If the U.S. is to decarbonize its electric grid by 2035, solar deployment will have expand at an unprecedented rate, from a cumulative capacity of 80 GW currently to between 760 and 1,000 GW by 2035, according to a report released Wednesday by the Department of Energy.

If electrification of transportation, buildings and other economic sectors is added, solar could be providing close to 45% of the nation’s electricity demand by 2050, up from just 3% .

At 310 pages, the Solar Futures Study drills into all aspects of what it is going to take to hit such ambitious numbers, which, it says, will be challenging but possible. Research to drive innovation and ongoing cost reductions; supply chain buildout, including recycling of critical materials; as well as grid expansion and new business models for wholesale and retail markets are all part of the roadmap.

Wholesale markets will have to “adapt to the increasingly dominant role of zero-marginal-cost renewable energy, and retail markets must adapt with rates that reflect the changing grid and an increased role for distributed energy resources,” demand-side services and enhanced energy reliability, the report says.

For example, the study calls for “flexible and adaptive interconnection” strategies to promote cost-effective DER deployment. An approach called active network management “uses flexible interconnection agreements, sophisticated communication infrastructure and information on local power system conditions (forecasted load, constraints, etc.) to automatically adjust the behavior of DERs,” the report says. “In exchange for allowing the utility limited control over the DER and accepting limited curtailment throughout the year, interconnecting customers endure shorter interconnection processes and avoid paying for prohibitively expensive distribution upgrades.”

At the same time, the report says, with more solar, wind and storage online, the grid will become “increasingly reliant on weather-dependent, inverter-based resources (IBRs), representing a dramatic change from the current grid based primarily on synchronous electricity generators. A grid dominated by IBRs will require new approaches to maintain system reliability and exploit the ability of IBRs to respond quickly to system changes.”

Clean, firm capacity will also be needed to fill the IBR gaps, the report says, specifically, 1,600 GW of energy storage with up to 12 hours of duration by 2050. “However, because solar and wind occasionally provide insufficient supply for several days, advances in technology that can provide clean, firm capacity at any time are needed to reliably meet demand as full decarbonization is approached.”

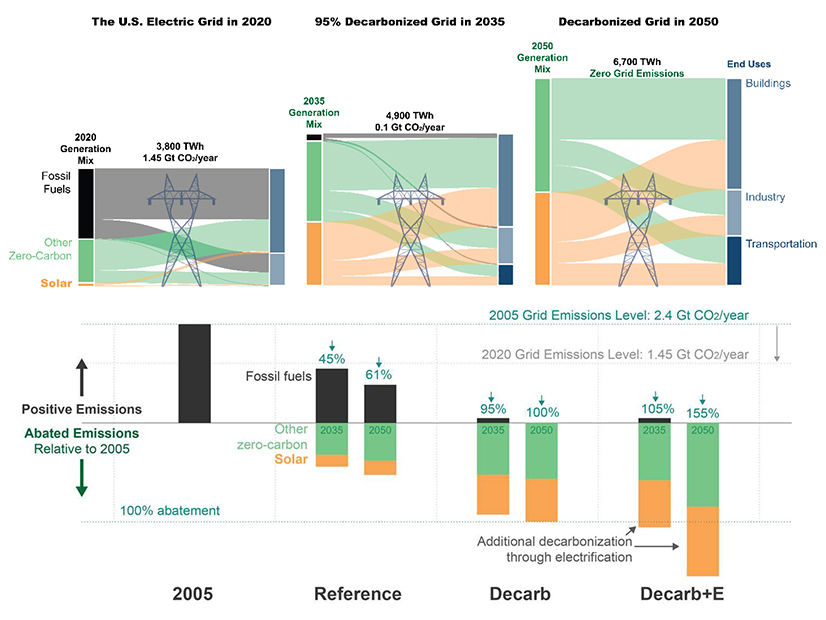

Those advances may not come fast enough. Based on models and projections from the National Renewable Energy Laboratory, the study anticipates that a 95% decarbonized grid will be possible by 2035, but getting the last 5% could be too expensive if the goal is also to ensure no major increases in consumer electricity prices. Even with aggressive policies, a residual 5% of fossil fuel generation may still be in the mix at that point, the report says, though a 100% clean grid will be possible by 2050.

Demand Grows, Emissions Drop

Heading into November’s U.N. climate change conference in Glasgow, the report positions the U.S. solar industry as playing “a unique and central role” in emission reduction because of two key attributes of the technology, the report says. It is modular; that is, it is deployable at any scale, from a few kilowatts of rooftop panels to hundreds of megawatts spread over hundreds of acres of land.

It is also “diurnal,” simultaneously variable and reliable, based on “daily and seasonal patterns of the rising and setting sun,” the report says. Daily variability of cloud cover and other factors notwithstanding, this diurnal reliability “means that grid operations and electricity demand can be proactively managed to maximize use of low-cost, zero-carbon solar energy,” the report says.

Even without President Biden’s aggressive target for grid decarbonization, the study’s business-as-usual scenario — based on market forces and existing federal, state and local policies — anticipates 380 GW of U.S. solar capacity in 2035 and 670 GW in 2050.

The bigger numbers are generated in a second “Decarb” scenario, which sees federal policy driving grid decarbonization and accelerated solar deployment by 2035, and a third, “Decarb+E” option, targeting economywide decarbonization via electrification of transportation, buildings and other sectors.

Other core findings in the study include:

- Electricity demand jumps 30% with a 95% decarbonized grid, from 3,800 TWh per year in 2020 to 4,900 TWh in 2035. Demand increases another 34% to 6,700 TWh in a net-zero 2050. At the same time, the Decarb+E scenario could make the U.S. carbon negative by 2035, with emissions dropping 155% from 2005 levels by 2050.

- Technological innovation could cut solar costs another 60% by 2030 “via improvements in photovoltaic efficiency [and] lifetime energy yield,” which could in turn open up new applications for solar “in novel configurations associated with agriculture, waterbodies, buildings and other parts of the built environment.”

- Getting to a 95% decarbonized grid by 2035 will increase system costs by $225 billion, or 10% more than business as usual, versus $562 billion, or 25% more for Decarb+E, the report says. “However, avoided climate damages and improved air quality more than offset those additional costs, resulting in net savings of $1.1 trillion in the Decarb scenario and $1.7 trillion in the Decarb+E scenario,” the report says.