The cost impacts of proposed wholesale capacity market changes topped the agenda of NYISO’s Installed Capacity (ICAP) Market Issues Working Group on Tuesday.

NYISO discussed the methodology used to measure the market impacts of implementing changes to buyer-side mitigation (BSM) rules, while the ISO’s Market Monitor, Potomac Economics, presented an analysis of the effects of capacity accreditation on consumers.

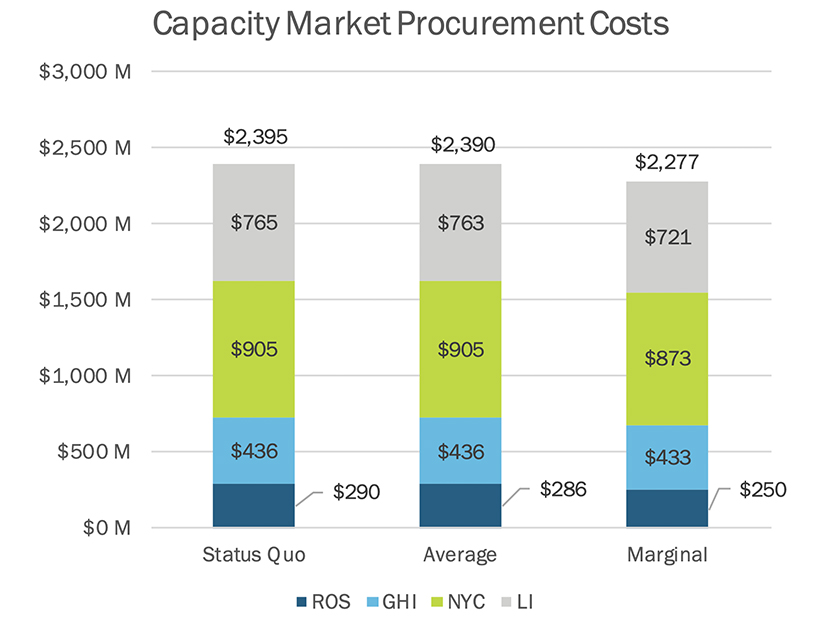

In 2026, capacity market procurement costs would be approximately $5 million below the status quo case using an average accreditation approach, while costs would be $119 million lower using the marginal accreditation approach proposed by the NYISO, Tariq N. Niazi, NYISO senior manager for consumer impact analysis, told the ICAP group.

The ISO is developing a proposal to help keep the capacity market just and reasonable as thousands of megawatts of state-solicited resources come online in New York. The Climate Leadership and Community Protection Act (CLCPA) requires the state to procure large amounts of renewable energy to get to zero-emission electricity by 2040, forcing the wholesale electricity market to adapt.

Several stakeholders forced some new business to the top of the agenda regarding BSM, asking the ISO to explain a request from the Price Responsive Load Working Group for information from demand response (DR) curtailment providers.

The issue stems from NERC and FERC analysis focused on the effect of load-management and load-shed programs on fuel supply infrastructure.

The NERC Standards Committee last month voted to delay approving the draft standard authorization request (SAR) developed in response to a preliminary joint report with FERC on the catastrophic winter storm events in Texas last February until after the final report is published. (See NERC Standards Committee Delays Action on Cold Weather SAR.)

The ISO is working on the issue, Zachary Smith, manager for capacity market design, said. In response to stakeholder interest in DR related to the Comprehensive Mitigation Review, the Analysis Group will be available at the Nov. 8 ICAP Working Group to answer question.

One stakeholder asked whether NYISO considers the study assumptions for DR differently from special case resources, which require a 21-hour notice before dispatch.

“I think we’re looking for false precision in the analysis that we’re doing,” Michael DeSocio, NYISO director of market design, said. “We’re not running an economic expansion analysis here. The analysis is intended to indicate directionally what would happen. The analysis we’ll see from Potomac goes a step further, but again there are limitations on how granular we’re able to get in these analyses.”

Accreditation: Consumer Impact

A marginal accreditation approach results in more efficient signals for investment and lower consumer costs than the status quo or an average approach, Joe Coscia of Potomac Economics said.

Marginal accreditation encourages a balanced mix of intermittent.renewables compared to other approaches. | Potomac Economics

Marginal accreditation encourages a balanced mix of intermittent.renewables compared to other approaches. | Potomac EconomicsCapacity market signals can help guide investment in policy resources at the lowest cost to consumers when renewable energy credits supplement wholesale market revenues, the analysis said.

Efficient accreditation will have more impact as the CLCPA requires larger quantities of investment, and the Monitor supports NYISO’s proposal to apply a marginal accreditation approach to all resources, Coscia said.

“You can’t look at these capacity credit numbers in a vacuum. They are always a product of the resource mix in the case being studied,” he said.

Stakeholders have asked about the period beyond 2030 that Potomac was not able to model explicitly in this study, prompting Coscia to share thoughts on factors that would intuitively tend to affect the results going forward, given the logic of the model.

“All of these things in the context of our model would tend to increase the divergence between accreditation methods going forward,” Coscia said. “Those include larger renewable and storage targets, and the reason would be that with more investment decisions that need to be made, the cost of making inefficient investment decisions is larger.”

Any policy requiring replacement of a larger measure of peaking resources would tend to increase the importance of accreditation, he said.

Consumer savings under a marginal approach would be greater at higher capacity prices because the differences in capacity payments would be magnified, which affects both the incentive effects as well as the total payment differences between methods, Coscia said.

“Higher load growth or changes in load pattern would tend to increase the importance of efficient accreditation, whether that’s just high load going forward or maybe something like a shift towards a winter peaking system,” he said.

Finally, application of enhanced accreditation methods to other technologies such as gas-only units or inflexible units would tend to produce values for those resource types that would decline more under a marginal approach than under an average approach or the status quo, which doesn’t apply any discount to those resources — also increasing the consumer savings under a marginal approach.

“For these reasons we believe that the advantage of marginal accreditation over other methods is likely to increase beyond 2030, and so the numbers that we presented here likely are conservative,” Coscia said.