Calpine says it is concerned about climate change. But that doesn’t mean it will quit natural gas-fired power generation any time soon.

In its first-ever sustainability report, the privately held independent power producer — the biggest generator of electricity from natural gas and geothermal in the U.S. — rejects the notion that falling prices for renewables and energy storage will eliminate the need for gas-fired power to fill gaps in intermittent generation.

“Cost-effective pathways to deep decarbonization require that modern natural gas power plants continue to operate for decades to come,” CEO Thad Hill says in the report. “Although the use of carbon capture and sequestration and possibly the increased combustion of hydrogen in these plants can help with carbon emission levels, these plants and the combustion of some natural gas will continue to be necessary, albeit at much lower capacity factors than today.”

Despite the increasing penetration of renewables and addition of battery storage, Calpine says “existing gas-fired generation capacity will be needed for many years to come and may even need to be expanded in some regions as demand for electricity increases as other sectors seek to decarbonize.”

‘Benchmark’ of Performance

Jill Van Dalen, an assistant general counsel who oversaw the report, said the company issued it “as a benchmark of our performance to date.

“We really think it demonstrates our commitment, our leadership, our credibility in the energy sector, which is obviously undergoing fairly rapid change,” she said in an interview with RTO Insider.

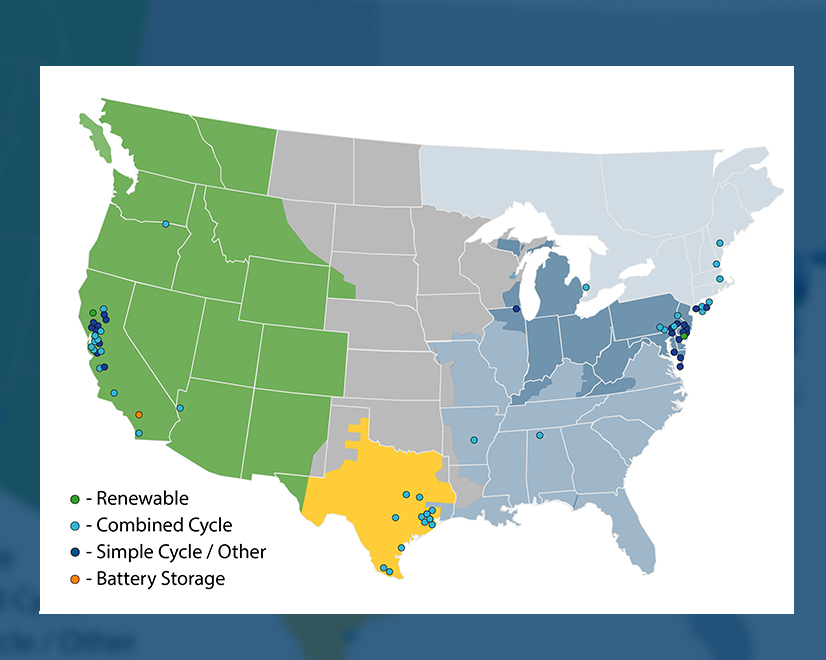

Calpine operates 76 generation plants totaling 26,000 MW, all of it natural gas except for 725 MW of geothermal capacity in California and a 4-MW solar plant in New Jersey that came as part of its acquisition of Conectiv Energy from Pepco Holdings in 2010. Only 3% of its generation in 2020 was renewable.

But the company’s retail electric providers have served as offtakers for renewable energy projects, helping them to obtain financing. In January, CDP (formerly the Carbon Disclosure Project), a non-profit that runs a global disclosure system, named retailer Calpine Energy Solutions as a “silver accredited renewable energy provider,” saying it has been “one of the largest buyers of renewable energy and environmental attributes” in the U.S. over the last 20 years.

In 2019, Calpine says its “steam adjusted” CO2 emission rate was 0.4 Mt/MWh, below the 0.67 Mt/MWh average for all thermal generation.

The company touts its membership in the Natural Gas Supply Collaborative, a voluntary initiative gas purchasers that supports reducing upstream methane emissions. And it says it conducts annual optical gas imaging to identify leaks in its own gas infrastructure.

The company also is expanding into storage and carbon capture. Last month, its first battery project, the 20MW/80MWh Santa Ana Storage Project in Southern California, went into commercial operation under a 20-year resource adequacy power purchase agreement with Southern California Edison (NYSE:EIX).

Last November, the company announced a partnership with Colorado-based ION Clean Energy to build and operate an engineering-scale carbon capture project at its Los Medanos Energy Center cogeneration plant in Pittsburg, Calif., supported with funding from the Department of Energy’s National Energy Technology Laboratory. The project, which will demonstrate ION’s solvent technology, is the first carbon capture pilot at a commercially dispatched natural gas combined cycle plant in the U.S., according to Calpine.

Calpine also is working with Blue Planet on a pilot-scale CCS facility at Los Medanos. Blue Planet has developed a way to sequester carbon in cementitious building materials for use in light-weight concrete. The pilot is expected to be in operation later this year.

Founding

Van Dalen said Calpine was “founded on the principles of sustainability.”

Launched in 1984, Calpine went public in 1996, raising capital that allowed it to acquire more than 60 gas turbines and The Geysers, the world’s largest complex of geothermal power plants, over the next four years.

Following the California energy crisis of 2000-1, the company found itself overleveraged. By the end of 2005, it had declared bankruptcy with $22 billion in debt and its CEO and CFO had departed.

After selling off some assets and eliminating one-third of its workforce, it emerged from bankruptcy in 2008, again as a publicly traded company. Over the next decade, it acquired Conectiv Energy, retail provider Champion Energy and Noble Americas Energy Solutions, an independent supplier of power to commercial and industrial retail customers. In 2018, it went private in an acquisition by an affiliate of Energy Capital Partners and other investors, including Access Industries and the Canada Pension Plan Investment Board. Hill, who joined the company as chief operating officer in 2010, was named CEO in 2014.

Calpine says it has long advocated for reducing power plant emissions as a supporter of the Paris Agreement on climate change and the Obama administration’s Clean Power Plan. In recent years, it has supported an economy-wide carbon price. But with carbon pricing a political nonstarter in most of the country, Calpine’s simultaneous advocacy for competitive electric markets has gotten it cross threaded with environmentalists. It was one of three owners of gas-fired generation in PJM that filed a complaint in 2018 that prompted FERC to order the RTO to expand its minimum offer price rule to include renewables receiving state subsidies. (See Gas Gens Ask FERC for ‘Clean MOPR’ in PJM.) Urged on by new FERC leadership, PJM stakeholders voted six weeks ago to reverse the expanded MOPR. (See Stakeholders Back PJM MOPR-Ex Replacement.)

Bridge or Dead End?

The future of natural gas-fired generation has been the subject of increasing debate at industry conferences over the last three years. (See How Long a Bridge for Natural Gas? and Electrification Raises Concerns over Stranded Gas Assets, Customers.)

“Clean energy is canceling gas plants,” the Rocky Mountain Institute said in a blog post last September, citing the “remarkable shift from gas to clean energy” in the generation interconnection queues of ERCOT and PJM. “Gas generation is now attracting only a small fraction of investor interest compared to clean energy and will soon likely see its market share decline accordingly,” it said.

The International Energy Agency said in a study in May that “there is no need for investment in new fossil fuel supply in our net zero pathway” to escape the worst impacts of climate change. (See IEA Paints Daunting Path to Net Zero by 2050.)

Calpine insists, however, that its gas fleet is well positioned for a future in which transportation and buildings are increasingly electrified.

“If you electrify everything, you’re going to need more power. The idea that you’re somehow going to magically do away with the only dispatchable fuel type that can help the transition in times of dark or non-windy days is not realistic,” said Brett Kerr, vice president of external affairs, in an interview. “… Our units will be needed far into the foreseeable future. We may run less, and renewables may run more, and that’s ok. But we’re absolutely going to be needed to ensure the successful transition to a lower carbon future.”

The company says it is among the lowest emitting fossil fuel generators because its natural gas plants have low heat rates and are “relatively young,” at a capacity weighted average age of 20 years.

But will the company invest in any new natural gas?

“It’s tough for us to say,” Kerr responded. “We’re always looking to do more development in markets where we think it’s needed and we’re a good fit. But we generally, as a matter of course, don’t comment publicly on specific development plans. It’s fair to say we’re looking at development across the spectrum in all types of resources, but we won’t get into any of the specifics.”

How about investing in other renewables? “I would not be surprised if you saw something [additional renewable capacity] certainly within a year, if not sooner,” he responded. “I wouldn’t want to characterize it as, `Yes, we’re absolutely going to build own and operate [renewables].’ But we’re absolutely going to be engaged and we view the changing dynamics of the market to be something we’re going to be heavily involved in.”