Members of the recently approved Southeast Energy Exchange Market (SEEM) on Monday called for FERC to reject the rehearing requested by the market’s critics earlier this month (ER21-1111, et al.).

The commission received two requests for rehearing on Nov. 12. One was filed by an ad hoc group of environmental and clean energy organizations calling themselves the Public Interest Organizations (PIOs), and the other by a separate group calling itself the Clean Energy Coalition. (See SEEM Opponents File Rehearing Requests.) Both groups urged FERC to reconsider its de facto approval of the SEEM agreement, which took effect Oct. 12 under Section 205 of the Federal Power Act after commissioners split 2-2 on approval. (See SEEM to Move Ahead, Minus FERC Approval.)

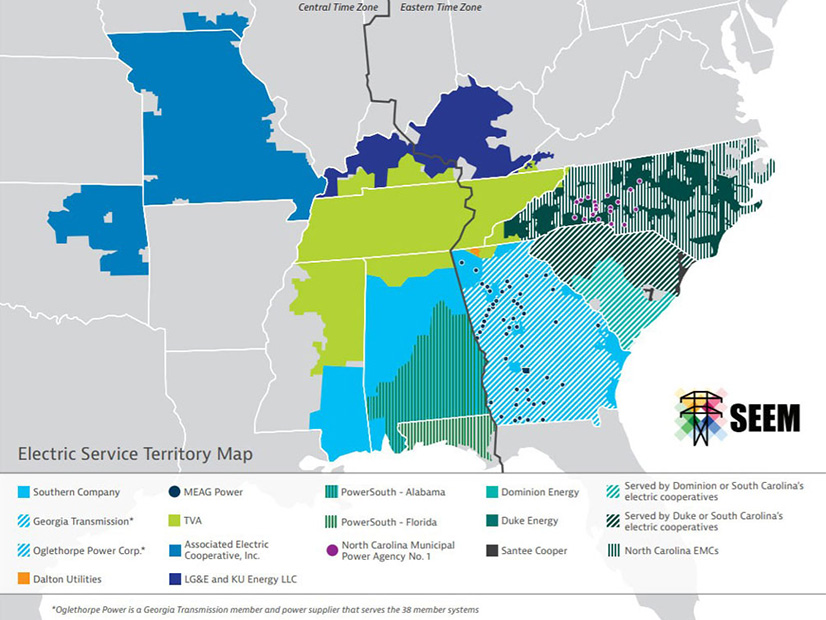

In their filing, SEEM members — a collection of utilities including Southern Co. (NYSE:SO), Dominion Energy South Carolina (NYSE:D), LG&E and KU (NYSE:PPL), the Tennessee Valley Authority, and Duke Energy (NYSE:DUK) — said the opponents’ request should be denied for several reasons.

The first issue the utilities raised was the timing of the rehearing requests, which they said by itself should be enough to quash the petitions. Under the FPA, any parties “aggrieved” by a FERC order may apply for rehearing within 30 days of its issuance. While the opponents filed their requests Nov. 12, which was 30 days after the commission’s announcement that the agreement had taken effect, the SEEM members asserted that this was actually two days after the deadline.

In their filing, the members argued that the “date of issuance” is not when the commission announced the decision, but when it failed to issue an order. Members cited FPA Section 205(g), which states that “the failure to issue an order accepting or denying [a] change … shall be considered to be an order issued by the commission accepting the change.” Under this wording, they said, the date that FERC failed to issue an order should be considered “no later than Oct. 11” — 60 days after the members filed their answer to FERC’s second deficiency letter. (See SEEM Members Push for FERC’s Decision on Market Proposal.)

SEEM members acknowledged some discrepancies between FERC’s announcement of the SEEM approval and the statements of commissioners: Commissioner Allison Clements suggested in a statement explaining her vote that the “statutory deadline” for FERC action in the proceeding was Oct. 8, while FERC’s notice said the deadline was Oct. 11. However, they emphasized that none of the previous filings in this case have stated any deadline after Oct. 11, which means that the 30-day deadline for rehearing requests expired Nov. 10, two days before the PIOs and CEC filed theirs.

Additional Claims Dismissed

Along with arguing to deny the rehearing requests on timing grounds, SEEM members dismissed the “substantive issues” raised in the requests as “largely moot” in light of last week’s filing in which they offered to implement a series of modifications intended to provide greater transparency. (See SEEM Members Embrace Market Changes.)

The issues dismissed by the utilities include concerns of the PIOs and CEC over the market’s use of the Mobile-Sierra doctrine, which presumes that any freely negotiated wholesale energy contract is just and reasonable. FERC Chairman Richard Glick also cited this as a reason for opposing the market. (See FERC’s Christie Accuses Glick, Clements of Prejudice for RTOs.) But SEEM members said this should no longer be a problem because they voluntarily offered in last week’s filing to make the “just and reasonable standard” the default for most SEEM rules.

Also dismissed by SEEM members were opponents’ fears about “the potential for exercise of market power” and monopolistic behavior by members. These concerns too should be negated by the “significant additional transparency measures” incorporated in last week’s filing, the utilities said.

The members did engage with the PIOs’ and CEC’s claim that the commission “has not engaged in reasoned decision-making” and that the commission’s approval of the SEEM agreement without an accompanying order or explanation “cannot be just and reasonable.” Calling this argument “odd,” the utilities asserted that the mechanism in the FPA by which SEEM took effect is intended by Congress for just such an occasion when commissioners are unable to agree on a course of action.

“In every such case there will not be a written opinion of the commission explaining the reasons the [decision] is just and reasonable,” members said. “Rather, it is just and reasonable because Congress said it is, subject to review on rehearing and by an appellate court, if pursued.”

FERC has 30 days to act on the merits of the rehearing request. If it fails to do so, the petitioners may appeal to the D.C. Circuit Court of Appeals.