After a 14-month hiatus, CAISO on Friday restarted the stakeholder process to expand its real-time Western Energy Imbalance Market to include day-ahead trading.

CAISO CEO Elliot Mainzer spoke at an Oct. 13 EDAM forum. | CAISO

CAISO CEO Elliot Mainzer spoke at an Oct. 13 EDAM forum. | CAISO“There is real momentum towards further regional coordination in the West,” CAISO CEO Elliot Mainzer said in a statement. “By building on the foundation of the EIM and harnessing the knowledge and experience of stakeholders from across the region, our goal is to position EDAM [extended day-ahead market] as the next major step in West-wide market evolution.”

The EDAM initiative was put on hold following CAISO’s energy emergencies in August and September 2020, which raised concerns about resource adequacy in the West and California’s dependence on imports. (See Heat Waves, Blackouts Slow Western EIM Expansion.)

An EDAM straw proposal issued in July 2020 generated stakeholder pushback over transmission rights and concerns that the market would not be as voluntary as the WEIM. (See EDAM Design Could Undermine Tx Rights, Critics Say.)

A select working group of stakeholders met over the summer to produce a set of “common design principles” as the basis for ongoing discussions. The closed-door process met with some criticism, but Mainzer said he was optimistic that the EDAM process would eventually yield consensus from the WEIM’s diverse constituents.

“This is a group of people that have a track record of coming together around solutions,” Mainzer said as he opened Friday’s call-in session.

CAISO held a forum Oct. 13 to generate interest in EDAM as it faces a more crowded field of competitors trying to organize Western markets, especially SPP, which has been pitching a Western RTO and will operate the Northwest Power Pool’s Western Resource Adequacy Program (WRAP). (See CAISO Promotes EDAM Effort in Forum.)

CAISO formally recommenced the EDAM stakeholder process with a call Friday to review the initiative’s design principles, scope and timeline, and to begin forming stakeholder working groups to address key components including resource sufficiency, transmission commitments and greenhouse gas accounting.

Milos Bosanac is leading CAISO’s EDAM stakeholder process. | CAISO

Milos Bosanac is leading CAISO’s EDAM stakeholder process. | CAISO“We envision that the first task of these working groups will be to identify the detailed market design issues that will need to be addressed … and a discussion of the common EDAM design principles that are relevant to [each] group,” Milos Bosanac, the ISO’s lead infrastructure and regulatory policy developer, said.

“Those [common design] principles potentially may be affirmed, edited or built upon throughout the discussion, and we encourage those working groups to dedicate time to this effort,” said Bosanac, who is heading the EDAM stakeholder process. “We recognize … [that] providing additional transparency and discussion on the common design principles” is important to stakeholders, he said.

The working groups’ recommendations will be incorporated into a comprehensive straw proposal due at the end of March, he said.

Resource Sufficiency

CAISO COO Mark Rothleder led a morning panel discussion.

The EDAM is meant to build on the WEIM’s success by optimizing dispatch of resources through the day-ahead market and maximizing efficient use of transmission to serve load across a larger footprint, Rothleder said. It is not meant to be an RTO substitute or to replace resource adequacy (RA) planning by its member entities or WRAP, he added.

But EDAM, like the real-time WEIM, will require members to show they have sufficient resources to meet their own demand and prevent “leaning” on the market for RA, Rothleder said.

<img src=”https://rtowww.com/wp-content/uploads/2023/06/140620231686783534.jpeg” data-first-key=”caption” data-second-key=”credit” data-caption=”

CAISO COO Mark Rothleder

” data-credit=”© RTO Insider” style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: left; width: 200px;” alt=”rothleder-dan-at-caiso-symposium-2018-10-17-rto-insider-fi-1″ align=”left”>CAISO COO Mark Rothleder | © RTO Insider

“We do need a common resource sufficiency examination going into the day-ahead to make sure that everybody’s coming in sufficiently resourced to cover load and uncertainty, but we’re not using this as a mechanism to create a common resource adequacy regime across the entire footprint,” he said.

The resource sufficiency evaluation and potential consequences of failing to meet it “is definitely going to be a hot topic in the working groups,” he said.

Stakeholders have raised concerns about whether the EDAM would impose greater RA requirements than currently exist, panelists said.

“We can’t use EDAM to … be a super-restriction that, in effect, undermines activities that have already been satisfying agreed-to formalized [RA] processes,” Jeffrey Nelson, director of FERC Rates and Market Integration at Southern California Edison said. “If we have systems out there that are already showing reliability, we need to respect them. The EDAM shouldn’t eviscerate those or add on something that was not designed.”

Josh Walter, strategic adviser with WEIM member Seattle City Light, said “this is ultimately going to be a very difficult issue to work through … but I do think that this also highlights the need for constructive dialogue in the workgroups.”

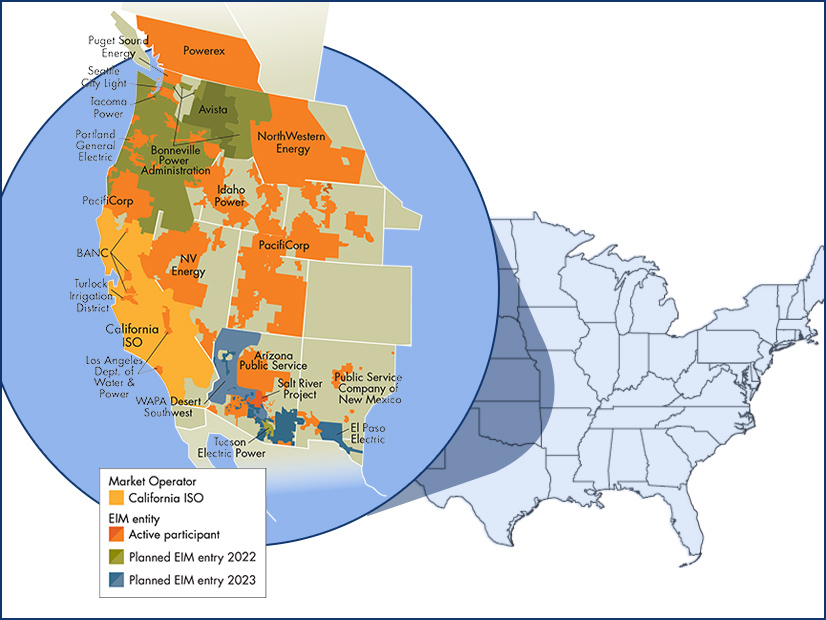

The WEIM’s main draw has been its economic benefits, which have totaled $1.7 billion since the market started in 2014. CAISO is basing its hopes for EDAM on achieving similar or greater benefits for members. The WEIM now has 15 participants with seven more scheduled to join in 2022 and 2023. Together, those entities would represent 84% of load in the Western Interconnection, CAISO said.

Other thorny topics in EDAM are expected to include transmission commitment, congestion rent allocation and accounting for greenhouse gas emissions.

The workgroups were scheduled to start Dec. 6, though some stakeholders said Friday it would be better to start after the holidays to avoid added stress on participants. Rothleder said CAISO would take it under consideration.

EDAM policy design is expected to last through 2022, with implementation to continue in 2023 and participation scheduled to start in 2024.