DENVER — A Colorado Public Utilities Commission report released last week found that joining an organized wholesale electricity market could save the state’s utilities between $50 million and $230 million annually.

“These kinds of savings were generally found to exist independent of whether Colorado looked west to the CAISO, east to SPP or created something new in the middle working with neighboring utilities,” the report said. It also found that joining a market — whether an energy imbalance market or an RTO — would accelerate the state’s clean energy goals.

The PUC conducted the study in response to 2019’s SB19-236, which directed the commission to investigate Colorado utilities participating in an organized wholesale market and determine whether it is in the public interest by Dec. 1. The PUC also discussed the potential of interstate transmission as a way to more rapidly decarbonize Colorado’s grid earlier this year. (See Colo. Regulators Consider the Advantages of Interstate Tx.)

In June, Gov. Jared Polis signed legislation (SB21-072) requiring all utilities with transmission facilities to join an organized wholesale market by Jan. 1, 2030. (See Polis Signs Bipartisan Bill to Support Interstate Tx.)

Colorado is not the only state to have passed legislation requiring its utilities to seek RTO membership. Nevada Gov. Steve Sisolak also signed SB448 in June, and last week he appointed a task force to “capture the ideal conditions and requirements for a future regional transmission organization that will represent the changing economics, resource mix and decarbonization trends of the West,” Vijay Satyal, Western Resource Advocates’ regional energy markets manager, said in a press release.

CAISO or SPP?

As CAISO “already optimizes real-time imbalance energy over 84% of the Western footprint,” it would seem to be the obvious choice, the report said, but the PUC took issue with the ISO’s governance structure, with a concern that states outside of California participating in the market may go unheard.

“The risk exists that CAISO could protect California’s parochial interests at the expense of what is best for the region,” the report said. It pointed to CAISO’s recent filings concerning a wheel-through tariff that “appears to have significantly exacerbated and given substance to these concerns.”

Along with governance, the commission is also concerned about CAISO’s resource adequacy issues, which it says have delayed implementation of an extended day-ahead market in its EIM. Until the ISO has addressed this concern, “electric utilities in states like Colorado will likely need to be cautious about shifting control of their transmission assets to a process controlled by California,” the report said.

The report said that joining SPP’s Western Energy Imbalance Service (WEIS) would offer Colorado considerable short-term benefits, including improving dispatch and curtailment issues within the state. Unlike CAISO, WEIS “allows states [to] maintain control over resource planning and acquisition by their electric utilities, which has historically been well run in Colorado, creating considerable customer benefits.”

But even so, WEIS’ governance structure also leaves something to be desired, the report said. It raises concern for new utility entrants because “substantial voting rights [are] vested in individual power marketing agencies and cooperatives, with little opportunity for regulators to meaningfully participate.”

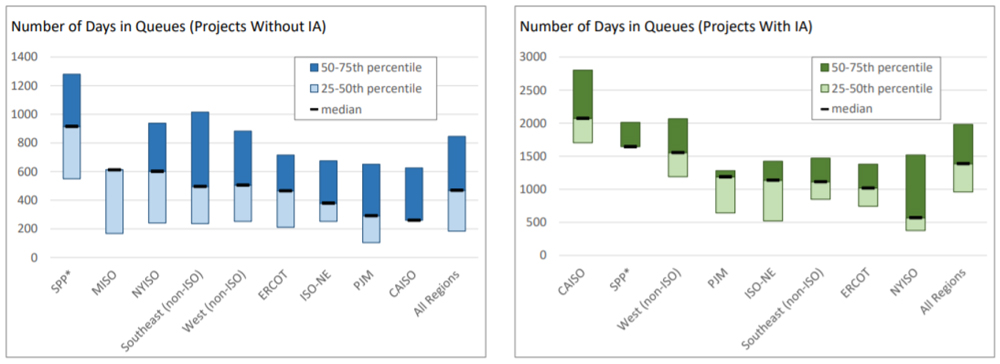

As well as potential governance issues, the report notes the concern of interconnection access and SPP’s overwhelmed queue.

“The inability to fairly and efficiently allocate interconnect to low-cost generators could delay new low-cost clean energy from coming online and would offer no direct mechanism for flowing the benefits through to native load customers,” the report said.

Moving Forward

The report encourages Colorado transmission utilities to communicate with the grid operators to address these concerns and explore potential market options in the meantime. By requiring utilities to join an RTO, Colorado aims to improve interstate transmission in the West to promote resilience and reliability.

“Under these circumstances, one near-term course for Colorado’s transmission utilities may be to participate in an EIM to resolve intrastate dispatch issues and to capture the enhanced near-term coordination benefits but preserve the flexibility to adjust as regional market opportunities in the West evolve,” the report said.