Texas regulators are expected to release a draft blueprint for a redesigned ERCOT market Thursday in response to February’s winter storm that will likely focus on increasing the amount of dispatchable generation.

The American Council for an Energy-Efficient Economy (ACEEE) has countered by saying rather than build new power plants or taking other measures, Texas could avert future blackouts at a lower price by instead improving the energy efficiency of its homes and using technologies to shift electricity usage away from peak demand periods.

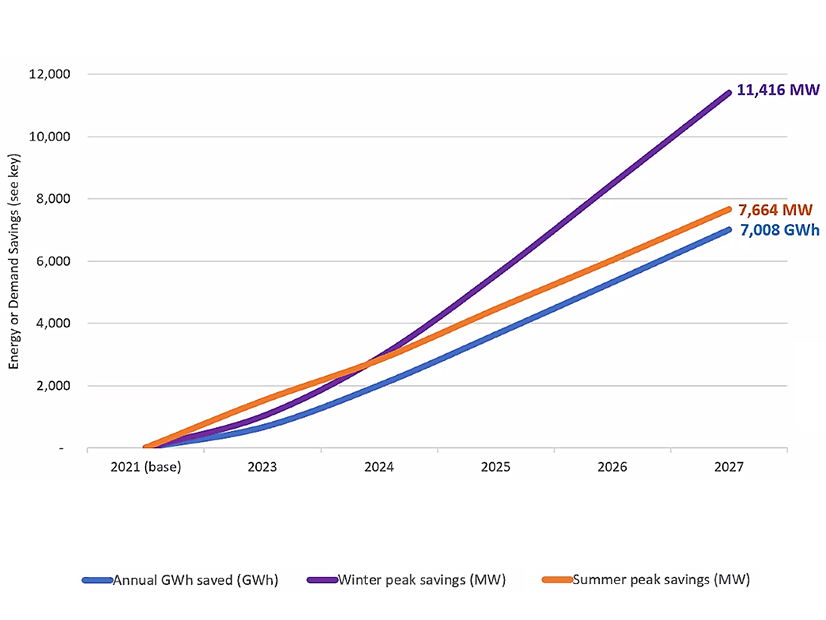

In a new report, the council said the state could deploy seven residential energy efficiency and demand response retrofit measures over five years that could serve about 9 million households and offset about 7.7 GW of summer peak load and 11.4 GW winter peak load at a cost of $4.9 billion. That is below separate proposals by Berkshire Hathaway Energy and Starwood Energy Group Global to build 10 to 11 GW in gas plants for $8 billion.

“That should be one of the first things the commission does,” said Stoic Energy consultant Doug Lewin, who moderated an ACEEE panel discussion Tuesday previewing the Public Utility Commission’s open meeting Thursday.

Lewin said Texas was the first state to adopt an energy efficiency resource standard in 1999. Nearly 30 states have now instituted similar standards, he said, but Texas now stands dead last.

“We have not increased energy efficiency programs even a smidge since 2011,” Lewin said, adding that demand continues to grow in the state.

“Does [ACEEE’s proposal] solve everything?” he asked rhetorically. “One of the biggest criticisms of energy efficiency is that it doesn’t solve the whole problem. Nothing solves the whole problem. We aren’t looking at silver bullets here. There’s a lot of silver buckshot.”

Alison Silverstein | ACEEE

Alison Silverstein | ACEEEAlison Silverstein, an independent consultant with a career that includes stints with the PUC, FERC and the U.S. Department of Energy, agreed with Lewin. She said she expects more discussion among the four commissioners, who have been in a “learning mode” since their appointments during the last eight months.

“There’s so much ground to cover and a lot of space between the commissioners to explore,” Silverstein said. “There’s no single solution here. What the commission needs to adopt is many measures for a layered approach. … How do we put all these pieces together rather than think one specific recommendation is going to solve all the problems?”

Noting the commission’s goals include improving resource adequacy, Silverstein said the market’s new design elements should focus on operational reliability and market considerations.

“Let’s make sure we have long-term and short-term solutions … to keep the lights on day-to-day,” she said. “The commission is under a lot of pressure. The legislature has already reminded them very explicitly that winter is coming. Don’t spare the horses. Let’s keep the pedal to the metal.”

The PUC has conducted four market redesign workshops since the summer to gather ideas and input from market participants on how to prevent a reoccurrence of the days-long blackouts that followed February’s winter storm. During last Thursday’s workshop, the commission heard from The Brattle Group, which called for fixes through the market, and Potomac Economics’ David Patton, who said increasing ERCOT’s capacity margin would not have effectively addressed last winter’s outages.

Suzanne Bertin, Texas Advanced Energy Business Alliance | ACEEE

Suzanne Bertin, Texas Advanced Energy Business Alliance | ACEEESuzanne Bertin, managing director for the Texas Advanced Energy Business Alliance (TAEBA), pointed out that most of the proposals brought forth have come from the market’s largest players who have proposed increasing dispatchable generation “by raising revenues to fossil fuel generators in particular.”

She divided the proposals into three major categories: paying certain plants to stay online instead of retiring because of market economics (Vistra); providing backup service by paying specific generators to run 24 hours straight (Lower Colorado River Authority); and mandatory forward procurements or load obligations of three years (NRG Energy). (See Study Suggests Texas LSEs Can Provide Reliability.)

“We’re interested in focusing on those types of solutions that would directly address the problems we faced in February,” Bertin said, using rooftop solar, home batteries and electric vehicles as examples. “The cost of electricity grid failure is so high that we need to be thinking about building a whole suite of resources and rules that provide layers of protection for Texans going forward. We also need to be thinking about how we make sure the costs borne by customers in Texas — because they ultimately pay for whatever policy decisions are made … are bearable.”

Bertin compared the result to an orchestra, with all the instruments playing their parts “to draw out the characteristics that make a symphony work.”

“Any market design changes made over the next couple of months need to incorporate the best available technologies … necessary for Texas to retain its energy leadership role and maintain confidence in the electric system,” she said.

PUC Chair Peter Lake said during the last workshop that any design decisions will be made quickly and without giving thought to protecting business models.

That is small comfort to Silverstein, who said she is hoping the commission will look at “performance-based, technology-neutral solutions” rather than favoring fossil-fired plants.

“I’m hoping they’ll layer multiple options. … I think they’ll pick a few favorites, and I think they’ll pick a bunch of them,” she said. “I agree [ERCOT] needs a lot of fossil plants in the short-term, but that doesn’t mean fossil plants can deliver every solution that we need. They cannot deliver, in fact, many of the solutions we need for operating responsiveness and capacity, as they painfully showed us last February.”

A coalition of 24 ERCOT stakeholder groups, including Silverstein, ACEEE and TAEBA, filed a document with the PUC Tuesday offering their “broadly applicable foundational principles” to guide the commission’s redesign efforts and their recommendations for prioritizing reforms most likely to prevent sustained load-shed events (52373).

The coalition’s principles include protecting customers, fostering competition, and promoting high-quality infrastructure. Its members recommend a phased-in approach by taking “low-hanging fruit” measures to improve operational responsiveness first before expanding low-cost energy efficiency and demand response to buffer bills against unknown future costs for the supply-side proposals.

As Lake promised, the PUC will move quickly after Thursday’s meeting. It will hold a fifth workshop on Nov. 4, with stakeholder comments on the draft plan due Nov. 12. A final work session will be held Dec. 9 before the commissioners’ target completion date of Dec. 19.