New Jersey’s plan to create a wind port that will serve as a marshalling and manufacturing hub for the East Coast has gotten a boost from applications by several prominent offshore wind players seeking to rent space in the facility, among them Siemens Gamesa Renewable Energy (OTCMKTS:GCTAY), Vestas-American Wind Technology (OTCMKTS:VWDRY) and Beacon Wind.

The three companies submitted some of the 16 nonbinding offers to become tenants at the New Jersey Wind Port, construction on which began Sept. 9 on the Delaware River in Lower Alloways Creek, the New Jersey Economic Development Authority (NJEDA) said. Other bidders include two developers awarded approval for offshore wind projects in June by the state Board of Public Utilities: Danish developer Ørsted (OTCMKTS:DNNGY) and Atlantic Shores Offshore Wind, a joint venture between Shell New Energies and EDF Renewables.

GE Renewables US also was among the companies that submitted proposals for space at the wind port, some of whom submitted multiple proposals, NJEDA said in a release announcing the submissions.

NJEDA said the applications by the six companies “confirms the offshore wind industry’s strong and sustained interest in partnering with the state” to create an “internationally recognized offshore wind hub that will drive economic growth and job creation in South Jersey and throughout the Garden State.”

Spain-based Siemens, with annual revenue of $11 billion, has developed onshore and offshore wind projects around the world, and a company presentation on its website says it is in the top three companies in both onshore and offshore wind markets. Vestas says it has manufactured, installed and serviced wind turbines across the globe, and has made turbines generating more than 140 GW in 85 countries. A 50-50 joint venture between Equinor (NYSE:EQNR) and BP (NYSE:BP) is developing the 1,230-MW Beacon Wind off Long Island and the 1,260-MW Empire Wind project in the New York Bight.

Tough Competition

Yet the success of the state’s wind port venture is far from assured. New Jersey faces fierce competition from other states that also see the sector as a source of investment, jobs and economic growth. Virginia, Massachusetts, Maryland and New York are all trying to position themselves as East Coast providers to the new industry.

Siemens, for example, announced last week that it would invest $200 million to establish a new plant for offshore wind blades at the Portsmouth Marine Terminal in Virginia. The plant will be a “finishing” facility, where blades manufactured elsewhere are painted and assembled prior to installation. (See Virginia Builds out OSW Supply Chain with Turbine Blade Plant.)

New Jersey Gov. Phil Murphy sees offshore wind generating 23% of the state’s energy by 2050, by which time he wants the state to use 100% clean energy. So far, the state has awarded three offshore wind projects — Ørsted’s Ocean Wind 1 and 2 and Atlantic Shores — for a total of 3,758 MW. The state plans to award a total of 7,500 MW by 2035.

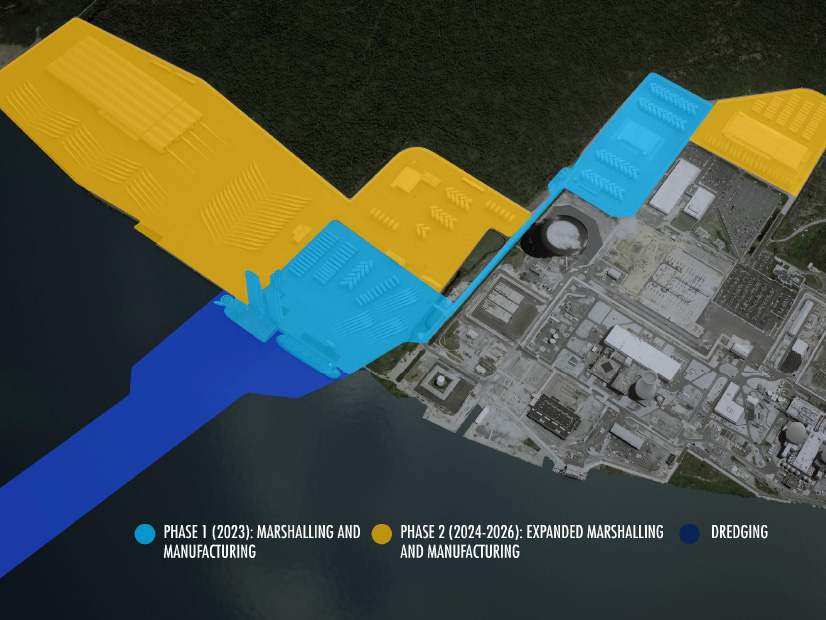

State officials hope that the wind port, with an opening date of 2023-2024, will give the state a “first mover advantage” in the effort to serve not only the state’s offshore wind facilities but those of other states as well. Plans for the port, for which the state has so far committed $250 million, include a 30-acre marshalling area, manufacturing space and a heavy-lift wharf. The port is scheduled to open in 2023. (See NJ Breaks Ground On Offshore Wind Hub.)

The four parcels for which NJEDA accepted submissions account for about 110 acres of the 200 available. The agency expects the successful bidders to be picked next year, with tenants occupying the space in 2024.

A complementary project, a factory that builds monopiles — the tubes driven into the ocean floor for the turbines — is under construction at the nearby port of Paulsboro.

“The interest we are seeing in the New Jersey Wind Port demonstrates that we do not have to choose between addressing climate change and creating jobs,” said Jane Cohen, executive director of the governor’s Office of Climate Action and the Green Economy. “Through this project and Gov. Murphy’s other efforts to combat climate change, we can drive economic growth, strengthen our workforce and create family sustaining jobs for all New Jerseyans who want to be in involved in the green economy.”

State or Regional Hub?

Ørsted and Atlantic Shores Offshore Wind each committed to using the port as part of their offshore wind application approved by the BPU. Ørsted agreed in its contract to establish a nacelle assembly facility at the port with GE. And Atlantic Shores said it would partner with Vestas on a nacelle manufacturing facility at the port. (See New Jersey Shoots for Key East Coast Wind Role.)

The two developers, along with Beacon Wind, submitted offers for land that is being purpose-built for offshore wind marshalling, staging and final assembly of turbines.

Paul Patterson, an energy analyst at Glenrock Associates, said it is unclear whether New Jersey will emerge as a regional leader in the offshore wind supply chain — or if any state will. Several states are essentially creating their own markets by awarding offshore wind contracts and incentivizing the participants to use state facilities created to serve the new ventures, he said.

“The question that comes to my mind is, will these hubs simply be serving the projects that are associated with that specific state policy?” Patterson said. “Or will the hub be used by other projects that are being sponsored by other states up and down the Eastern Seaboard?”

Preparing the Grid for Offshore Wind

NJEDA’s announcement came as Ørsted and PSEG (NYSE:PEG), which owns a 25% share of Ocean Wind 1, revealed plans to upgrade the grid in preparation for the additional energy coming from the offshore wind projects. The companies announced Thursday that they had submitted several proposals for offshore transmission, collectively named Coastal Wind Link, that are designed to deliver thousands of megawatts of offshore wind energy into New Jersey, PSEG said in a statement.

The companies said they submitted the proposals as part of FERC Order 1000’s state agreement approach, under which the BPU requested that PJM integrate the state’s OSW goals into the RTO’s Regional Transmission Expansion Plan process. New Jersey was the first state do so. (See New Jersey Seeks OSW Transmission Ideas.)

The BPU is looking for suggestions on issues including how to upgrade the existing grid to allow for integration of wind energy, how to extend the onshore grid to bring it closer to offshore wind generators and what upgrades are needed on interconnections between offshore substations to create an offshore grid, or “backbone.”

PSEG and Ørsted said their proposals “encompass individual and networked solutions and would ensure that New Jersey has a clear path to connect to the offshore wind energy coming online during the next decade while minimizing environmental impacts along New Jersey’s coastline.”