Texas regulators last week ignored political pressure in approving a pair of ERCOT requests for debt-obligation orders that will allow the grid operator to securitize $2.9 billion in market debt as a result of high charges incurred during the February winter storm.

The Public Utility Commission on Thursday tweaked and accepted a settlement reached between 46 parties and participants over ERCOT’s proposal for a $2.1 billion market uplift to cover short pays to the market, despite letters sent to each commissioner by Lt. Gov. Dan Patrick (R) in opposition to the agreement (52322).

Patrick said he supported the prioritization and securitization of retail electric providers (REPs) unaffiliated with generation companies. “However,” he said, “any portion of the proposed settlement agreement that does not calculate cost exposure on a net basis … is unacceptable.”

The state’s second most powerful politician said that the intent of legislation authorizing the securitization process (House Bill 4492) was to “calculate cost exposure on a net basis” by taking into account the profits of affiliated generators — such as Luminant and NRG Energy, affiliated with REPs TXU Energy and Reliant, respectively.

“The Texas Senate would not have passed a bill that gave money to companies that profited during the winter storm,” said Patrick, who as lieutenant governor is president of the Senate.

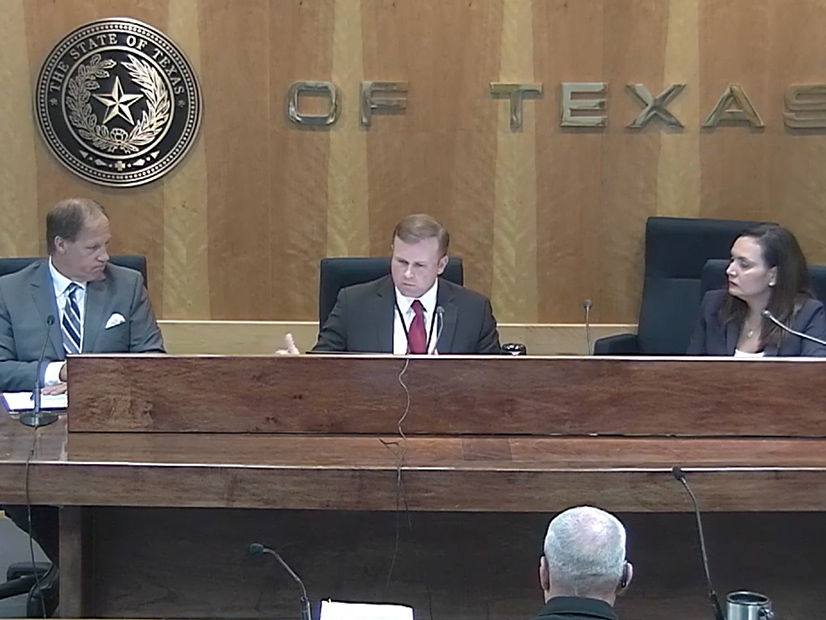

Commissioner Will McAdams, leading the PUC’s open meeting after Chairman Peter Lake recused himself, responded to the letter before the commission took up the docket. He said it was “well taken” and its assertion of legal intent “is always valuable to agencies” as they try to “execute the intent of the legislature and the letter of law.”

“With the submission of the unopposed settlement, we have a path forward and the mechanics of accomplishing securitization in an order,” McAdams said. “This is a complicated proceeding, with many intervenors. If we breach the unopposed settlement agreement, there’s a very good chance we would prevent staff from being able to move forward in a timely way to [meet] the deadline for issuing the order.”

The PUC faces a statutory deadline of Oct. 14 for issuing orders in the two proceedings. ERCOT’s other debt-obligation requests involves financing $800 million owed to the market by cooperatives and municipalities (52321). (See Texas PUC Hearings Begin on $2.9B ERCOT Securitization.)

“This settlement is that tool to provide badly needed liquidity into a market that has been significantly disrupted by” the storm, McAdams said. “Many actors are limping along, waiting on state-backed relief. If we restart this process, I fear that it may result in bankruptcies on the part of our most at-risk market participants.”

Patrick responded by issuing a statement after the meeting, calling the PUC’s decision “bad public policy and a bad decision for Texas taxpayers.” He also took shots at the commissioners, who replaced those seated during the winter storm, and HB4492’s author, Rep. Chris Paddie (R).

“After the winter storm, I called for the resignation of members of the PUC. They all resigned,” Patrick said. “I can assure you that the new commissioners’ Senate confirmation hearings would not have gone as smoothly if senators knew they intended to disregard the will of the Senate.”

He said Paddie, who recently said he was stepping down after eight years in the legislature, has been “disingenuous” during the legislative process and that he may be “seeking a highly compensated position in the same electric industry that stands to benefit from his position of no netting and no transparency.”

House Speaker Dade Phelan stood up for Paddie, chair of the powerful House State Affairs Committee, posting on Twitter that he was grateful for his “steady leadership, his character and his integrity.” Saying that implementing legislation related to ERCOT’s market “merits a deliberative, factual hearing,” Phelan said he has asked Paddie to convene a hearing to gather a progress report on the grid.”

“Shot … chaser,” tweeted energy consultant Doug Lewin, contrasting the Patrick and Phelan statements.

Lewin added that the political tit-for-tat is a fight about “who gets how much” of the $2.1 billion bailout, which is likely to be ultimately paid by ratepayers. “This is not a fight about how to give assistance to ratepayers or prevent another outage.”

State Senate Grills Gas Regulator

Texas senators took out their ire on the Texas Railroad Commission (RRC), which regulates the state’s oil and gas industry, when it became apparent that legislation they wrote earlier this year included a loophole that allows natural gas companies to opt out of weatherization requirements if they don’t voluntarily declare themselves to be “critical infrastructure.”

The opt-out fee is only $150. Should the facilities declare themselves “critical infrastructure,” they would be forced to spend significantly more money on weatherizing their facilities.

A timetable that requires a committee to map the state’s critical energy infrastructure by next September, and then gives the RRC 180 days to issue its weatherization rules, also raised the legislators’ hackles.

“Our weatherization rule will not be adopted for this winter because we have to put the map together,” RRC Executive Director Wei Wang said during the Senate Business and Commerce Committee’s Sept. 28 hearing on the energy industry’s winter preparations.

“Wait a minute … you haven’t done it yet?” Sen. Robert Nichols (R) asked.

Wang responded that the commission is just following Senate Bill 3’s language. The comprehensive bill was the legislature’s primary response to February’s devastating winter storm. (See Abbott Signs Texas Grid Legislation into Law.)

“Your rulemaking proposal sucks, and we need a different direction,” Sen. John Whitmire (D) told Wang.

“Appreciate your guidance on that particular issue, and if we need to change the language, we will,” Wang replied.

The committee directed Wang to ask the RRC’s legal counsel as to whether lawmakers can revise the legislation during the current special session that ends Oct. 19.

“This gives the Texas Railroad Commission a great opportunity to prove up its worth,” Sen. Donna Campbell (R) said. “If you don’t, it can just be moved the PUC. It’s going to be looked at. You better prove up your worth.”

The FERC–NERC joint inquiry into February’s generation outages in Texas and the Midwest during the storm have fingered the lack of gas infrastructure weatherization as the primary culprit. Other reports and studies have come to the same conclusion. (See FERC, NERC Share Findings on February Winter Storm.)