The Western Energy Imbalance Market Governing Body met twice last week, once by itself and once in a joint session with the CAISO Board of Governors, receiving briefings in both meetings on potential changes to the interstate market’s resource sufficiency test, which is being re-examined in a stakeholder initiative.

The test is meant to ensure that each WEIM participant enters a trading hour with enough capacity and ramping capability to supply its own needs and to prevent participants from “leaning” on the market to meet internal demand.

Participants raised objections to the test, including the recent addition of components that account for the unpredictability of weather-dependent resources such as solar and wind generation, transmission outages and other variables. Some contended the “uncertainty” components skewed results and led to periodic test failures, including by CAISO during intervals last summer.

A revised final draft proposal in the resource sufficiency evaluation (RSE) enhancements stakeholder initiative was released Thursday, when the board and governing body met in joint session. CAISO Vice President of Market Policy and Performance Anna McKenna provided a briefing on the proposed changes, as she had done in the governing body’s regular meeting Wednesday.

Stakeholders had four areas of concern over test accuracy, McKenna said.

“The first category is with regards to the measurement of uncertainty used in the capacity test,” she said. “After hearing more concerns about the current measurements that we use to capture uncertainty and the adders that we’ve put into the test, we are now considering suspending … uncertainty in the tests.”

Participants also raised concerns around demand response resources, capacity counting rules and consideration of load conformance.

CAISO planners had proposed increasing penalties for including demand response resources in the sufficiency test that do not materialize, but they now recommend shelving that plan because the penalties could have a “detrimental impact on how (participants) use demand response,” McKenna said.

A third category of stakeholder concerns involved CAISO’s proposed rules for counting resources toward the sufficiency test. CAISO still intends to enhance the counting criteria “so that the resources that are used to count to meet the test … can better reflect their actual reliability,” McKenna said.

The fourth category of concerns involves “how conformance of load forecast, which is done by our operators, can trigger EIM transfers to meet the [resource sufficiency] test,” McKenna said. CAISO continues to believe that understanding and adjusting for the impact of load forecast is important, but additional analyses showed complexities that deserve further testing and evaluation, she said.

“So, we’re proposing to take that additional time with regard to this one item,” McKenna said.

CAISO already had extended its timeline for the RSE initiative to take stakeholder comments into consideration and now plans to submit a final proposal to the board and governing body in a joint meeting Feb. 9.

Thursday’s joint meeting was the first to be held under new governance rules adopted by the CAISO and WEIM in August. The vote on the sufficiency test will among the first joint decisions under the new rules. (See CAISO Agrees to Share More Power with EIM.)

A meeting on the latest draft RSE draft proposal is scheduled for Dec. 21, with stakeholder comments due Jan. 10.

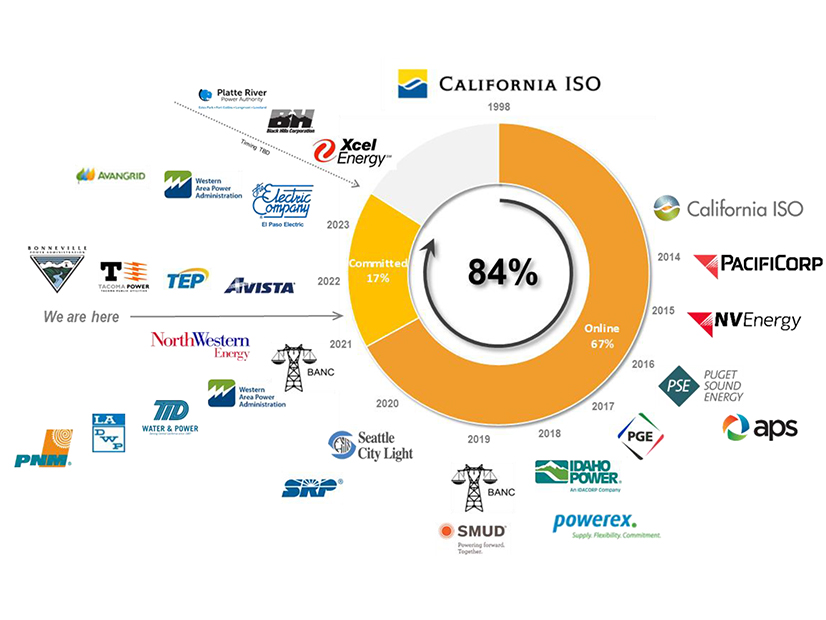

The WEIM now has 15 participants with seven more scheduled to join in the next two years, eventually accounting for more than 80% of load in the Western interconnection. Participants have amassed more than $1.7 billion in benefits since the market started in 2014 by buying and selling excess power across state lines.

CAISO is undertaking a major effort this to year to expand the real-time market to a day-ahead market (EDAM), further increasing cooperation among the West’s 37 balancing authorities.