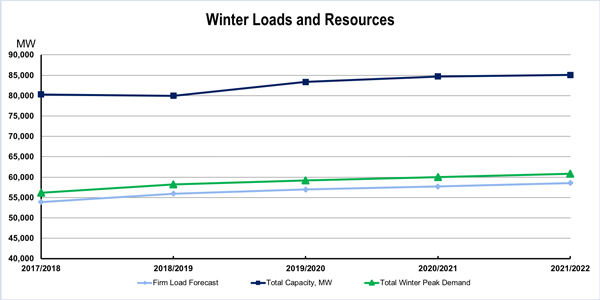

ERCOT expects 14 GW of resources to be in service by 2020 and will still have 77.2 GW of capacity on hand to meet a 2018 summer peak demand forecast of almost 73 GW. That would break the August 2016 record peak of 71.1 GW.

Demand is expected to grow at a 1.7% average annually over the next 10 years. The reserve margin is expected to increase to 11.7% by summer 2019, peaking at 11.8% in 2020 before dropping to 9% in 2022. Total capacity is expected to reach almost 83 GW in 2022.

“We see these types of shifts as the ERCOT market experiences cycles of new investments, retirement of aging resources and growing demand for power,” CEO Bill Magness said in a statement.

If the worst comes to worst, Lasher said ERCOT can always request emergency assistance across DC ties with Mexico or the Eastern Interconnection, or fall back on interruptible customers and switchable units obligated to other regions.

The December CDR report includes information about existing and planned generation resources and expected energy needs over the next 10 years. The report does not include the potential additional migration of nearly 600 MW of load should Lubbock Power & Light and Rayburn Country Electric Cooperative eventually migrate customers from SPP into the Texas grid. (See “ERCOT, SPP to Coordinate Second Load-Migration Study,” PUCT Briefs: Aug. 17, 2017.)