Endorsement of Fast-start Revisions

PJM stakeholders Wednesday endorsed manual revisions implementing fast-start pricing even after some members questioned one of the changes.

In a sector-weighted vote of 3.41 (68.2%) at last week’s Markets and Reliability Committee meeting, members endorsed the proposed revisions to Manual 11: Energy & Ancillary Services Market Operations. Two related revisions, to Manual 18: PJM Capacity Market and Manual 28: Operating Agreement Accounting, were unanimously endorsed as part of the meeting’s consent agenda.

The revisions were first endorsed at the August Market Implementation Committee meeting. (See “Fast-start Pricing Revisions Endorsed,” PJM MIC Briefs: Aug. 11, 2021.)

FERC accepted PJM’s filing in May on the changes with an effective date of July 1. (See FERC Accepts PJM Fast-start Tariff Changes.) The RTO filed a request to move the effective date to Sept. 1 to avoid implementation during the summer peak period, which the commission approved.

Greg Poulos, executive director of the Consumer Advocates of the PJM States (CAPS), requested that the Manual 11 revisions be pulled from the consent agenda and voted on separately. Poulos said the Monitor identified a revision that concerned the advocates, pointing to section 4.2.9: Synchronized Reserve Market Clearing Price Calculation.

“We’re concerned it’s a step further than what was approved by FERC and would raise prices for consumers,” Poulos said.

The Monitor originally provided an overview of concerns regarding the formation of ancillary service market clearing prices under some fast-start conditions at the Aug. 11 MIC meeting. The updated manual language in section 4.2.9 states, “In the pricing run, the cost of the marginal synchronized reserve resource may also include amortized start-up and amortized no-load costs due to integer relaxation for eligible fast-start resources.”

The Monitor argued that PJM should not implement fast-start pricing in this way because it’s inconsistent with previous filings and the Operating Agreement, saying the result of the change will be that the commitment cost of the marginal unit for reserves is included in the reserve clearing price when there is no lost opportunity cost. It made a filing earlier this month requesting FERC to evaluate the revision. PJM responded on Aug. 23, saying the challenge was “beyond the scope” of the compliance filing proceeding.

Susan Bruce, counsel to the PJM Industrial Customer Coalition (ICC), said she supported Poulos’ perspective on the manual change and the reasoning of the Monitor for challenging the language. Bruce said the ICC was in “the uncomfortable position” of opposing a piece of a manual change that it otherwise would have supported.

Paul Sotkiewicz of E-Cubed Policy Associates said he believed the manual changes PJM made were consistent with what was filed before FERC and that a problem didn’t exist in section 4.2.9.

Poulos made a motion to defer the vote on Manual 11 until the September MRC meeting, but the motion failed in a sector-weighted vote of 2.08 (41.6%).

Initial Margining Solution

One of the last significant changes resulting from the GreenHat Energy default is set to be voted on by stakeholders next month.

Michele Greening, lead stakeholder affairs consultant for PJM, provided an update on the activities of the Financial Risk Mitigation Senior Task Force (FRMSTF). Eric Endress of PJM reviewed the proposed solution and tariff revisions endorsed by the FRMSTF to address rules related to initial margining.

Stakeholders endorsed a proposal provided by Duke Energy and Perast Capital Management on initial margining at the Aug. 4 FRMSTF meeting with 69% support. A related proposal from PJM garnered 37% support at the meeting and failed to be endorsed.

GreenHat acquired the largest financial transmission rights portfolio in PJM between 2015 and 2018 but defaulted in June 2018, leaving stakeholders to cover more than $179 million in the market. When the company defaulted, GreenHat had only $559,447 in collateral on deposit with PJM. (See Doubling Down — with Other People’s Money.)

Endress said the objective of initial margin under Duke and Perast’s proposed methodology is to have a collateral deposit collected for future contracts and posted by a trading participant to protect against the financial consequences of a default. Initial margin is specifically set to cover the period it would take to unwind a defaulted portfolio.

Endress said initial margin is not a fixed quantity based on the initial contract inception, but it is updated at the time of every auction to “ensure that the appropriate risk is captured” of potentially unwinding a defaulted portfolio.

The initial margin method based on historical simulations methodology (IM-H) includes the confidence interval, which represents the range of values likely to include a population value within a certain degree of confidence. Endress said typically, the higher the confidence interval, the higher the resulting initial margin. PJM conducted analyses at confidence levels of 99%, 97% and 95% when evaluating the IM-H calculation.

In PJM’s testing of total FTR collateral, Endress said, the status quo had a failure rate of 8% based on backtesting, which represents the percentage of instances when collateral was insufficient to cover actual market moves. Endress said the 95% confidence interval, which Duke and Perast settled on, had a failure rate of 1.21%. PJM’s proposal used the 97% confidence interval, Endress said, which resulted in a failure rate of 0.9% in backtesting.

Both positive and negative mark-to-auction (MTA) would be part of the FTR collateral credit calculation in the proposal, and all bids would be considered during the bidding window and have IM-H calculated for them. The adjusted historical values based on the modeling of future transmission upgrades would no longer be included.

The methodology also uses the liquidation period, which represents the number of periods a defaulted portfolio can be liquidated. Endress said a two liquidation period was recommended to stakeholders and aligns with the potential unwinding of defaulted positions.

Several stakeholders questioned PJM, Duke and Perast over the proper confidence interval to use, with some pushing for 99% used by other RTOs.

Perast’s James Ramsey said the endorsed proposal suggested the 95% confidence interval because the failure rate was reduced to 1.21% from the status quo of 8%. Ramsey said the 97% interval proposed by PJM would cost an extra $140 million to achieve a failure rate improvement of 0.3%.

“We just think the cost-benefit of that doesn’t make any sense,” Ramsey said.

Bruce said both the Duke and Perast proposal, along with the PJM proposal that wasn’t endorsed at the FRMSTF, represented improvements over the status quo. She asked if there was a “comfort level in a hardwired relook” by Duke and Perast of the 95% confidence interval in the future to move closer toward industry standards on the number.

Duke’s Matthew Holstein said they would be open to re-examining the confidence interval at a future date if there’s a better methodology to reach the number or if there’s changing market conditions. He said given the data provided by PJM, the 95% confidence interval seemed better than the 97% of 99% numbers on a cost-benefit analysis.

“We want to make the best decisions for the market,” Holstein said.

The committee will be asked to endorse the proposed solution and tariff revisions at its next meeting.

Natural Gas and Electric Markets Issue Charge

Jim Davis, regulatory and market policy strategic adviser for Dominion Energy, reviewed a problem statement and issue charge related to natural gas and electric market coordination, saying they were the result of “continued concerns over the misalignment between the natural gas and electric markets.”

Fueling gas-fired units is fundamentally different from units with on-site fuel sources, Davis said, because they require close coordination with pipelines. There are more restrictive operations for gas-fired generation with a greater frequency of localized operational flow orders, which can also create greater imbalance penalties with more restrictive imbalance provisions, he said.

Davis said the primary problem with the current market design is that it discourages fuel procurement at the time generation is most needed. He said corporate structures regarding authorization, protocols and trading limits during extreme pricing events can prevent fuel purchases, leading to system failures like the ones seen in ERCOT during the winter storm in February.

Secondary problems involving coordination and operations include greater limits on pipeline flexibility. High-demand events, Davis said, combined with decreased flexibility and the growth of intermittent resources on the grid will require greater coordination to maintain reliable operation of the electric system.

Key work activity in the issue charge would include providing education on topics such as the history of pipeline and electricity coordination, pipeline tariffs, products, procurement, imbalance charges and penalty structure; and the impact of intermittent generation on the system.

Davis said a goal is to take a “deep dive” into examining the recent grid emergency events in Texas by looking at the gas-electric coordination failures.

“We recognize that this is a broad and complex issue to address,” Davis said. “That’s why we believe education is going to be key in the scope of the work.

A second key work activity would include identifying potential improvements to the PJM market to mitigate the impacts of misalignment. Davis said the issue charge calls for examining possible improvements to coordination and emergency procedures, looking at PJM’s situational awareness of the fuel supply and exploring improvements to PJM’s economic dispatch model.

Davis said out-of-scope items are issues that can only be resolved by FERC or the North American Energy Standards Board taking action to reform the gas market.

“We’re trying to keep this in the confines of what PJM has authority over,” Davis said.

The expected deliverables are accounting for natural gas transportation, gas procurement and oil reserves in PJM’s economic dispatch signal and reserve calculations, and developing market rules that can address the challenges of procuring gas over non-peak hours, weekends and holidays.

Davis said the goal is to begin the review process in October with a year set aside for work and reforms.

“I believe we’re at a critical point in history in the evolution and transformation of the energy industry,” Davis said.

Monitor Joe Bowring said the IMM agreed with the “broad statements” from Dominion about the issues with misalignment between gas and power and that it has been a topic of discussion for several years. But it disagreed that the gas side of the issue should be out of scope. Bowring said stakeholders should be allowed to express their views about the structure of the gas industry and make suggestions to FERC.

“If we simply accept the limitations of the gas side, that means ultimately imposing all the risks on PJM and PJM customers,” Bowring said. “That doesn’t make sense.”

Davis said Bowring’s comments will be considered before the next MRC meeting.

Bruce said the issue charge covers an important work effort, calling it a “pervasive issue” and challenging to solve. Part of the challenge as stakeholders is not having “the right people in the room” to start the conversation and that it’s not just a PJM issue but a regional and national issue.

She said she wanted to know how pipeline operators would be involved in the conversation and expressed concern about PJM customers shouldering the costs of any changes while other industries and regions may reap the benefits of changes.

The committee will be asked to endorse the proposed issue charge at the September MRC meeting.

‘Know Your Customer’ Tariff Changes

Members unanimously endorsed two different tariff changes related to PJM’s implementation of changes last year to the “know your customer” requirements and procedures.

Steve Pincus, associate general counsel for PJM, reviewed the proposed tariff revisions to address making cure periods uniform across the tariff and OA. Pincus said appropriate cure periods defined in section 15.1.5 of the OA were originally updated in that document, but not in section 7.3 of the tariff, which involves provisions limited to transmission service customers.

The new revisions eliminate duplicative specification of cure periods for transmission customer payment violations in section 7.3 of the tariff by referencing section 15.1.5 of the OA.

“The purpose of the change is to eliminate the confusion that could be caused if there’s two different sets of rules applicable to a transmission customer,” Pincus said.

Jessica Troiano, senior counsel for PJM, reviewed the proposed solution and tariff revisions to address making the definitions of working credit limits uniform across the tariff.

Troiano said PJM requires all participants to maintain credit equal to the highest exposure experienced in the past year, which is usually the sum of the highest three consecutive weekly bills during that time called the peak market activity requirement. Participants’ current obligations may not exceed 75% of the unsecured credit allowance as established by PJM settlement, or the working credit limit requirement.

The revisions eliminate duplicative definitions of “working capital limit,” Troiano said, leaving only the definition in the definitions section of the tariff and removing the additional definition in Attachment Q of the tariff to remove ambiguity.

The changes now go to the Members Committee for a vote at the Sept. 29 meeting.

Market Suspension

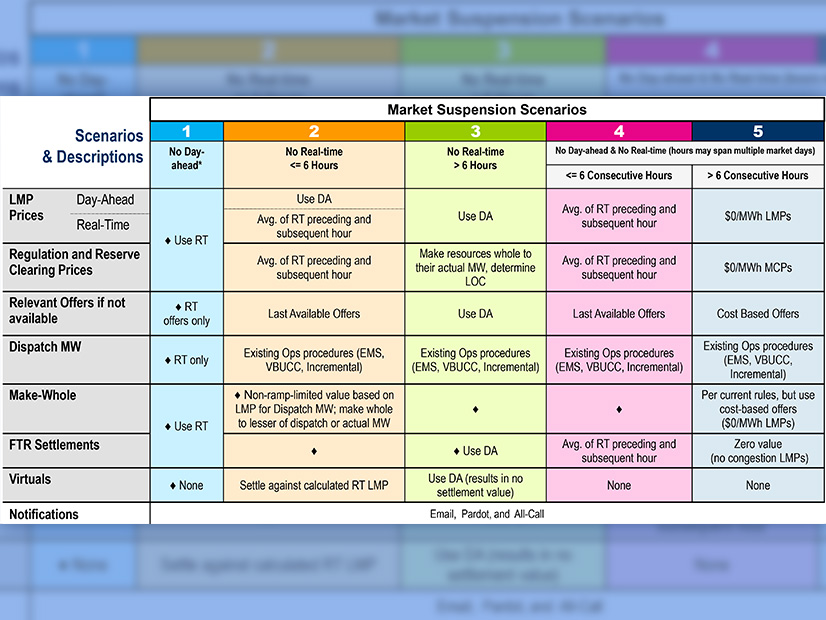

Stefan Starkov, senior engineer for PJM’s day-ahead market operations department, reviewed the proposed solution and tariff and OA revisions to address rules related to market suspension. The proposed rules were first endorsed at the June MIC meeting. (See “Proposed Rules for Market Suspension Endorsed,” PJM MIC Briefs: June 9, 2021.)

Starkov said the revisions are designed to provide clear business rules in PJM markets to account for a market suspension where the RTO cannot clear or produce market results.

PJM has several current versions of the tariff and OA reflecting approved and pending language before FERC, Starkov said, but the current draft does not reflect any pending language on five-minute dispatch pricing, reserve price formation and fast-start pricing. He said the language would be updated after FERC approval.

The RTO is looking to have an endorsement at the Sept. 29 MRC and final approval at the Oct. 20 MC meeting.

Calpine’s David “Scarp” Scarpignato said the market suspension issue has “been a hole in the tariff.” He requested that the final endorsement be pushed back by one month because of timing issues and that he had several proposed changes to bring to the stakeholder body.

PJM officials said Scarp would be able to introduce changes as friendly amendments at the next MRC meeting.

Consent Agenda

The committee unanimously endorsed several manual changes as part of its consent agenda. They included:

- revisions to Manual 3A: Energy Management System (EMS) Model Updates and Quality Assurance (QA) resulting from the periodic cover-to-cover review. The changes were endorsed at the August Operating Committee meeting. (See “Manual 3A Updates Endorsed,” PJM Operating Committee Briefs: Aug. 12, 2021.)

- revisions to Manual 6: Financial Transmission Rights resulting from the periodic cover-to-cover review. The changes include an update to section 6.8 to align language with the current approach for addressing a defaulting member’s FTRs with various options. (See “Manual Revisions Endorsed,” PJM MIC Briefs: July 14, 2021.)

- revisions to Manual 11: Energy & Ancillary Services Market Operations addressing five-minute long-term changes and transparency. The manual revisions were endorsed at this month’s MIC meeting. (See “Fast-start Pricing Revisions Endorsed,” PJM MIC Briefs: Aug. 11, 2021.)

- revisions to Manual 20: PJM Resource Adequacy Analysis resulting from the periodic cover-to-cover review. PJM said the minor changes included cleaning up outdated and redundant language and ensuring the manual language follows current processes in the RTO. (See “Manual 20 Endorsed,” PJM PC/TEAC Briefs: Aug. 10, 2021.)

- revisions to Manual 28: Operating Agreement Accounting resulting from the periodic cover-to-cover review. The manual changes were first endorsed at the July MIC meeting. (See “Manual Revisions Endorsed,” PJM MIC Briefs: July 14, 2021.)