Planning Committee

CISO Mitigation Update

PJM last week updated stakeholders on the next steps of a vote on the RTO’s mitigation proposal to avoid designating projects as critical infrastructure under NERC reliability standards.

Michael Herman of PJM’s transmission planning department led a discussion at last week’s Planning Committee meeting on the approved mitigation proposal, including a review of Operating Agreement language. Members endorsed the proposal with 61% support at the February PC meeting. (See “Critical Tx Infrastructure Proposals Endorsed,” PJM PC/TEAC Briefs: Feb. 9, 2021.)

Herman said the Critical Infrastructure Stakeholder Oversight (CISO) issue has resulted in a long stakeholder process dating back to an original endorsement of the issue charge at the December 2019 PC meeting. (See “Critical Infrastructure Mitigation,” PJM PC/TEAC Briefs: Dec. 12, 2019.) The mitigation portion of the issue is all that remains after stakeholders endorsed the avoidance portion of the PJM proposal at the May Markets and Reliability Committee meeting. (See “CISO Avoidance Endorsed,” PJM MRC Briefs: May 26, 2021.)

PJM is now looking to conduct a stakeholder vote at the July PC meeting to determine whether the proposed OA language reflects the CISO mitigation proposal approved in February. Some members at the April MRC requested that the mitigation proposal be sent back to the PC for further discussions to determine if the language corresponded with that in the endorsed matrix.

Herman said PJM conducted a critical review with its subject matter and legal experts to review the OA language presented as part of the development of the mitigation proposal and reviewed changes resulting from stakeholder discussions. He said the RTO based its review on changes made between the first read at the March MRC meeting and discussions the following month, researching whether the concepts were “in alignment” with what was approved in the matrix by the PC. (See “CISO First Read,” PJM MRC/MC Briefs: March 29, 2021.)

PJM examined the OA language defining a critical substation planning analysis (CSPA) project as a regional or subregional Regional Transmission Expansion Plan (RTEP) project “with an anticipated in-service date of more than three years but no more than five years from the year” in which the RTO identifies the need for the potential CSPA project. Herman said PJM determined that the in-service date language does not need to be included in the draft OA language because the concept is “well defined” in other parts of the OA and corresponding manual language.

The second OA language piece PJM examined dealt with the RTO’s ability to determine that any component of a CSPA project “can be included in an RFP proposal window without disclosing the location of or vulnerabilities associated with the critical substation contingencies and associated facilities.”

As part of the competitive process and design component of the matrix, a project will be open to competition as part of an RFP process “if the mitigating solution does not disclose the substation associated with the substation contingency.”

Herman said that, based on its five-year analysis, the RTO expects to identify any critical facilities in advance of the need for any immediate need projects. It didn’t feel changes were needed to the proposed OA language.

“We don’t anticipate the need to place any immediate need projects based on the annual evaluation,” Herman said.

2021 RRS Assumptions Endorsed

Stakeholders unanimously endorsed the 2021 reserve requirement study (RRS) assumptions developed in the Resource Adequacy Analysis Subcommittee.

Jason Quevada of PJM’s resource adequacy planning department reviewed the 2021 RRS assumptions first brought to the PC last month. (See “2021 RRS Assumptions,” PJM PC/TEAC Briefs: May 11, 2021.) Quevada said the study results reset the installed reserve margin (IRM) and the forecast pool requirement (FPR) for the 2022/23, 2023/24, 2024/25 delivery years and establish the initial IRM and FPR for the 2025/26 delivery year.

Quevada said the 2021 RRS assumptions are very similar to those in the 2020 RRS except for the modeling of effective load-carrying capability (ELCC) resources. Because of a pending decision by FERC regarding a PJM proposal on ELCC, the 2021 RRS capacity model and results will be modeled in two different cases, he said.

In the first case, all generators except for ELCC resources will be modeled as capacity units per the modeling assumptions in Attachment III of the RRS assumptions letter. In the second case, all generators except wind and solar resources will be modeled as capacity units per the modeling assumptions in Attachment III.

The final RRS report will be presented to the RAAS and PC in September, Quevada said. PJM will seek approval in October.

Manual 14A Updates

Onyinye Caven of PJM provided a first read of conforming Manual 14A: New Services Request Process language for the quick fix of close of queue date and application review timing changes.

Caven said the changes impact the close of the queue window and the deficiency review clock. The issue charge and proposed changes were endorsed at the May 2021 PC and MRC meetings. (See “New Service Requests Approved,” PJM MRC Briefs: May 26, 2021.)

Proposed tariff changes have been reviewed at the PC and MRC, Caven said, with endorsement targeted for the June Members Committee meeting. She said the Manual 14A changes are being presented to align existing documentation with the proposal.

The existing tariff language stipulates that new service queue windows stay open from April 1 to Sept. 30 and Oct. 1 to March 31, while the proposed language moves up those closing dates to Sept. 10 and March 10 for each respective window.

Current tariff language requires PJM to review the new service customer’s response to the RTO’s deficiency notice within five business days. The proposed update requires PJM to review the customer’s response to the notice within 15 business days or “use reasonable efforts to do so as soon thereafter as practicable.”

Caven said the manual updates mirror the proposed tariff language changes.

Members will vote on the manual changes at the July PC and MRC meetings, and PJM is looking for an effective date of Sept. 1.

AMP Transmission FERC Form 715 Update

Ed Tatum, vice president of transmission at American Municipal Power, provided an update on the company’s FERC Form 715 criteria changes after it began reviewing the form and its interconnection requirements.

Tatum said AMP Transmission is proposing to remove the megawatt-mile — or delivery point — exposure criteria from the “adequacy criteria” section of its annual transmission planning and evaluation report. The objective of the criteria was to “quantifiably determine the necessity to provide a second delivery feed located on independent transmission structures to any load delivery point serving a load by, or through an AMPT-owned facility.”

“It’s important to us that the documents accurately reflect our reliability as well as resilience goals,” Tatum said.

AMPT determined that the megawatt-mile criteria was an internal design standard criteria, and that the delivery point exposure criteria projects do not address maintaining PJM system regional reliability, including voltage or thermal violations, or alleviate any specific bright line regional planning criteria violations of the RTO or NERC. Tatum said the criteria was more related to resilience rather than reliability.

Sharon Segner, vice president at LS Power, said she was “scratching her head” how the change would work legally. Segner said PJM has “explicit manual language” that supplemental projects can’t be submitted in the middle of open windows and requested that the RTO follow up to determine the impacts of the change on the open planning window.

Transmission Expansion Advisory Committee

Transource Reliability Analysis Update

Aaron Berner, senior manager with PJM, provided an update on the 2021 RTEP analysis, specifically highlighting the Independence Energy Connection (IEC) East and West transmission project in Maryland and Pennsylvania.

In May the Pennsylvania Public Utility Commission rejected siting applications filed by Transource Energy, putting the controversial project in jeopardy. (See Transource Tx Project Rejected by Pa. PUC.)

Berner said PJM is currently “preparing for a retool” of the 2021 RTEP to determine the impacts of any delays of the transmission project.

Transource’s plan for the eastern section of the project originally proposed extending 15.8 miles of transmission lines from a new Furnace Run substation in York County, Pa., to the Conastone substation in Harford County, Md. An updated configuration released in October 2019 increased the size of the new substation in Pennsylvania and added four miles of lines connecting to an existing right of way that would feed into two upgraded Baltimore Gas and Electric substations. (See Transource Files Reconfigured Tx Project.)

The western segment of the IEC project called for a 230-kV double circuit transmission line running 28.8 miles from Franklin County, Pa., into Washington County, Md.

PJM is updating modeling to perform a sensitivity study to determine any reliability impacts associated with the removal of the project from the case used to perform the 2021 RTEP, Berner said, and the RTO will have more information on the impacts at the August TEAC meeting.

The project is not officially completed, and there are “other means” of regulatory appeals, he said. The appeals process is underway and should be completed by the middle of July.

Segner pointed to Section 1.4.3 of Manual 14B relating to the scenario of a regulatory authority denying a siting application. The section states: “A project denied siting authority in a final regulatory order by the relevant regulatory siting authority will generally be removed from the RTEP base case as determined by PJM after discussion with the relevant transmission owner(s) or designated entity and vetting with stakeholders at the TEAC. A project will generally not remain in the RTEP base case during the duration of a court appellate action. Decisions to remove a baseline upgrade from the RTEP base case will be submitted to the PJM Board and decisions to remove a supplemental project from the RTEP base case will be provided to the applicable transmission owner.”

Segner asked whether the PJM Board of Managers will receive information in July related to the Transource project’s status.

Berner said he hasn’t spoken to other PJM officials to determine what will be brought to the board in July.

Segner asked what the PUC decision means to the Maryland portion of the project. The Maryland Public Service Commission approved a settlement last July allowing the project to move forward in the state. (See Md. PSC OKs Independence Energy Connection Deal.)

Berner said the project won’t move forward without approval of the Pennsylvania portion.

Generation Deactivation Notification

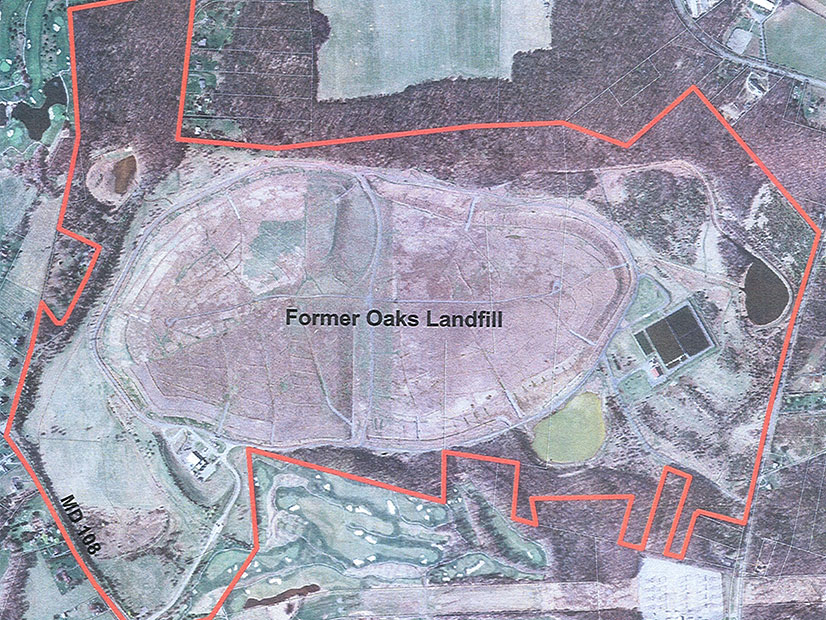

Phil Yum of PJM provided an update on a recent generation deactivation notification on the Oaks Landfill in the Pepco transmission zone in Montgomery County, Md.

According to Montgomery County records, the Oaks Landfill is approximately 545 acres with a waste disposal footprint of 170 acres. The county-owned site received mixed municipal solid waste beginning in June 1982 and closed in 1997, containing more than 7 million tons of waste.

A 2.2-MW landfill gas-to-energy facility started operation at the property in mid-2009.

Yum said a reliability analysis conducted by PJM and Pepco found no violations with the deactivation. The requested deactivation date is July 16.