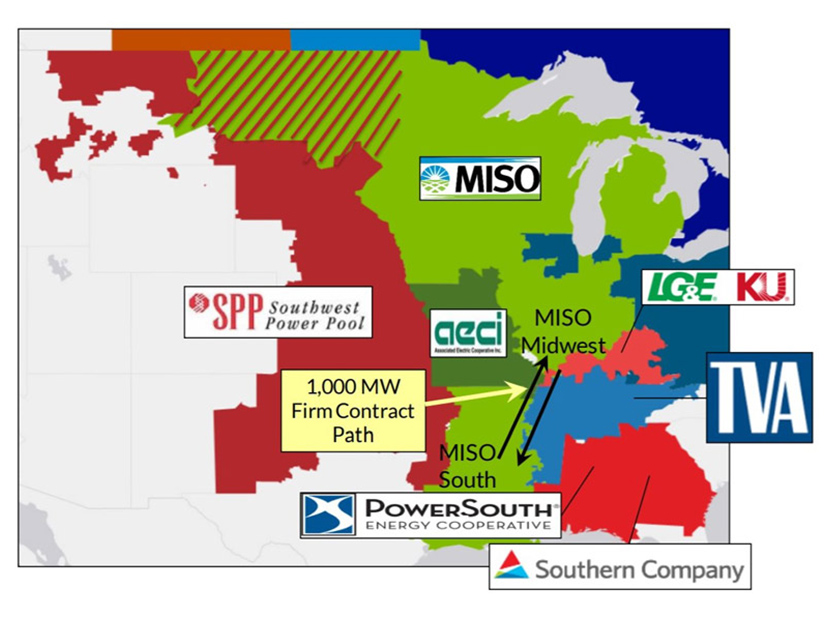

MISO said it has a new cost-allocation method in mind for members that use the regional transfer limit linking its Midwest and South regions.

Senior adviser Jack Dannis said the grid operator will make a filing for a new rate structure with FERC in November. The grid operator hopes the proposal will serve as a permanent cost-allocation mechanism for settlement payments made by market participants that use the subregional transfer limit beyond the 1,000-MW contract path linking MISO Midwest and MISO South after Feb. 1, 2022.

MISO’s payments to SPP and six other parties for regional flows on the transfer limit are recovered from market participants using a special rate schedule called Schedule 49, which is considered separate from the 2016 settlement agreement that the eight parties signed for use of the transmission.

Based on stakeholder feedback, Dannis said MISO will abandon its current load ratio-based allocation method among members and adopt a market-based allocation that assigns costs based on the level of congestion accrued when the transfer limit binds on its 2,500- or 3,000-MW limits, depending on flow direction. Over the past five years, day-ahead and real-time congestion on the transfer limit makes up 74% of total costs needing to be allocated under the settlement agreement. He said the market-based approach more effectively assigns costs to beneficiaries.

MISO said Schedule 49, which also employs a diminishing flow-based calculation, is too complex, with the RTO using a planning model to estimate flow-based benefits. That allocation is currently pending in FERC settlement proceedings after MISO extended its use through January 2022. (See FERC Orders Hearing on MISO Pact for Midwest-South Tx.) Alliant Energy and MidAmerican Energy have complained that market participants in an Iowa local resource zone bore a disproportionate one-third of rate schedule costs in 2020.

Director of Market Design Kevin Vannoy said the new market-based approach is predicated on the theory that an importing region is benefiting — despite accruing congestion charges — from using the transfer to access lower-cost energy instead of calling up even more expensive generation. Now, when the transfer limit binds, congestion costs will be collected from the importing region through higher LMPs.

MISO said Schedule 49 charges will be collected monthly through multiple methods: the current month’s congestion fees, and a carryover of past excess congestion charges that went beyond its settlement agreement payment. If there’s a shortfall after those two, MISO will collect the remainder of costs through a pro rata charge to the majority importing region that month.

Stakeholders asked whether MISO Midwest or MISO South would more often be categorized as the importing region. Staff said regional use varies and doesn’t appear to follow a set pattern.

The new approach will “eliminate some of the modeling variables that could be disputed,” Dannis said.

“I think parties will see less volatility monthly and yearly in their Schedule 49 payments,” he added.