Stakeholders at last week’s Operating Committee meeting endorsed a PJM proposal seeking to improve the deployment of synchronized reserves during a spin event.

The proposal, which was developed from discussions in the Synchronized Reserve Deployment Task Force (SRDTF), was endorsed with 164 members voting in favor (72%). PJM first presented the proposal at last month’s OC meeting. (See “Synchronous Reserve Deployment Initiative,” PJM Operating Committee Briefs: Oct. 7, 2021.)

Ilyana Dropkin, an engineer in PJM’s performance compliance department, provided a review of the task force initiative endorsed at the March OC meeting. Stakeholders were educated about synchronized reserves and created a matrix to develop proposals through the task force. (See PJM OC Endorses Synchronized Reserve Discussion.)

Synchronized reserve events are emergency procedures triggered by PJM to maintain grid reliability in accordance with NERC’s Resource and Demand Balancing (BAL) standards. PJM invokes those procedures under conditions such as the simultaneous loss of multiple generating units or a sudden influx of load.

The SRDTF examined ways to secure controlled deployment of synchronized reserves throughout emergency events by using tools such as real-time security-constrained economic dispatch (RT SCED) to maintain consistent pricing and dispatch signals. The goal was to ensure BAL compliance during the recovery process and maintain a reliable transition in and out of emergency events and to define clear rules and expectations that address how PJM operators approve RT SCED cases around a synchronized reserve event.

The task force developed two different proposals: PJM’s intelligent reserve deployment (IRD) proposal, and another by the Independent Market Monitor. In a nonbinding poll taken by stakeholders, PJM’s proposal received 75% support, while the IMM’s received 9% support. Sixteen percent of stakeholders preferred the status quo.

Michael Zhang, senior lead engineer in PJM’s markets coordination department, reviewed the PJM proposal. Zhang said no changes were made to the proposal since it was first presented at the October OC meeting.

The IRD proposal is a SCED case that simulates the loss of the largest generation contingency on the system and for which approval of the case will trigger a spin event, Zhang said.

The PJM proposal calls for taking the megawatts of the largest generation contingency and adding them to the RTO forecast to simulate the unit loss, Zhang said. PJM would then be allowed to flip condensers and other inflexible synchronized resources cleared for reserves to energy megawatts and procure additional reserves to meet the next largest contingency.

Zhang said some of the significant changes over the status quo in the proposal include updating the economic basepoints to replace all-call instructions and having active constraints controlled by IRD so that deployed resources don’t have negative impacts on the constraints.

PJM is looking to conduct a phased approach of IRD with the initial phase of 6 to 12 months beginning in early 2022, Zhang said, possibly by March. The RTO will reconvene the SRDTF toward the conclusion of the initial phase to review performance metrics, solicit stakeholder feedback and adjust and finalize deployment approach and adapt to market changes.

“IRD is production ready,” Zhang said. “It’s been designed to be highly flexible and customizable so we can make changes on the fly as needed.”

Siva Josyula of Monitoring Analytics asked what changes could be made “on the fly” by PJM.

Zhang said one of the major changes is the use of the largest contingency, which was a major focus of the effort. Zhang said the development of using the largest contingency was driven by fears of both over- and under-deployment of resources.

Josyula reviewed the IMM proposal, saying the concept was to ensure reserves are deployed in proportion to the cause of the spin event. He said the resources deployed during a spin event would be those that clear and are being compensated for providing synchronized reserves.

The proposal called for using a reserve deployment tool that generates new dispatch signals, and the total megawatts to deploy would be equal to those lost or required for area control error recovery.

Stakeholders voted down the IMM proposal, with 159 votes against (76%).

Brock Ondayko of AEP Energy questioned the effectiveness of both the PJM and IMM proposals, saying it wasn’t clear what problems they solve. Ondayko said units will be forced into a market system that “doesn’t model things correctly” and that will ultimately have ramifications for other market products and systems, opening a “pandora’s box” of issues.

“You’re trying to fix a problem with solutions that don’t address the main issue while you’re trying to force people to update things in a system that’s not adequate for updating,” Ondayko said.

The PJM proposal will go on to the Nov. 17 Markets and Reliability Committee meeting for a first read and a final endorsement vote at the January Members Committee meeting.

Day-ahead Schedule Reserve Endorsed

Members unanimously endorsed changes to the 2022 Day-ahead Scheduling Reserve (DASR) requirement.

David Kimmel, senior engineer in PJM’s performance compliance department, reviewed the proposed changes to the DASR requirement, which is the sum of the requirements for all zones within the RTO and any additional reserves scheduled in response to a weather alert or other conservative operations. (See “Day-ahead Schedule Reserve (DASR),” PJM Operating Committee Briefs: Oct. 7, 2021.)

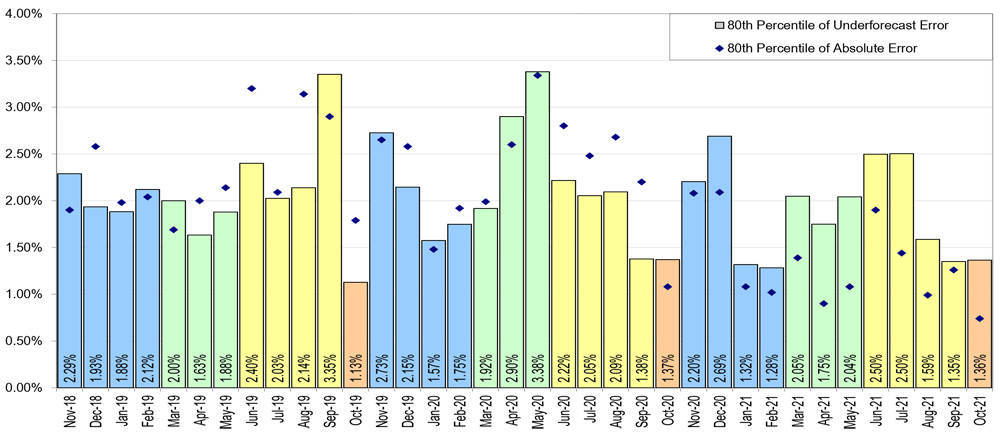

DASR is the sum of the three-year averages of both the under-forecasted load forecast error (LFE) and eDART forced outage rate component.

The final endorsed 2022 DASR requirement was 4.43%, Kimmel said, slightly lower than the 2021 requirement of 4.78%. Kimmel said the number comes from the LFE component of 2.04%, which is down 0.14% from last year, and the forced outage component of 2.39%, down 0.21%.

The value is incorporated into Manual 13 changes and effective through Sept. 30, 2022, after which it will be replaced with the day-ahead secondary reserves. Kimmel said the change is dependent on FERC’s review and action on reserve price formation and PJM’s operating reserve demand curve (ORDC).

Manual Changes Endorsed

Several manual updates were unanimously endorsed. They included:

- Manual 14D — Vince Stefanowicz, senior lead engineer with PJM’s generation department, reviewed updates to Manual 14D: Generator Operational Requirements as a part of the periodic review. The updates featured the addition of several new sections, including one describing eDART modeling requirements.

- Manual 10 — Stefanowicz also reviewed updates to Manual 10: Pre-Scheduling Operations as a part of the periodic review. The updates resulted from FERC’s approval of changes to black start unit testing.

- Manual 3 — Dean Manno of PJM’s transmissions operations department reviewed updates to Manual 3: Transmission Operations as a part of the periodic review. Updates included minor changes such as removing a reference to NERC standard PRC-001 because of its retirement.

- Manual 13 — Brian Oakes of PJM’s dispatch department reviewed updates to Manual 13: Emergency Operations as part of the periodic review. Updates include notes to articulate the expectations of members’ load shed plans.

The manual changes will be voted on at the November MRC.