A joint PJM-stakeholder proposal to address the RTO’s auction revenue rights (ARRs) and financial transmission rights won endorsement after failing an initial vote at last week’s Markets and Reliability Committee meeting.

The changes, whose proponents included Calpine, Exelon, NextEra Energy, Vitol and Public Service Enterprise Group, was endorsed in a sector-weighted vote of 3.74 (74.8%), surpassing the necessary 3.33 (66.6%) threshold. In a first round of voting, the proposal failed the sector-weighted vote with 3.16 (63.2%) support.

Members first endorsed the proposal at the Market Implementation Committee meeting earlier this month with 84% support, and now it heads to the Members Committee for a final vote in November. (See “ARR/FTR Market Task Force Proposal,” PJM MIC Briefs: Oct. 6, 2021.) Two other proposals presented as alternatives failed in sector-weighted votes.

<img src="https://rtowww.com/wp-content/uploads/2023/06/140620231686783941.jpeg" data-first-key="caption" data-second-key="credit" data-caption="

Brian Chmielewski, PJM

” data-credit=”© RTO Insider LLC ” style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: right; width: 200px;” alt=”Chmielewski-Brian-2017-08-10-RTO-Insider-FI.jpg” align=”right”>Brian Chmielewski, PJM | © RTO Insider LLC

Brian Chmielewski, manager of PJM’s market simulation department, said the changes “represent the culmination of a two-year stakeholder process” that were initiated after the GreenHat Energy default in 2018, including a six-month review by an independent consultant and work done at the ARR/FTR Market Task Force.

GreenHat acquired the largest FTR portfolio in PJM between 2015 and 2018 but defaulted on the portfolio in June 2018, leaving PJM stakeholders to cover more than $179 million in the market to the present. When the company defaulted, GreenHat had only $559,447 in collateral on deposit with PJM. (See Doubling Down — with Other People’s Money.)

Chmielewski said the resulting work was a “balanced package” that received overwhelming stakeholder support at the MIC.

“We believe the changes in the proposal strike an appropriate balance in advancing the benefits for load while advancing the efficiencies of our current FTR auction structure,” Chmielewski said.

PJM Proposal

Chmielewski reviewed the proposal, which included revisions to the tariff and the Operating Agreement, saying they were guided by the findings of a report developed by London Economics International (LEI), a consultant enlisted by the RTO to conduct a “holistic review” of the ARR/FTR market.

LEI was hired on the recommendation of the “Report of the Independent Consultants on the GreenHat Default,” which called for an outside expert to review PJM’s FTR market and its other markets to evaluate risks and benefits of rule changes. (See “PJM Seeking Consultant on ARR/FTR Task Force,” PJM MIC Briefs: May 13, 2020.)

Proposed enhancements to PJM’s current ARR/FTR market design. | London Economics

Proposed enhancements to PJM’s current ARR/FTR market design. | London Economics

Chmielewski said the proposal aimed to recognize recommendations made in the LEI report and address concerns raised by the Independent Market Monitor and stakeholders regarding the ARR/FTR market. He said the proposal also sought to maintain the consultant’s conclusion that the existing FTR product is “reasonable and generally achieving the intended purposes” of serving as a financial equivalent to firm transmission service and to ensure “open access to firm transmission service by providing a congestion-hedging function.”

The proposal was broken into three separate areas as recommended in the LEI report, with an ARR track dealing with “equity” issues, an FTR track for “efficiency” issues and a transparency track for a “simplicity” model.

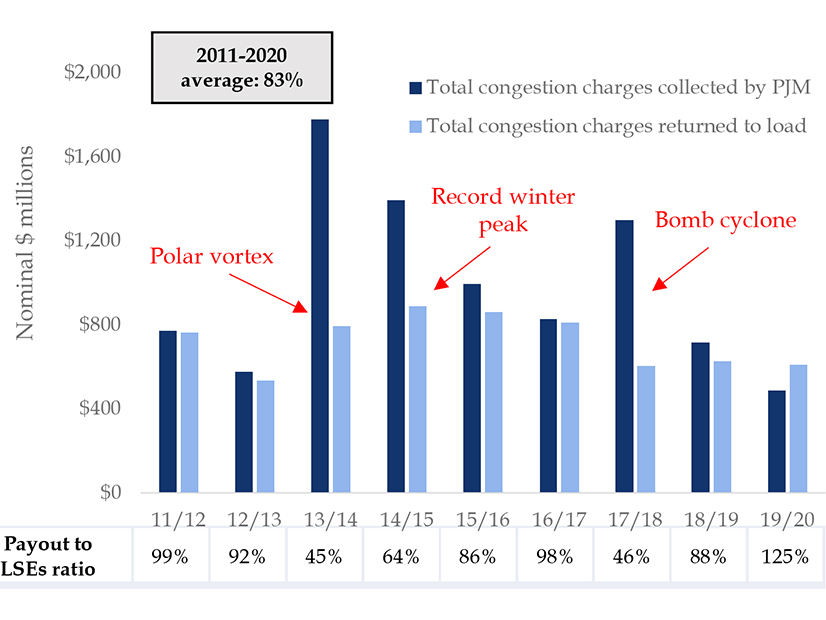

Chmielewski said the ARR section was the main part and intended to answer a primary concern that the ability for some load to “efficiently hedge congestion costs can be deteriorated at times” when a “misalignment” occurs between the allocation of ARRs and congestion charges paid by load.

The other main features included a guarantee of 60% of network service peak load for each load-serving entity, which was meant to “protect zonal native load hedging ability with additional upfront capability.” The proposal also expanded the source/sink availability for ARR allocation so that they “align with any source/sink that is available for bid in the annual FTR auction.”

Key market components of RTOs/ISOs across the country. | London Economics

Key market components of RTOs/ISOs across the country. | London EconomicsThe FTR section contained features intended to “advance the efficiencies” of the FTR auction structure. Efficiencies cited included market liquidity and future price discovery, Chmielewski said, both of which are designed to add value and contribute to a competitive market.

The changes also add hedging product to account for on-peak weekend and holiday hours to increase hedging flexibility; increase the bid limits in all FTR auctions from $10,000 to $15,000; and add a $1/MW-period class clearing price floor for all FTR option products.

The transparency section includes recommendations to “help bolster confidence in the FTR action results,” Chmielewski said, including the creation of a network model user guide to standardize market procedures and the posting of market limits utilized in approved cases for binding constraints.

Chmielewski said the ARR changes are anticipated to take effect by February 2023, and the other changes in the proposal could happen even sooner.

Alternative Proposals

Erik Heinle, D.C. OPC

” data-credit=”© RTO Insider LLC” style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: left; width: 200px;” alt=”heinle-erik-2019-01-04-rto-insider-fi.jpg” align=”left”>Erik Heinle, D.C. OPC | © RTO Insider LLC

Erik Heinle of the D.C. Office of the People’s Counsel reviewed the group’s alternative proposal, which was identical to the joint proposal except that 100% of the surplus allocation would have been given to ARR holders. Heinle said the LEI report was “pivotal” for the group’s evaluation of the allocation issue and that it “really focused on what was best for the market.”

Heinle said the LEI report recognized the dual purpose of the market through returning congestion charges to load and supporting hedging activities, both of which benefit consumers. And while the PJM proposal addressed several important issues, Heinle said, the issue of auction and congestion surplus was left unchanged.

“This places D.C. OPC in the unfortunate and uncomfortable position of offering an alternate that does address these equity concerns,” Heinle said.

The OPC alternative proposal nearly won stakeholder endorsement in the first round of voting, receiving a sector-weighted vote of 3.28 (65.6%).

In reviewing the IMM’s proposal, Monitor Joe Bowring said he disagreed with a recommendation in the LEI report that load should be satisfied with receiving 50 to 75%, instead of 100%, of overpayments. He also said the other proposals didn’t go far enough on the congestion payment issue.

PJM Monitor Joe Bowring

” data-credit=”© RTO Insider LLC” style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: right; width: 200px;” alt=”capacity transfer rights ” align=”right”>PJM Monitor Joe Bowring | © RTO Insider LLC

“PJM’s proposal takes some tiny, tiny steps towards increasing the congestion revenues that belong to load,” Bowring said.

The Monitor’s proposal also failed to receive endorsement in the first round of voting, garnering a sector-weighted vote of 1.33 (26.6%).

Susan Bruce, counsel to the PJM Industrial Customer Coalition, said she appreciated all the work taken on by PJM and stakeholders on the issue. The LEI report gave members a clear path to come up with solutions, she said.

“In the wake of GreenHat, this was very important form the customer’s perspective to understand what’s going on in this market,” Bruce said.