Google has purchased renewable energy equal to its total consumption every year since 2017, yet it’s still a long way from its 2030 goal of using carbon-free energy in all locations and all hours.

Although Google currently purchases renewable energy equivalent to its load, there are hours when its contracted renewables produce more than its data centers and other facilities consume. Conversely, in the middle of the night, it must rely on nuclear- and fossil fuel-generated power when wind and solar production is lower than consumption.

To overcome this “dissonance,” says Mike Della Penna, Google’s technical program manager for energy development, the company is pursuing improved wind forecasting, enhanced geothermal generation and policy changes to increase competition and eliminate barriers to corporate procurement.

But to get all the way there, the company and other large energy users say, they will need to greatly increase their use of storage.

“Wind and solar [are] great, but it will only get us so far,” Della Penna said during a webinar sponsored by the Energy Storage Association on Thursday. “Hence the need for energy storage technologies.”

Corporate Buyers Seeking Storage

Priya Barua, director of zero-carbon innovation for the Renewable Energy Buyers Alliance (REBA), said 2020 marked a change in the way companies are procuring renewables to ensure decarbonization. “While this change in procurement played out in many ways, the inclusion of storage in corporate procurement contracts was one that really jumped out,” she said. “Since 2010, we’ve seen an 88% reduction in the cost of some storage technologies. And now a decade later, in 2020, five corporate companies announced transactions and included storage totaling nearly half a gigawatt.”

In response to member interest, Barua said REBA will release a primer on using battery energy storage later this month that will include contracting best practices and examples of business use cases. REBA says its 240 members are responsible for 95% of the renewable energy transactions in the U.S.

Including all the units of Google parent Alphabet (NASDAQ:GOOGL), the company’s annual electricity consumption has quadrupled since 2012 to more than 12 TWh in 2019. In 2020, Della Penna said, Google reached 67% carbon-free energy globally on an hourly basis, with five of its 23 data centers operating 90% carbon-free around the clock.

Della Penna said Google believes it can meet its 2030 goal because of the declining costs of storage and renewables, government commitments to reduce electric-sector emissions, and increasingly sophisticated commercial offerings.

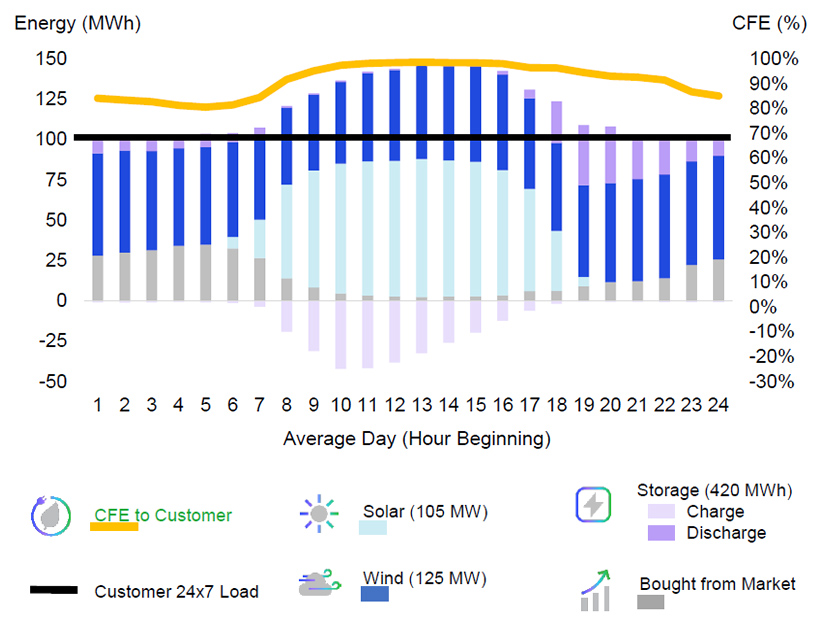

In May, Google and AES (NYSE:AES) announced a 10-year, 500-MW supply contract that will provide Google’s data centers in Virginia with 90% carbon-free electricity (CFE) from the PJM grid by 2024.

AES will use its own renewables and those of third-party developers to assemble the 500-MW portfolio, which it said will require about $600 million in investments. The plan envisions storing excess renewable energy during the hours of the strongest solar production and tapping the storage after the sun goes down.

Neeraj Bhat, chief product officer for AES Clean Energy, said AES sought to reduce complexity and market risk in soliciting bids from developers across PJM on Google’s behalf.

“You can model 24/7 CFE in [Microsoft] Excel, and then when you go to the market and talk to real developers with real projects with real challenges, all those nice little assumptions start to really get tested,” he said. “We ended up modeling north of 200 different portfolios [and] ended up [with] about 10 different assets to produce a load-shaped 90% carbon-free energy supply.

“The portfolio that we ended up putting together for Google did include some [run-of-river] hydro as well, which is great,” he added. “Any time you can get a generation source with a different generation profile, that really adds to the CFE output.” To reduce market risk, AES made trades for price hedges, allowing it to offer Google a fixed-price contract.

Storage’s ‘Surgical Nature’

Bhat said the value of storage is its “surgical nature.”

The PJM grid averages 30 to 40% carbon-free energy over a year, Bhat said. That increases to 65% CFE with a solar-only portfolio or 77% for a wind-only portfolio. Adding energy storage to wind and solar increases that to 91%, he said.

The PJM grid averages 30 to 40% carbon-free energy (CFE) over a year. That increases to 65% CFE with a solar-only portfolio or 77% for a wind-only portfolio. Adding energy storage to wind and solar increases that to 91% CFE. | AES

Adding wind to a portfolio can help fill evening hours with CFE, but it’s inefficient. Bhat likens it to Jackson Pollock’s method of painting. “You’re really throwing a lot of megawatt-hours of paint at that canvas, and a lot goes to waste, because you’re not getting exactly where you need to; you’re not getting the pixels that you really need,” he said. “The beauty of energy storage in this picture is that it becomes extremely surgical for taking exactly the hours that you need and pulling that out when you don’t need them and putting them in exactly when you need them. And that’s why we think the linchpin of a grid that is going to be 100% carbon-free is going to be storage.”

Bhat said the carbon reductions provided by storage are not linear. “You really start to dig deeper into those very carbon-intensive hours. And so you get much more carbon reduction when you’re really painting the full canvas rather than kind of cherry picking the solar hours, which, in most grids of the country, are becoming less and less carbon intensive.”

Dispatching for Carbon, not Cost

Reaching 24/7 CFE also requires “hourly load data aggregation: people understanding what their hourly profile is, understanding where they have load flexibility, and the carbon intensity of a particular grid and scenarios in which they can ramp down their own load, and especially carbon-intensive hours,” Bhat said.

Dispatch algorithms must be maximized not for the price of energy, but for the carbon-free content of the supply. “Happily, there’s a lot of correlations between those two,” Bhat said. “It’s not perfect, but it tends to serve in both directions if you’re dispatching the storage facilities appropriately.”

Another tool will be more granular renewable energy credits (RECs), he said. “Renewable energy credits today are effectively a monthly tool. There’s not hourly granularity on when a particular renewable megawatt-hour was generated.”

Tagging RECs by the hour of production allows companies seeking 24/7 CFE to value RECs differently based on when they were produced.

“So if a noon REC is worth $5 or $6[/MWh], maybe a REC [produced] at 8 p.m. is worth $12 or $15,” Bhat explained. “And so all of a sudden, you’re starting to create price signals and incentives for more storage to be deployed into the system.”

Della Penna said not all the regions where Google operates data centers have the market structures that allow the deal it signed with AES for its Virginia facilities.

He said the company is seeking to use the Tennessee Valley Authority’s “robust” corporate renewables procurement program “to solicit for new resources that can help us build up our carbon-free energy profile across the region.”

“We’re equally comfortable — although it’s more work on our side — assembling the CFE portfolio ourselves … and building up a book of resources and” power purchase agreements, he said. “That’s precisely what we’ve done in SPP to date.”