Grid operators and planners need “a seat at the policymaking table” and a reliability “safety valve” to ensure efficient and reliable integration of renewables, the Eastern Interconnection Planning Collaborative said in a white paper Wednesday.

The EIPC was formed in 2009 under an agreement by 19 planning coordinators from the Eastern and Central U.S. — including MISO, SPP, PJM, ISO-NE and NYISO — with funding from the Department of Energy.

Its new report, titled “Planning the Grid for a Renewable Future,” contains no new data but makes three main recommendations for adapting the Eastern Interconnection to the increase in inverter-based renewables:

- Enhance policy coordination across the “three-legged stool” of planning, cost allocation and siting: “Enhancing planning alone will do little to manifest the significant transmission needed to achieve a high-renewable future unless policymakers also deal with the issues of who pays for the new transmission … and challenges in siting new transmission, including issues of property rights, land use, and environmental and social justice.”

- Establish a system of monitoring and course correction as events unfold: Regulators, industry and stakeholders should have the “opportunity to both monitor and correct course in a timely fashion if a particular [policy] path is leading to unnecessarily higher costs, limited choice for customers or negative reliability impacts.”

- Enhance collaboration: To “ensure that public policy and the physics of the power system work harmoniously together,” EIPC says policymakers considering renewable portfolio standards, carbon dioxide standards, or other energy-related goals should invite system planners and operators to provide input “as to the full-range of planning and operational challenges, costs and trade-offs associated with the proposed set of standards. Understanding the full range of implications can be extremely challenging, which sometimes more high-level analyses used in the legislative process can overlook.”

The paper acknowledged the issues it raised “should not surprise industry leaders.”

But it said that because of the size and diversity of the Eastern Interconnection, “the insights among the planning coordinators through this effort provide a robust view on the lessons learned in planning the transmission grid to support high-renewable systems.”

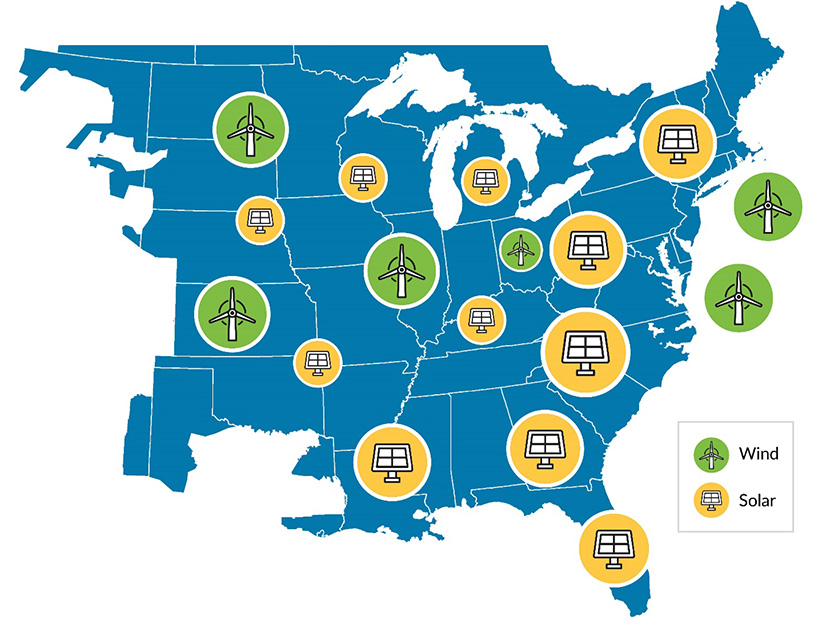

The report says the growth of wind and solar resources is shifting resource adequacy risks beyond peak load periods, necessitating “more detailed modeling and integrated resource planning.” It also said additional transmission is needed to integrate renewables and meet increased demands for electrification of the transportation and industrial sectors.

To respond, there should be “a seat at the policymaking table for power system operators and planners to articulate the system reliability needs and how they are changing, so that public policy has built-in processes to account for these needs,” EIPC said. “… Grid operators and planners need to be more engaged in the discussions.”

The report said planners need more sophisticated modeling because of the growth of rooftop solar, backup generators, home chargers for electric vehicles, the conversion of gas and oil heating to heat pumps and whole-building battery backups. “As with operations, system planners must have adequate visibility into the locations and level of penetration of distributed energy resources so that the impact on the bulk system can be accurately modeled and controlled.”

In addition to transmission upgrades, integrating renewables may require “non-traditional assessments,” such as electromagnetic transient (EMT) studies to determine the impact of interruptions caused by lightning and system faults.

It praised the “proactive” implementation of IEEE 1547, the standard for interconnection and interoperability of DERs, as an example of “good, enhanced consultation.” (See State Regulators Endorse IEEE DER Standard.) “State utility commissions must adopt the new requirements if they are to be effective,” it said.

The lack of standardized performance requirements for inverter-based renewables has caused “significant delays” in the interconnection study queues of system planners, it said. “To address this issue, there must be transparency of the control systems by the designers and vendors, so that they can be validated by the resource owners and system planners to ensure system reliability.”

The report predicts energy markets will face increasing challenges in obtaining reliability services such as generator ramping, voltage support, reactive power, frequency response and system inertia that have historically been supplied by legacy synchronous resources at no cost or through regulated rates. “As resources become more diversified, the reliable and efficient delivery of electricity will require the development of additional market products to properly incentivize those ancillary services the grid needs,” it said. “Additionally, falling marginal energy prices due to the increase in renewable resources has already put pressure on existing resources that rely on energy or capacity revenues to remain operational.”

The group said regulators could consider a “reliability safety valve” in any future legislation to address unintended consequences that could impact grid reliability as new policies are implemented.

“The intent of the ‘timeout’ to address an identified reliability problem isn’t to block progress on the intended policy objective,” it said. “Rather, it is designed to ensure a limited surgical opportunity to address particular reliability issues that may arise either during the regulatory process in developing a final rule or during its implementation.”

Previous EIPC reports have examined gas-electric coordination, transmission planning and system inertia. (See Study: Frequency Response OK in Eastern Interconnection.)

In addition to the RTOs, the EIPC includes Associated Electric Cooperative Inc.; Dominion Energy (NYSE:D); Duke Energy (NYSE:DUK); NextEra’s (NYSE:NEE) Florida Power & Light; PPL’s (NYSE:PPL) Louisville Gas & Electric/Kentucky Utilities; South Carolina Public Service Authority (Santee Cooper); Southern Co. (NYSE:SO); and the Tennessee Valley Authority.