Green hydrogen produced with renewable power will be cheaper than blue hydrogen produced from methane with carbon capture within a decade, Paul Browning, CEO of Mitsubishi Power Americas predicted Tuesday.

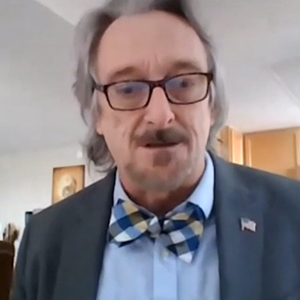

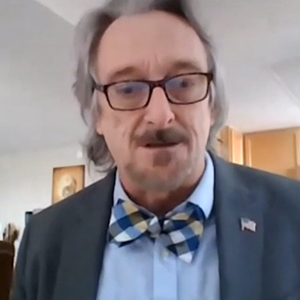

“Right now green hydrogen is more expensive than blue hydrogen, but we and many others believe the cost of green hydrogen is going to come down rapidly in the next seven years or so and actually be below the price of blue hydrogen,” Browning told the H2Power conference, sponsored by the Smart Electric Power Alliance (SEPA) and the Electric Power Research Institute (EPRI). “… We plan to get there this decade. It’s not the distant future.”

The current cost of blue hydrogen is about $1.50/kg.

Mitsubishi, known for its gas turbines, is betting its future on hydrogen, Browning said, because there’s no way to get to net zero greenhouse gas emissions by 2050 without it.

“Right now with the technologies that we see in front of us, we don’t see a way to get to net zero without hydrogen. We don’t know what new technologies are coming down the pike, and so there’s always the chance that some new long-duration energy storage technology or some new low-carbon fuel technology will come in that will supplant the need for either green or blue hydrogen going forward,” he said, during a panel discussion moderated by SEPA CEO Julia Hamm.

The year 2050 “is a long time from now,” he said. “But if you believe we’re headed to net zero in 2050, then you really have to believe in hydrogen. So, we’re all in. We’re planning on building the underground infrastructure — both salt dome storage and hydrogen pipelines — to … bring green and blue hydrogen to our customers throughout North America.”

Earlier this month the Department of Energy announced its first “Earthshot” project, which seeks to reduce the cost of green hydrogen by 80% to $1/kg by 2030. (See Granholm Announces R&D into Green Hydrogen as 1st ‘Energy Earthshot.’)

Eric Miller, senior adviser at DOE’s Hydrogen and Fuel Cell Technologies Office, cited studies showing hydrogen could help reduce GHG emissions by up to 25% when used in heavy-duty transportation and industrial applications such as steel and chemical production.

“If you look at ammonia alone in the chemical sector, it accounts for up to 5% of the CO2 emissions globally. By transitioning to a clean hydrogen alternative, we can cut that by 90%.” Steel emissions could be cut by 30-40%, he said.

Joe Hoagland, vice president of innovation and research for the Tennessee Valley Authority, agreed that hydrogen will be part of the net zero solution. “But I don’t think it’s the only solution. I think at the end of the day it’s going to be all of the above. You’re going to need things like new nuclear [and] solar to produce green hydrogen,” he said. “I think by 2050 we can get there, but we’re going to have to use everything we’ve got and everything we’ve got has got to get to scale.”

Daniel Brooks, vice president of integrated grid and energy systems for EPRI, said hydrogen could be a boon for utilities by providing large-scale storage to aid grid reliability and absorb excess renewables while also providing a new source of electric demand.

Hoagland said that prospect is exciting. “Hydrogen production allows us the ability to better utilize all the other resources we’ve got on the system, which will help to reduce their carbon footprint, increase their efficiency, and reduce the cost.

“At the same time, it gives us the opportunity to sell something. We can either use hydrogen ourselves directly or we can put hydrogen out into the transportation system or other parts of the economy,” he added. “I will say it’s a bit of a challenge for a utility. Generally we like to make electricity. So, this is going to require some rethinking.”

Mitsubishi is building an 840-MW project with Intermountain Power that will initially burn 30% green hydrogen and 70% natural gas, transitioning to 100% green hydrogen over time.

It also signed a 10-year joint development agreement with Entergy with two projects planned: a 22-MW electrolysis demonstration project at an Entergy plant using Mitsubishi gas turbines and a 1.2 GW storage project in Texas.

“Entergy has the good fortune of sitting on top of the world’s largest existing infrastructure of hydrogen because hydrogen is used at the Gulf Coast to desulphurize motor fuels. They’re sitting on top of two existing hydrogen salt domes … and 1,100 miles of existing pipelines.”

In North Dakota, Browning said, the company will build the world’s largest blue hydrogen hub. “And we think we’re going to be able to create blue hydrogen for less than $1/kg.”

It is also working on a project with a goal of delivering green hydrogen to the Los Angeles basin at $1.50/kg “with the idea of decarbonizing the city of Los Angeles.”

Neha Rustagi, a DOE technology manager, said a high capacity factor “is one of the most crucial things to achieving low-cost hydrogen. So, scenarios where you do have abundant solar and wind are where I think optimal deployment” would occur.

Because of the predictions of reduced-cost green hydrogen, Browning said, some of his customers are asking whether they want to invest in blue hydrogen or leapfrog it for green.

“If you start today talking about putting one of these projects in the ground, you’re probably talking about a 2025-2026 COD [commercial operation date]. So, if it takes us seven years to get to cost parity between green and blue … then in COD space we’re already there,” he said. “On the other hand, if you’re in North Dakota and you’ve got a lot of natural gas available and you don’t have a huge amount of renewables on your grid and you don’t think you’re going to need long duration storage for a little while, maybe in North Dakota you start blue and you stay blue.”