PJM said transmission upgrades to support state renewable portfolio standards (RPS) could cost upwards of $3.2 billion by 2035, according to a study released this week to stakeholders.

Matthew Bernstein, a policy advisor in PJM’s state government and policy department, provided an update on the RTO’s offshore wind scenario study at the Transmission Expansion Advisory Committee meeting on Tuesday.

Bernstein said the study, which the Organization of PJM States Inc. (OPSI) originally requested in late 2019, consisted of modeling five different scenarios related to the integration of renewable resources — and especially offshore wind — in PJM. The first phase of the study was intended to estimate the transmission costs required to support all the PJM states in meeting their clean energy goals.

Bernstein said the study is meant to be a starting point and baseline analysis that “holistically” looks at the integration of offshore wind throughout the region. While the study identified costs and the location of upgrades, it does not identify the ratepayers responsible for the costs of upgrades.

“This is not any indication of cost allocation,” Bernstein said.

Background

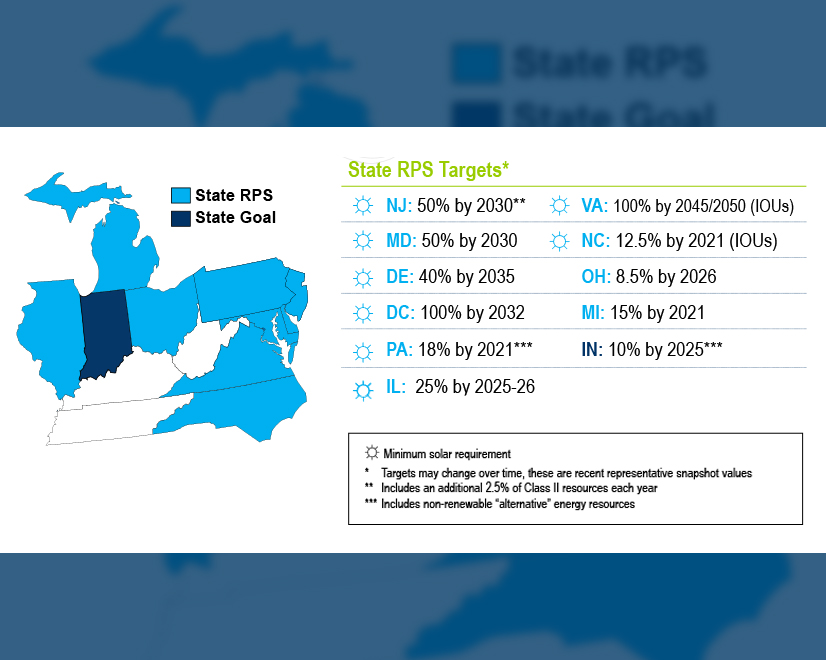

PJM and interested state agencies began meeting in October 2020 in an effort independent from the normal stakeholder process to consider offshore wind public policy needs, Bernstein said. The effort also looked at factoring in all PJM state RPS requirements in the study, even those located far away from the coast.

Preliminary results of the study were presented to stakeholders at the April TEAC meeting. (See “Offshore Transmission Study Update,” PJM PC/TEAC Briefs: April 6, 2021.)

PJM estimates that reaching state RPS goals will require 74.2 GW of new renewable energy by 2035, including 14.2 GW of offshore wind, 14.5 GW of onshore wind and 45.5 GW of solar. The states’ current RPS standards also call for nearly 7.2 GW of energy storage by 2035.

Bernstein said the study was meant to be advisory, providing information to states as they move forward on renewable integration and offshore wind policies. It will be up to individual states to determine how to use the information and whether they want PJM to conduct further analysis in a second phase of the study, he said. A final report is expected by the end of the year.

Nothing in the study prevents offshore wind projects from integrating into the system through PJM’s normal generation interconnection queue, Bernstein said.

Phase 1 of the study only looked at the onshore impact from offshore wind, omitting considerations of the cost of building offshore or mesh grid networks to handle the new generation. The study also didn’t account for the impact to neighboring grid systems, instead focusing on a high-level overview of impacts.

PJM examined the impacts on transmission lines 100 kV and higher across the entire footprint, identifying thermal violations as part of the first phase. The study does not include any generation deactivations announced after Oct. 1, 2020, including those after the 2022/23 Base Residual Auction.

Bernstein said the modeling in the study does include the Transource Independence Energy Connection (IEC) transmission project that was expected to be built between Pennsylvania and Maryland. The project was rejected by the Pennsylvania Public Utility Commission (PUC) in May, but Transource is challenging the decision in court. (See Transource Tx Project Rejected by Pa. PUC and Transource Challenges Pa. PUC Decision in Court.)

Study Results

Jonathan Kern, PJM principal engineer, presented study results that examined two different timeframes for development: a short-term window looking at goals to 2027 and a long-term window extending to 2035.

Scenario 1 was the only short-term study conducted by PJM, modeling RPS targets across the RTO along with six different onshore wind injection points designated to handle 6,416 MW of offshore wind. The scenario also looked at utility-scale solar, onshore wind and storage units, along with distributed solar, electric vehicle (EV) and energy efficiency (EE) values included in the 2020 PJM Load Forecast Report.

Scenario 1 estimated transmission upgrade costs came in at $627.34 million, Kern said, with the largest expenses in the PECO Zone at $311 million and the BGE Zone at $173.5 million. Kern attributed those high costs to the necessary upgrade of an overloaded 500 kV tie line that required reinforcement.

Kern said the market efficiency analysis for Scenario 1 demonstrated decreased gross load payments, especially for coastal states.

“For the most part, the costs were relatively uniform for Scenario 1,” he said.

The four remaining long-term scenarios involved minor variations in the modeling, mostly around changes in the offshore wind assumptions.

Scenario 2 modeled offshore wind injections of 14,416 MW at nine different onshore injection points, Kern said, calling it a “substantial increase” in the amount of offshore wind set to come online between 2027 and 2035.

Scenario 2’s estimated cost was about $2.46 billion. Each state with RPS requirements had increased renewable penetration in the scenario, Kern said, with the Dominion Zone expected to take on 16,000 MW of added solar by 2035. Along with the additional offshore wind, Dominion Zone transmission upgrade costs exceeded $1 billion.

Scenario 4 modeled 17,016 MW of offshore wind injections, including an additional 2,600 MW at the Fentress Substation in Virginia. Costs under the scenario jumped to more than $3.2 billion, with the Dominion Zone accounting for $1.8 billion.

Kern said PJM identified possible opportunities for regional solutions to reach goals, especially in the long-term scenarios. More than 150 network upgrade requirements would be necessary in the long-term scenarios.

“This is a very high-level analysis,” Kern said. “It didn’t include all PJM tariff facilities, and we didn’t consult local transmission owners to examine their systems.”

Stakeholder Reaction

Tom Rutigliano, an advocate with the Natural Resources Defense Council’s Sustainable FERC Project, said PJM’s renewable study should serve as a model for grid operators across the country as they begin to make plans for the grid of the future.

Rutigliano called the study an “important first step” that showed the advantages of coordinated planning among PJM and its states instead of independently building projects. He said current planning procedures can become “piecemeal” as transmission upgrades are done and paid for by each new project developer.

“PJM’s new big-picture look should allow for much more efficient and cost-effective planning, consolidating many small projects into fewer large ones,” Rutigliano said. “This type of planning, done in consultation with the states driving clean energy in the region, offers a much clearer vision of how to cost-effectively meet state goals.”

Rutigliano said the multi-billion-dollar price tags for line upgrades may seem large, but the totals are “surprisingly low” considering the amount of work needed to account for the new renewables. He said the transmission upgrades will represent only a small fraction of the total cost for the clean energy projects.

Transmission upgrades resulting from the necessary improvements could lead to other benefits, Rutigliano said, including addressing the estimated $528.6 million in congestion costs for 2020 cited in Monitoring Analytics’ State of the Market Report. Rutigliano would like to see PJM conduct more market analysis to determine how much money can be saved through transmission investment.

“We expect FERC to pay close attention to this problem as it works on its major transmission reform effort,” Rutigliano said. “Work like this recent PJM study shows us that large-scale planning and coordination between states and grid operators has much to offer.”