Current trends suggest that Oregon will come up short of its zero-emission vehicle adoption goals over the next decade, but near-term policy developments, expanded buyer incentives and buildout of a reliable charging network could salvage the outcome for 2035, a new report said last week.

Oregon’s ZEV registrations reached 33,579 in 2020, up 20% from the previous year but well below the state’s target of 50,000, according to the Biennial Zero Emission Vehicle Report released by the state’s Department of Energy (ODOE).

As of June, 38,482 light-duty ZEVs were registered in the state, representing about 1% of all registrations, the report said.

“While ZEVs are increasingly popular, the state did not achieve its 50,000 registered ZEVs by 2020 goal, and it is not on track to achieve the 2025 or 2030 goals,” the report’s authors said. “However, Oregon is well positioned to increase ZEV adoption with policies and programs that support ZEV sales in Oregon, including incentives, to help reduce upfront vehicle costs.”

A 2019 Oregon law outlines the state’s clean vehicle targets, which include:

- 250,000 registered ZEVs by 2025;

- at least 25% of registered vehicles and 50% of new vehicles sales be ZEVs by 2030;

- at least 90% of all vehicles sold annually be ZEVs by 2035.

The ODOE report found that the COVID-19 pandemic likely contributed to the 2020 shortfall but was not the sole factor.

“In early 2019, ZEV adoption was growing quickly, boosted by the first year in sales of the Tesla Model 3. By the end of the year, ZEV growth had slowed as Tesla completed backorders for the vehicle and resumed more normal vehicle production,” the report said.

With the onset of the pandemic last year, vehicle production and sales fell nationwide in April and May because of shutdowns at auto factories and dealerships. Overall new vehicle registrations in Oregon fell by about 23% to 165,770, while new ZEV registrations fell 8% to 6,532, bumping the ZEV market share for new cars from 3.3% to 3.9%.

Additionally, registration numbers for all vehicles last year likely did not reflect the total number of vehicles in the state because of delays in registration while the Department of Motor Vehicles allowed for a grace period during the pandemic.

Near-term Uncertainty

The ODOE report describes the heavy lift required to get the state back on track to meeting its next set of ZEV targets.

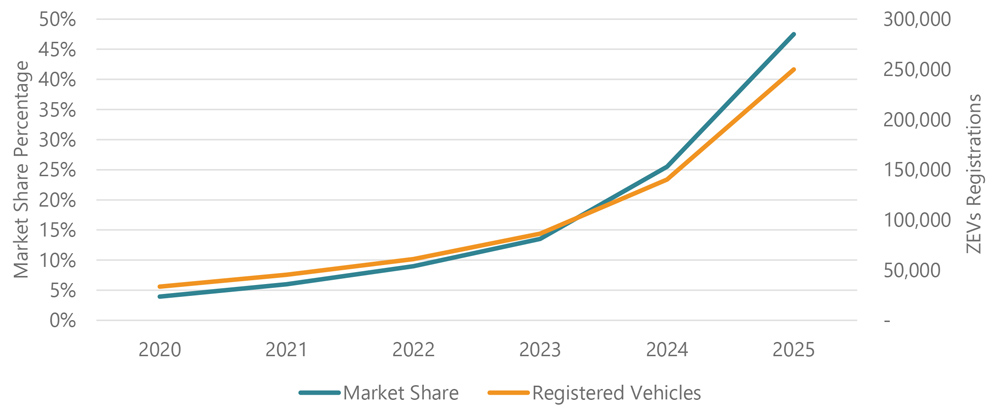

“In order to achieve the 2025 goal of 250,000 registered ZEVs, the market share of ZEVs would need to grow from 4% in 2020 to more than 47% in 2025 — more than a tenfold increase,” the report said.

Furthermore, to reach the target of 25% of registrations by 2030 (equating to about 1 million vehicles), ZEVs would need to comprise 50% of new car sales by 2026, ODOE found.

The required growth curve in Oregon’s ZEV market share “exceeds all recent EV market share forecasts by leading studies and is twice that of the most aggressive curve forecasted by the Electric Power Research Institute, which was included in a recent report from the University of Berkeley.”

Achieving such a steep trajectory of ZEV growth would require Oregon to outpace the country’s leading EV adopter, California, which currently last year had nearly 133,000 ZEVs on the road and an 8.1% ZEV market share. The California Air Resources Board (CARB) has estimated that ZEVs will make up 15.4% of that state’s market share in 2025, compared with the 47% market share Oregon would require to reach 250,000 ZEVs that year, ODOE pointed out.

In May, CARB proposed its Advanced Clean Cars II program, designed to boost California’s ZEV and plug-in hybrid electric vehicle (PHEV) market share to 26% by 2026, 60% by 2030 and 100% by 2035. But even if those growth estimates are applied to Oregon’s projected ZEV market share, the state will come up 100,000 vehicles short of its 2025 goal and 460,000 vehicles short of its 2030 goal, the ODOE report said.

Still, ODOE sees some hope that Oregon could meet its 2035 goal.

“Oregon is too early in the ZEV technology adoption curve to assess progress on the ZEV adoption goal of 90% ZEV market share by 2035. But because the goal is strictly based on market share and not total registrations, there is some qualitative evidence that the goal is achievable. Many vehicle manufacturers have indicated they will be ramping up production of ZEVs and, in some cases, phasing out production of internal combustion vehicles altogether,” the report said.

Furthermore, the report notes, ZEV production and adoption could get a boost after the International Energy Agency in May said that sales of cars with internal combustion engines must be phased out by 2035 for the world to meet net-zero CO2 emissions by 2050 and limit the increase in global temperatures to 1.5 degrees Celsius. (See IEA Paints Daunting Path to Net Zero by 2050.)

State Efforts

Oregon is taking its own steps to encourage the purchase of EVs. During its most recent session, the state legislature increased the amount of money the Department of Environmental Quality can make available through its Charge Ahead rebate program. Low- to moderate-income residents will now be eligible for up to $5,000 in rebates for the purchase of a new or used ZEV, on top of $2,500 in federal rebates.

“Higher upfront costs for EVs and a limited used vehicle market remain barriers to EV adoption for low-income families,” the ODOE report said.

In addition, the state’s Transportation Electrification Infrastructure Needs Assessment (TEINA) Advisory Group this year issued a study containing recommendations for state officials to consider in developing a network of EV charging stations that will encourage ZEV adoption. The wide-ranging report focuses on the needs of various vehicle classes, income levels, housing types and geographic locations. (See Oregon Study Charts Explosive Growth of EV Chargers.)

The ODOE report reiterated some of the findings of the TEINA study and additionally emphasized a set of key elements necessary for a successful public charging network, including open access, multiple payment options, pricing transparency and accessibility for people with disabilities.

“Widespread electric vehicle charging infrastructure is considered essential to the continued adoption of EVs,” ODOE said.