ERCOT’s Technical Advisory Committee last week held its last scheduled meeting of a year that was upended by February’s disastrous Winter Storm Uri.

The storm, which came close to collapsing the ERCOT grid, was linked to billions of dollars in damages and hundreds of deaths. It also resulted in political pressure and legislation that revamped the ISO’s board, the regulatory commission, and the market’s design, the latter of which has fallen partly on the stakeholder group to implement.

“What a year it’s been,” said South Texas Electric Cooperative’s Clif Lange, the committee chair, during its Nov. 29 virtual meeting. “We’ve had quite a bit to tackle this year, and we have done some really good work and provided some good information and feedback to the ERCOT board and the commission, as necessary.”

Despite the work, TAC faces uncertainty in its future. In July, interim ERCOT CEO Brad Jones discussed with the committee his plan to convert TAC into an officer-level group. During a candid conversation, Jones told members that if they didn’t “think TAC is in the crosshairs, you’re not paying close attention.” (See ERCOT Technical Advisory Committee Briefs: July 28, 2021.)

Since that meeting, Jones’ 60-point roadmap to improving grid reliability has updated his plans to note that TAC “has cancelled further discussion on this item until the new ERCOT Board and/or the [Public Utility Commission] initiate discussions on it.”

Lange told the committee that the board will review TAC’s processes and “make tweaks as necessary, while still retaining valuable input from the stakeholder process.”

“We don’t have any further guidance at this point on what further processes we need to review, but we’ll continue to engage with the board as they deem fit,” Lange told TAC’s members.

Storm-related NPRRs Pass

TAC members approved four nodal protocol revision requests (NPRRs) related to operational actions and other measures taken as a result of the winter storm.

Stakeholders offered some pushback against staff’s urgent measure NPRR1105 allowing ERCOT to instruct transmission and/or distribution service providers (TDSPs) to deploy any available distribution voltage-reduction measures before declaring an energy emergency alert (EEA). The revision is the result of Board Chair Paul Foster’s directive in October that TAC endorse the NPRR before the directors’ December meeting.

“We do think this can be an effective tool in the right circumstances,” Woody Rickerson, the ISO’s vice president of grid planning and operations, said in addressing concerns that the revision will put the system in a weakened condition. “We would like to see this passed so we can use this tool, but we welcome additional conversation on this.”

“It’s a small arrow in the quiver. I think it’s a wasted quiver,” Advanced Power Alliance’s Walter Reid said. “Hopefully, ERCOT will use this in a very judicious way.”

Morgan Stanley Capital Group’s Clayton Greer said he agreed with the NPRR’s use to avoid rolling blackouts but said, “In this instance, we’re not ever close to that level. We’re taking pretty severe action when we don’t even know whether there’ll be [severe] conditions present.”

Morgan Stanley and Demand Control 2 opposed the measure, which passed 23-2 with four abstentions.

A second change (NPRR1107) adds new fees for ERCOT’s weatherization inspections of the resource entity’s capacity divided by the entity’s aggregate capacity. Those inspections already have begun, with staff hoping to inspect about 300 facilities.

The NPRR also clarifies that existing generation interconnection or change request fees apply to all GI projects, regardless of whether they will interconnect at the transmission or distribution level. Those fees are $5,000 for projects less than or equal to 150 MW and $7,000 for projects greater than 150 MW.

Transmission service providers will pay $3,000 for each substation or switching station that is inspected.

“We would like to pay for the actual costs of our plants,” said NRG Energy’s Bill Barnes, who represents Reliant Energy Retail Services. He said lower costs for renewable resources “would be fair.”

The measure passed without opposition, although independent generators Engie North America and Avangrid Renewables abstained.

The committee also approved:

- NPRR1103, which establishes the processes for assessing and collecting default charges and default charge escrow deposits for the debt-obligation order securitizing about $800 million owed to the market by cooperatives and municipalities. (See “Securitization Orders Finalized,” Texas PUC Nears Market Redesign’s Finish Line.) ERCOT expects to begin issuing invoices in January.

- NPRR1106, codifying the grid operator’s current practice of deploying emergency response service when physical responsive capability falls below 3 GW before declaring an EEA. The PUC ordered the new approach in October.

Staff to Seek Price Correction

ERCOT will request board review and a price correction for eight operating days in September and October after staff discovered a modeling error for a generation transmission constraint in the day-ahead market. Staff patched the defect by the end of surrender, but not before determining the Sept. 30 and Oct. 6-12 operating days met the criteria for a price correction from the board.

Staff’s resettlements of the error resulted in more than $816,000 in increased charges and more than $122,000 in reduced charges to market participants.

The board will take up the issue during its meeting Friday.

Lange Honors John Dumas

TAC is short one member heading into 2022 following the recent death of the Lower Colorado River Authority’s John Dumas in November. Dumas, long a fixture in ERCOT circles and with more than 28 years of experience in managing electric grids and wholesale market operations, was one of four cooperative representatives.

“He was a great person to know. Very congenial and always willing to talk,” Lange said. “He contributed an extraordinary amount to the ERCOT market and the reliability of the system over his career. His influence on the ERCOT region will persist for quite a few years to come.”

Dumas joined LCRA in 2015 as vice president of market operations. Previously, he was with TXU, Vistra’s predecessor, before joining ERCOT in 2008 as manager of operations planning and then director of wholesale market operations.

Annual Membership Meeting Friday

Staff said ERCOT’s annual membership meeting will be held virtually on Friday. In lieu of the usual guest speaker, Jones and Foster will both deliver short comments. The 2022 TAC members, currently comprised of familiar faces, will also be announced during the 30-minute session.

The meeting will follow the board’s December meeting, which will be held in-person in Taylor. The directors will meet in executive session Thursday before holding an open session Friday morning. ERCOT’s Austin headquarters building is closed to meetings during the transition to a new nearby facility.

In-person stakeholder meetings are expected to resume in January, beginning with TAC on Jan. 26. ERCOT’s new headquarters workspace is expected to be ready by then.

TAC Endorses $1.28B Tx Project

TAC’s combination ballot, which passed unanimously, included the endorsement of a $1.28 billion dollar transmission project put forward by the Regional Planning Group. (See ERCOT Finds 345-kV Solution for Valley Constraints.)

The project would add 351 miles of transmission lines radiating from a new substation in the Lower Rio Grande Valley, where ERCOT and the PUC have identified an urgent need for more transmission capacity. The commission in September exerted its new-found regulatory muscle in bypassing the stakeholder process and directing three utilities to add a second 345-kV circuit to an existing transmission line in the valley. (See Texas PUC Directs Tx Construction in Valley.)

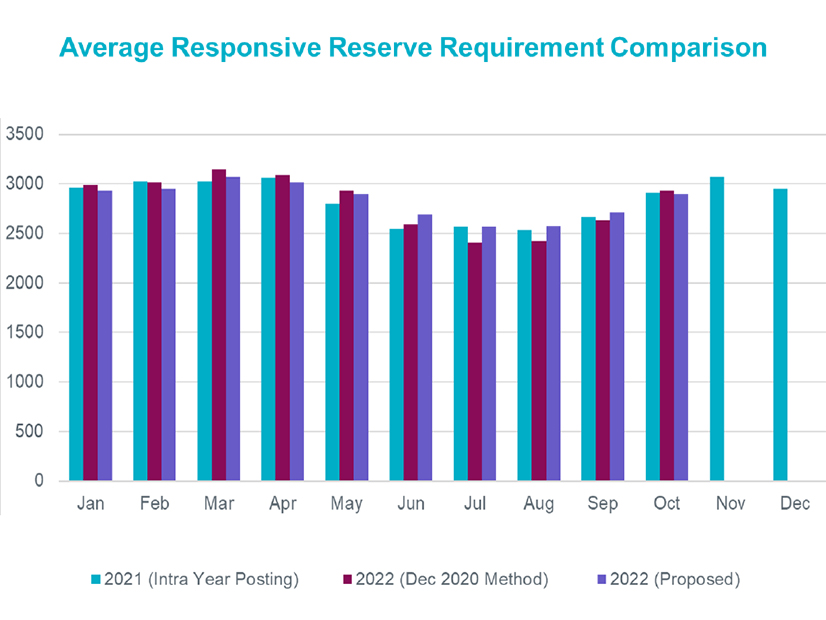

The combo ballot also included endorsement of ERCOT’s proposed 2022 ancillary service methodology. Staff recommended one change in computing minimum responsive reserve service (RRS) requirements by using a floor of 2.8 GW to meet the grid’s more conservative operations approach. They also proposed changing the minimum RRS-primary frequency response limit to 1.24 GW, based on NERC’s updated BAL-003 Interconnection Frequency Response Obligation assessment for next year.

The combo ballot also included five NPRRs, two Nodal Operating Guide revisions (NOGRRs), a pair of other binding document changes (OBDRRs), a revision to the Planning Guide (PGRR) and two modifications to the resource registration glossary (RRGRRs).

Members approved separately a revision request (NPRR1109) that allows a resource entity to bring a decommissioned generating unit back to service if it notifies ERCOT within three years of its removal from the network operations model. The measure passed by a 21-2 margin with six abstentions.

-

- NPRR1077: expands NPRR1026’s self-limiting facility concept to include sites with one or more settlement-only generator (SOG) and introduces additional revisions to fully address requirements for generators and energy storage systems (ESSs) connected at distribution voltage. The NPRR requires the SOG’s qualified scheduling entity to provide telemetry of the injection or withdrawal at the point-of-interconnection (POI) for transmission-connected sites or point-of-common coupling for distribution-connected sites.

- NPRR1091: addresses energy-price suppression and liquidity issues created by ERCOT’s early and greater procurement of ancillary service by extending the treatment of must-take energy from reliability unit commitments in pricing run to offline non-spinning reserve (non-spin), when it is manually deployed. The change also increases the amount of responsive reserve and non-spin services that an entity can self-arrange above its obligation.

- NPRR1094: allows a transmission operator (TO) and a transmission and/or distribution service provider (TDSP) to manually shed load connected to under-frequency relays during an energy emergency alert (EEA) Level 3 if the affected TO can meet its overall under-frequency load shed (UFLS) requirement and its load shed obligation under the Nodal Operating Guide.

- NPRR1101: modifies load resources’ deployment grouping requirements if they’re not controllable load resources (“NCLRs”) providing non-spin to include generation resources providing offline non-spin.

- NPRR1104: corrects the definition of real-time liability extrapolated (RTLE) to include market activity for entities that have no load or generation but do have real-time exposure.

- NOGRR231: updates ERCOT’s regional map in Section 1.1 to reflect the current boundaries.

- NOGRR233: allows a TO and a TDSP to manually shed load connected to under-frequency relays during an EEA Level 3 if the affected TO can meet its overall UFLS requirement and load-shed obligation.

- OBDRR034: provides ERCOT with the authority to move network operations model resource nodes for POI changes or resource retirements.

- OBDRR035: aligns the non-spinning reserve deployment and recall procedure with NPRR1101’s revisions.

- PGRR092: allows an interconnecting entity (IE) proposing a SOG to designate it as part of a self-limiting facility during the generator interconnection or modification (GIM) process, consistent with NPRR1077.

- RRGRR029: allows an IE proposing a SOG to designate it as part of a self-limiting facility during the GIM process.

- RRGRR030: removes voltage levels’ hard coding for certain resource registration information related to transformer data, allowing resources connected to other voltage levels to submit their data without receiving a validation error.