PJM kicked off what it said will be a multiyear initiative on the increasing integration of renewables Wednesday with the release of a study on the transformation of generation.

The paper, Energy Transition in PJM: Frameworks for Analysis, includes the RTO’s preliminary five-year strategy built on three pillars: facilitating state and federal decarbonization policies, planning for the grid of the future and fostering innovation for the transition.

PJM told the Markets and Reliability Committee the study is designed to help the RTO identify gaps and opportunities in the current market construct and provide insights into the future of market design, transmission planning and system operations.

“As the generation mix continues to rapidly evolve in PJM, we must be ready to maintain the reliable, cost-effective delivery of electricity at all times,” said CEO Manu Asthana. “This study represents an important step in understanding how PJM can best work to facilitate the energy transition and make the grid of the future possible.”

Study Overview

Emanuel Bernabeu, director of PJM’s Applied Innovation and Analytics department, presented a high-level overview of the study, saying PJM believes it can “play a major role” in facilitating the decarbonization transition through reliability and cost-efficiency measures.

PJM is also working on defining what the grid of the future will be and how it will be operated, Bernabeu said, and fostering innovation both internally at the RTO and within the stakeholder community.

“These are pretty heavy pillars, so it does require a strong foundation,” Bernabeu said.

The first phase of the study was not meant for PJM to propose solutions, Bernabeu said, but to inform stakeholders on broad issues and initiate a discussion to “put some light” on areas that need focus.

Bernabeu called the paper a “living study” because the assumptions that went into the work will continue to be refined as PJM continues to look for opportunities to improve market designs, operations and planning.

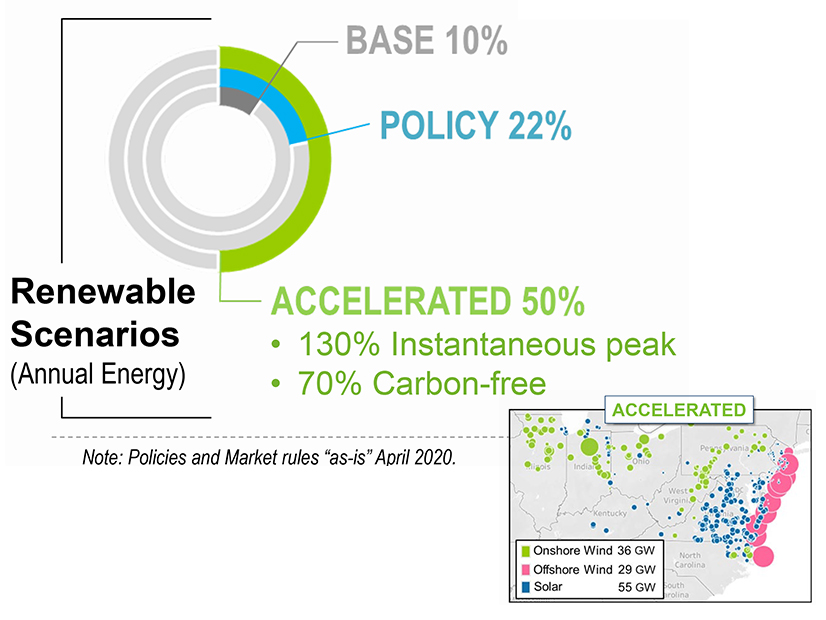

The study considers three scenarios in which an increasing amount of energy is served by renewable generation. The “base” scenario included 10% of the annual energy in the PJM footprint coming from renewable generation, while the “policy” and “accelerated” scenarios had renewables representing 22% and 50% of the annual energy, respectively.

In the accelerated scenario, up to 70% of the dispatch was considered carbon-free when combined with nuclear generation. The accelerated scenario includes 29 GW of offshore wind, 36 GW of onshore wind and 55 GW of solar.

As of 2020, renewables represented 6% of PJM’s annual energy, a total of more than 40% carbon-free including nuclear.

Bernabeu acknowledged that annual energy is “not the most intuitive metric.” In the accelerated scenario, he said, there are periods of time when PJM is serving 130% of the load with renewables — with any generation over the 100% mark exported to other regions.

PJM studied the resource adequacy of the three scenarios and simulated an entire year of the energy market with an hourly resolution to see how the renewable resources will operate.

Bernabeu said the study’s initial findings suggested five key focus areas for PJM’s stakeholder community, including correctly calculating the capacity contribution of generators. He said transmission systems with increased variable resources will require “new approaches” to assess the reliability value of each resource and the overall system.

The study determined the need for “operational flexibility” to address the uncertainty of variable resources, Bernabeu said, including lower capacity factors for thermal resources and average locational marginal pricing (LMP) decreases of as much as 26%.

The report says thermal generators provide “essential reliability services,” and an adequate supply will be needed until a substitute is “deployed at scale.” Bernabeu said PJM and stakeholders should ensure market structures provide the necessary incentives to maintain the generation for reliability.

He said expected increases in congestion, renewable curtailments and interchange with other regions “suggest opportunities for strategic regional transmission expansion.”

Reliability standards also must evolve, PJM said. The development of PJM’s markets, operations and transmission planning must be accompanied by the “advancement of comparable reliability requirements across interdependent infrastructure,” Bernabeu said. “Reliability cannot be achieved in a vacuum.”

Work on the study is expected to continue through 2022 with an updated report coming around the end of the first quarter of next year. “This study is not meant to be done and collect dust in your desk,” Bernabeu said.

Stakeholder Questions

Bernabeu was asked about the modeling done in neighboring RTOs and ISOs and the assumptions that were used. Wind projects in MISO were highlighted as an example of potential impacts on generation in PJM.

Bernabeu said the export and interchange numbers in the first version of the study were based on modeling neighboring regions maintaining the status quo with transmission and generation.

“The models tend to be extremely detailed inside PJM, and then the accuracy tends to degrade the further you move away from the footprint,” Bernabeu said.

Another stakeholder asked what PJM believes is an adequate supply of thermal generation.

Bernabeu said the first round of the study stopped short of making definitive quantitative assessments. He said there’s not a definitive quantity of supply for adequacy, so sensitivity analysis is going to continue to seek answers.

The most important aspect of the thermal focus area is how to incentivize behavior to maintain “essential reliability services,” he said.

“What is adequate? We haven’t found an answer yet,” Bernabeu said.