A Hawaii Senate bill to expand funding for clean energy projects is headed to the governor after passing the legislature last week.

SB932 will expand the Hawaii Green Infrastructure Authority’s (HGIA) ability to invest in renewable energy by creating a “clean energy and energy efficiency revolving loan fund.” The fund would provide $50 million to state agencies to better finance energy performance contracts and power purchase agreements, provide funds for renewable energy loans at below-market rates, invest in electric vehicles and their charging infrastructure, and serve “other approved uses.”

The multipurpose fund would replace the 2009 “building energy efficiency revolving loan fund,” which was used only for energy efficiency improvements in buildings. The bill says the additional funding would “reduce the cost of clean energy for ratepayers, drive job creation, and save billions of taxpayer dollars currently being spent on importing petroleum oil.”

The fund is part of Hawaii’s larger attempt to reduce what the bill calls a “significant barrier to clean energy adoption,” which is the lack of flexible financing and low-cost capital. The bill says the fund would give state agencies leverage for more cost-effective agreements, including the outright purchasing of renewable energy infrastructure from private partners.

The bill provides an example of a 2016 PPA by a state agency that reduced its energy costs by 42%. If the agency had the requisite funds to purchase the infrastructure, savings over time would rise to 61% even with the loan repayment and ongoing maintenance costs, the bill’s author contends.

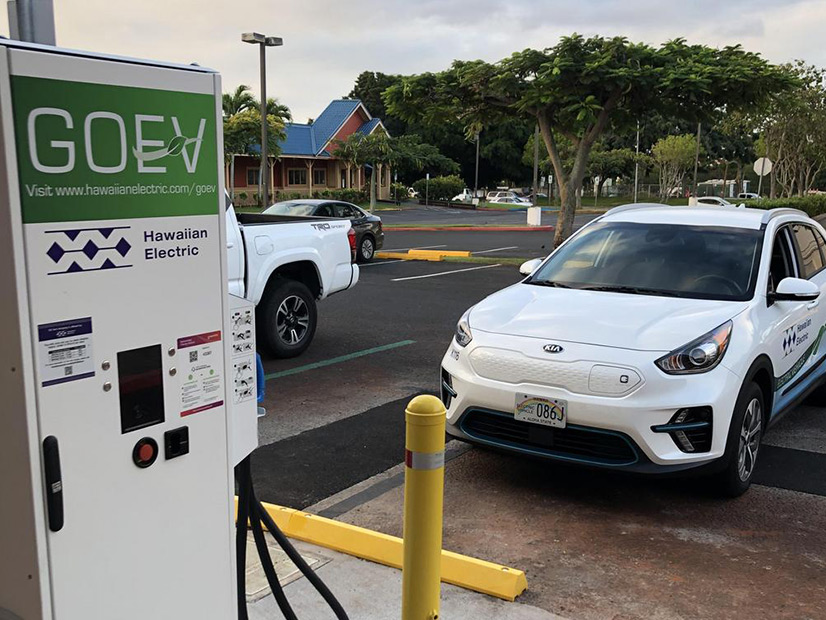

Given that Hawaii’s primary source of GHG emission reductions will be from transportation, the bill said that the savings from the example cited would have allowed the state agency to install one Level 3 charging system and lease seven electric vehicles. The potential savings would provide “a tremendous opportunity for additional energy savings to be utilized to finance the conversion of the State’s retiring internal combustion fleet to short-term leases on electric vehicles as well as install electric vehicle charging systems while remaining budget neutral.”

The fund is part of a wider network of diversified funding the state is using to encourage renewable energy. The Green Energy Market Securitization (GEMS) program, while providing more than $110 million in solar PV and energy efficiency projects, only focuses on established technologies and is unable to serve all ratepayers. The GEMS mechanism of a rate-reduction bond created a “time lag between the issuance of the bond and expenditures for improvements,” whereas a revolving loan fund can expend “annually and in a more expedient manner,” the bill said.

The fund’s monies would come from “federal, state, county, private or other” areas. Oversight for the fund would fall solely to the HGIA, which could authorize loans to any state agency that wishes to apply.