The biennial gathering of Texas lawmakers in Austin concluded on Memorial Day with a few last-minute administrative duties, but not before the 87th Texas Legislature passed an omnibus bill and several other pieces of legislation addressing ERCOT’s disastrous performance during February’s winter storm.

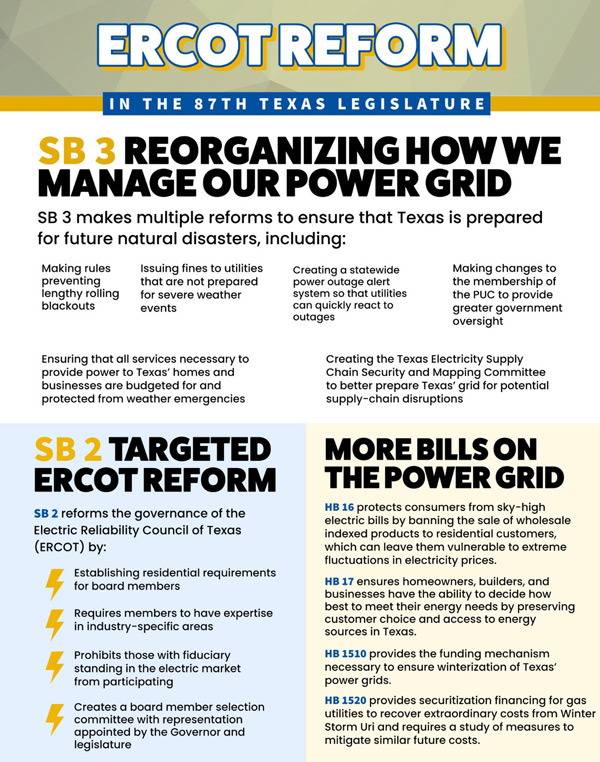

Senate Bill 3 captured most of the changes. Legislators approved, with little debate, a 56-page document designed to help the state prepare for, prevent and respond to weather emergencies and power outages and to increase administrative and civil penalties. The bill would require generators and transmission lines to be weatherized. However, only gas facilities that regulators consider “critical” by regulators would need to be weatherized, with penalties capped at $1 million per day per violation.

SB3 would also mandate that the critical gas facilities be mapped and registered with utility providers to prevent a repeat of the dayslong outages; create a new statewide emergency alert system; and bring together electric and natural gas regulators and market participants in a new energy subcommittee.

A separate bill, SB2, would shrink ERCOT’s Board of Directors from 16 seats to 11 and direct that most of the members be appointed by politicians. Previously, a search committee picked five independent directors (those seats have been eliminated) with market segment members electing their representatives. (See Texas Legislative Response to Winter Storm Leaves Some Doubting.)

Attorney Katie Coleman emerged shortly after the legislature adjourned sine die, having spent four months lobbying lawmakers on behalf of industrial customers. While reacquainting herself with family and friends, she said legislators focused on the right issues in addressing reliability.

“They got done everything that needed to get done. The question is whether we have an eventful summer or not, and there’s no real reason to think we will,” Coleman told RTO Insider, referring to ERCOT’s healthy 15.7% reserve margin and the market’s greater attention to resource adequacy.

“Our message was it’s harder to do the work to understand the root causes and address those,” she said. “There wasn’t some big silver bullet to all of this, which is often what people want in a legislative process. This was not a situation that lent itself to that. SB3 really targeted the right issues and will go a long way in making sure something like February doesn’t happen again.”

The bill would not fund weatherization or add energy efficiency standards for homes and other infrastructure, but it would remove requirements that renewable resources pay ERCOT for backup power when their units are offline.

“I’m hoping we can start moving to the implementation phase of this. It’s going to take some time, the ERCOT piece in particular,” Coleman said.

ERCOT would have until Sept. 1, when the legislation would become effective, to make any changes to its bylaws. Coleman’s attention is drawn more to SB3’s Section 18, which is directed at non-dispatchable generation and would mandate ERCOT establish requirements for ancillary or reliability services “appropriate” during extreme weather and low-supply conditions. It would also direct the Public Utility Commission to establish an emergency pricing program that takes effect when the high systemwide offer cap has been in effect for 12 hours in a 24-hour period.

Pat Wood, former FERC and PUC chair, praised Section 18’s language, which he called “very smart, very intelligent, very nuanced.”

“Section 18 tells the commission to go figure out how that’s going to work long term,” Wood said Friday as he drove home. “We have got to figure out how we keep dependable resources. Let’s not call them dispatchable resources, but dependable resources.”

Legislators also considered proposals by Berkshire Hathaway Energy and Starwood Energy Group Global to build natural gas-fired power plants that would sit on the sidelines of ERCOT’s energy-only market until needed. The proposals didn’t advance far; capacity market discussions never made the table. (See Berkshire Hathaway Offers Texas Emergency Power Supply.)

“What you really want here are capabilities that we know the regulators or the market model would support, because we just don’t have weather like [February] often enough and predictable enough to invest around,” Coleman said.

She also has her eyes on SB1281, which would reinstate a consumer-impact test of congestion costs and future load growth when ERCOT studies proposed transmission projects. The requirement disappeared from the criteria last decade when generators pushed back against a proposed economic project that would have brought low-cost generation into the Houston region, Coleman said.

“It gives ERCOT more flexibility to include the utilities’ load forecasts,” she said, noting staff currently use a banded approach.

The bill would also require ERCOT to assess the system’s reliability in extreme weather scenarios every two years.

Redefining ERCOT, PUC

During the session, lawmakers frequently said they were acting to “ensure this never happens again.” If so, SB2 left a few observers confused.

“One way to ensure ‘this never happens again’ is to redefine the organizations involved,” the R Street Institute’s Beth Garza said in an emailed statement. “After ERCOT and the PUC were ‘decapitated’ in the aftermath of the storm, they certainly have redefined both organizations.”

Garza, who directed the grid operator’s Independent Market Monitor until 2020, was referring to the mass resignations at both ERCOT and the PUC. Politicians criticized both organizations’ leadership in the aftermath of the storm, with many pointing fingers at the grid operator’s five out-of-state independent directors.

“I don’t think it matters whether anyone thinks the changes are good or bad. The important thing is the change, and that everyone in a leadership role be a Texas resident,” Garza said.

Consultant Alison Silverstein, a former adviser to Wood at both FERC and the PUC, disagreed. She said it’s a “disservice” to “disqualify” out-of-staters from serving on the board.

“Although it is superficially attractive to have only Texas residents on the ERCOT board, the power industry here is a small community, and it’s unlikely that the pool of candidates can be dispassionate, expert and unbiased on all the issues involved in running the ERCOT grid,” Silverstein told RTO Insider.

She said using a “politically slanted” selection committee to pick the eight independent directors and the chair and vice chair— with the governor, lieutenant governor and the speaker of the House of Representatives each choosing a member — implies that new board members might have good connections and passed a political screen.

“We need board members with the best expertise, not board members with the best political answers,” Silverstein said. “A better board selection committee that seeks to raise all aspects of ERCOT’s performance should come from the full board itself, not from politicians.”

One of SB2’s requirements is that no more than two board members can be university professors. That has drawn snickers from some capitol insiders, who jokingly referred to the criteria as the Cramton Amendment in a dig at former Director Peter Cramton, professor emeritus of economics at the University of Maryland College Park. The academic was fluent in market design and frequently suggested taking ideas from other markets.

“An independent board that only has the interest of the grid and ERCOT as a whole is the right way to go,” Coleman said. “Compared to some other proposals, this was a much better approach.”

Legislators also sent several securitization measures to Gov. Greg Abbott for his signature. HB4492 would use $800 million from the state’s “rainy day” account to create a financing mechanism that funds unpaid balances in the ERCOT market. The market was still short almost $3 billion at the end of last week.

Two other bills, HB1520 and SB1580, would securitize natural gas utilities and cooperatives, respectively, for costs incurred during the winter storm. It remains to be seen whether that keeps Brazos Electric Power Cooperative, which owes the market almost $1.88 billion, out of bankruptcy.

Senate language to give ERCOT customers a one-time $350 credit on their bills failed to make any of the final bills.

Other industry legislation on its way to Abbott’s desk include:

- SB2154, which would expand the PUC from three members to five and only require two commissioners to be “well informed and qualified in the field of public utilities and utility regulation.” The other three would need only five years of experience in business or government administration or as a practicing attorney, certified public accountant or professional engineer. Abbott is expected to move quickly to fill the bench so it can handle the work in front of it.

- SB713, which was revised to include the PUC into the Sunset Advisory Commission’s current review cycle that determines which governmental agencies are still needed.

- HB16, which would ban electric retailers from offering wholesale-indexed products, such as those that led to five-figure bills during the storm.