The Bipartisan Policy Center Wednesday proposed a compromise $1 trillion infrastructure package that would authorize $300 billion in spending for a clean energy transition, paid for by a combination of increased corporate taxes and user fees.

The BPC announced its proposal after House and Senate leaders emerged from a White House meeting with President Biden expressing cautious optimism on the chances for a bipartisan agreement.

In March, Biden proposed a $2.3 trillion American Jobs Plan that would be paid for by raising the corporate income tax from 21% to 28%. (See Biden Infrastructure Plan Would Boost Clean Energy.) Senate Republicans countered with a $568 billion proposal paid for by increased user fees.

The BPC said that the numbers cited by the proponents of both plans are misleading because of their disparate treatment of $360 billion in existing “baseline” funding.

“The Republican $568 billion plan includes current funding levels … in all but its broadband numbers,” making its proposal appear larger than it is, BPC said. “The president, in contrast, underrepresents the true costs of his proposal by neglecting to include the $360 billion in baseline infrastructure funding and by undercounting the cost of renewable energy tax credits. When including these expenditures, the true cost of the administration’s plan approaches $3 trillion over eight years.”

Comparing the proposals is also complicated by use of different time horizons, with the Republicans spending over five years, as is traditional for surface transportation legislation, while the administration proposes spending other than surface transportation over eight years. “Adjusting the administration plan to five years, assuming ‘straight line’ spending, reduces its cost from nearly $3 trillion to just over $2 trillion,” BPC said.

BPC’s proposal would spend $1 trillion over five years, adding nearly $700 billion to the baseline.

“BPC believes that it is possible to generate bipartisan support for a package that is considerably broader than traditional infrastructure investments while maintaining a focus on the built environment inclusive of targeted investments in surface transportation, clean energy, childcare facilities, and affordable housing,” it said.

The group acknowledged skepticism that an agreement could be reached, but said the effort must be made because it is preferable to a Democrat-only package pushed through the reconciliation process to avoid a Senate filibuster. “An effective national infrastructure plan must include regulatory, administrative, permitting and environmental provisions — none of which can be included in a budget reconciliation bill,” it said. “For example, under the historic process, spending from the federal highway trust fund cannot be authorized through reconciliation.”

“It is by no means certain that Senate Democrats can create unified support for a partisan infrastructure package and highly implausible that a Democrat-only approach will contain all the elements of the administration’s nearly $3 trillion Jobs Plan,” it continued. “… The bottom line: The chance of enacting a bipartisan $1 trillion+ program, like that outlined [by the BPC] is equal to or greater than the chance of Democrats enacting a $3 trillion package using the reconciliation process.”

Clean Energy Transition Spending

The BPC proposal would spend $300 billion on the “clean energy transition” over five years, compared with about $467 billion in the Biden plan and none in the GOP plan:

- Innovation and Scaling: $100 billion for clean energy research and development and efforts to accelerate commercial-scale demonstration of technologies, including carbon capture and storage (CCS), low-carbon manufacturing, advanced nuclear facilities and carbon removal.

- Deployment: $100 billion to extend and expand clean energy tax credits for offshore and onshore wind, solar, CCS and direct air capture, nuclear technologies, hydrogen and energy storage.

- Transmission: $50 billion to expand and upgrade the electric grid to increase resiliency and connect renewables to load centers.

- Electric Vehicles: $50 billion for charging infrastructure, particularly for medium- and heavy-duty vehicles, and development of vehicle manufacturing capabilities and a domestic supply chain for critical minerals.

BPC also called for implementing 23 recommendations made in April by its Smarter, Cleaner, Faster Infrastructure task force to modernize the permitting process for infrastructure projects. “The imperative to achieve net-zero carbon emissions by 2050 is an enormous undertaking that will not succeed unless we modernize our permitting processes to match the required breakthroughs in energy technology,” BPC said.

The federal government should pre-approve federal land for clean infrastructure projects and create a grant program for states to identify and pre-approve sites as well, BPC said. “Further, Congress should authorize a new National Grid Planning Authority and update the Energy Corridors program to reflect current clean infrastructure needs.”

It also proposed a competitive grant program to encourage states to reduce their greenhouse gas emissions.

Paying for It

The group would pay for the spending by combining the user fees and corporate tax increases proposed in the Republican and Democratic plans. “This balance will address the regressivity and competitiveness concerns that result from relying solely on one approach or the other,” it said.

It would offset the $500 billion of spending on surface infrastructure with user fees, including adding 15 cents to the current excise frees on motor fuels (18.4 cents/gallon for gas and 24.4 cents/gallon for diesel fuel) — which has not increased since 1993 — and indexing it for inflation.

To address the increase in electric vehicles, it also called for a transition to a vehicle miles traveled (VMT) fee.

Another $300 billion in federal income taxes would come from tougher tax enforcement and $150 billion would come from reprogramming unspent money from the pandemic recovery bills.

The corporate tax rate would rise from 21% to 25%, which would generate $400 billion over 10 years, the BPC said, adding that the rate would be near the OECD weighted average of 25.85%. Republicans cut the rate from 35% in 2017.

‘Red Line’

“There is certainly a bipartisan desire to get an outcome,” Senate Minority Leader Mitch McConnell (R-Ky.) said after the 90-minute meeting with Biden. But he said any increase in the corporate and personal income tax rates set in the 2017 bill was a “red line” Republicans would not cross.

House Minority Leader Kevin McCarthy (R-Calif.) also said the GOP continues to oppose the breadth of the Biden plan, which includes spending on home health aides and colleges as well as roads and bridges. “We first have to start with a definition of what is infrastructure,” he said. “That’s not home health. That’s roads, bridges, highways, airports, broadband.”

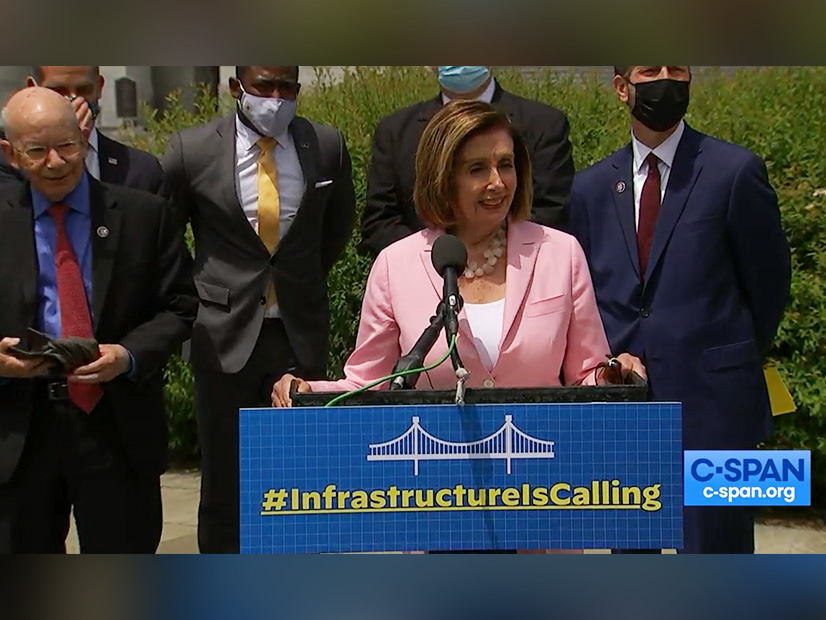

House Speaker Nancy Pelosi (D-Calif.) said she was encouraged by the meeting. “I’m more optimistic now about being able to do so in a bipartisan way, but we’ll see,” she said in a press conference afterward. But she said she opposes increasing user fees and acknowledged the Republicans disagreed with including funding for electric vehicles.

House Transportation and Infrastructure Committee Chair Peter DeFazio (D-Ore.) said his panel hopes to approve an infrastructure bill “in the near future” and bring it to the House floor before Congress’ July 4 recess.