New York officials on Friday announced the release of a roadmap outlining expanded programs to achieve 10 GW of distributed solar in the state by 2030 (Case No. 21-E-0629).

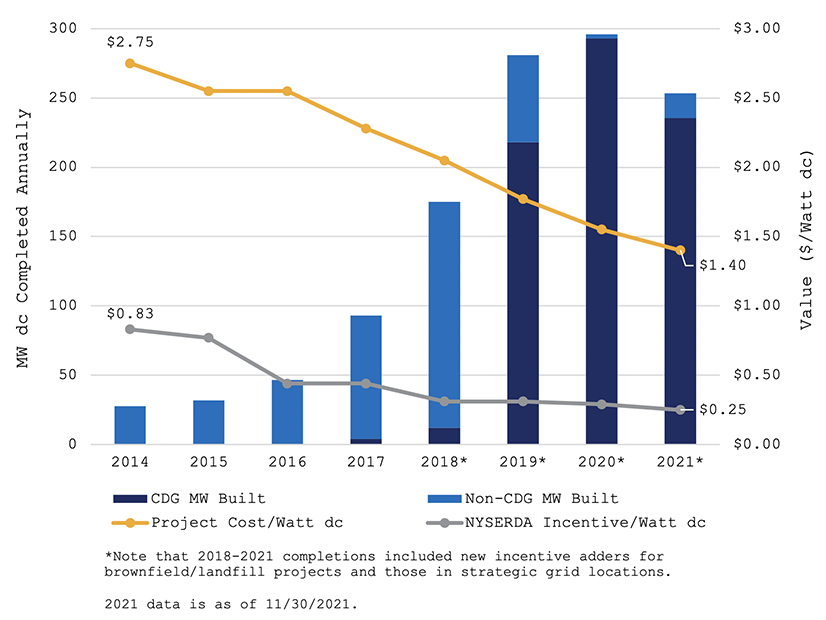

The state defines distributed solar as projects under 5 MW, including rooftop installations and community solar projects. The new framework builds on New York’s solar energy progress so far, with installed distributed solar and projects under development already totaling 95% of the current state goal of 6 GW by 2025.

“Strengthening our commitment to solar energy will help build healthier, more resilient communities while catalyzing quality, good paying new jobs in this thriving sector of our clean energy economy,” Governor Kathy Hochul said in a statement.

The New York State Energy Research and Development Authority (NYSERDA) and the Department of Public Service (DPS) submitted the roadmap to the Public Service Commission for public comment.

The expanded NY-Sun initiative aims to incent the construction of at least 1,600 MW of new solar capacity to benefit disadvantaged communities and low-to-moderate income New Yorkers, and proposes that at least 450 MW be built in Con Edison’s service territory covering New York City and parts of Westchester, increasing installed solar capacity there to more than 1 GW by the end of the decade. NYSERDA also proposes that at least 560 MW be advanced through the Long Island Power Authority.

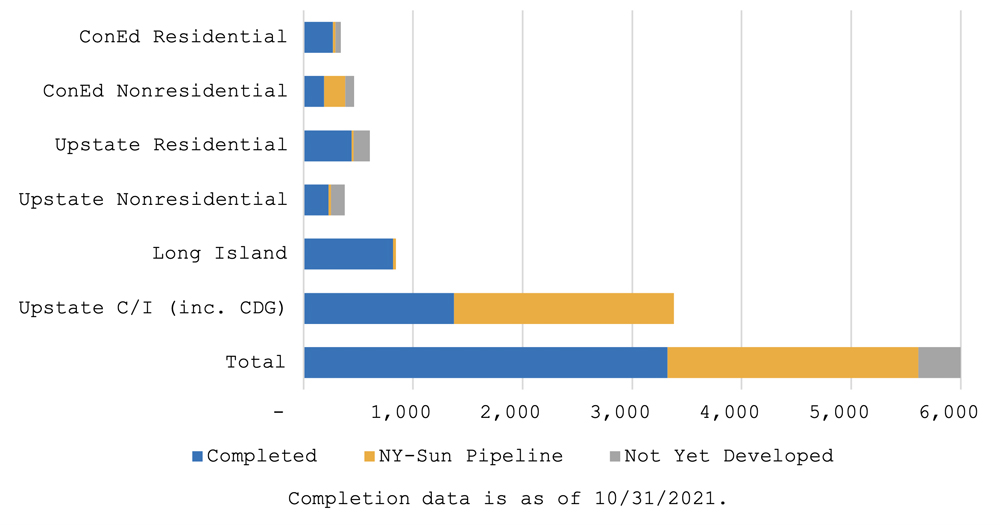

An overview of the progress made toward the 6 GW target, by development phase, market sector, and region. Most of the progress to date has been in the Upstate region for C/I onsite and community solar projects. | NYSERDA

An overview of the progress made toward the 6 GW target, by development phase, market sector, and region. Most of the progress to date has been in the Upstate region for C/I onsite and community solar projects. | NYSERDAThe proposal would require workers associated with projects supported by NY-Sun that are greater than 1 MW be paid the applicable prevailing wage, although projects that submitted their initial utility interconnection application prior to the Dec. 17 filing of the roadmap would be exempt from that requirement.

NYSERDA and the DPS estimated that the new solar push would direct $600 million in investments toward disadvantaged communities, with the Climate Leadership and Community Protection Act (CLCPA) mandating that at least 35% of the benefits from the state’s renewable energy spending go to such communities.

The proposal estimates that the solar program expansion will spur $4.4 billion in private investment and create 6,000 additional solar jobs across the state.

A study commissioned by the New York Climate Action Council’s Just Transition Working Group last month predicted that the state’s clean energy sector will add at least 211,000 jobs this decade and nearly 350,000 by midcentury, and that 10 new jobs will be created for every job displaced through 2030 by the state’s transition away from fossil fuels. (See NY Predicts 200K+ New Clean Energy Jobs by 2030.)

Questions and Answers

To ensure funding for the incremental 4 GW target, NYSERDA proposes ratepayer collections of nearly $1.5 billion through 2032. The cost of up-front incentives would be distributed across utilities proportional to load via a Clean Energy Fund surcharge.

Funding would not require new processes or ongoing settlements between utilities or NYSERDA. NYSERDA’s cashflow analysis has been updated to reflect the projected expenditure forecast of the $1.47 billion.

“Assuming collections occur over the 11-year period of 2022-32, the average levelized ratepayer bill impact is 0.79%,” the roadmap said. “The levelized impact on residential bills would be $0.71 per month. Expenditures, collections, and ratepayer impact are forecasted to peak in 2024. The 2024 bill impact is calculated at 1.07%, with an average 2024 statewide residential bill impact of $0.92 per month.”

The Public Service Commission on Thursday approved NYSERDA’s 2022 Clean Energy Standard compliance period administrative budget in the amount of $30.2 million, up from $28.4 million this year (Case No. 15-E-0302).

PSC Commissioner Diane X. Burman, one of two Republicans on the seven-member commission, said that while it’s reasonable that the NYSERDA team must grow as the workload continues to grow, the commission needs to engage in more discussion about how the state will deal with legislation that creates significant cost drivers.

“I believe very strongly that we should look at the proper resources, staff resources across the board,” Burman said. “I’m tired of it just being NYSERDA who we’re looking at … I’m left with blanks.”

Under the same CES proceeding, nuclear energy advocacy group New York Energy and Climate Advocates on Dec. 7 submitted to the PSC a query regarding differences between NYSERDA’s analysis of the steps needed to meet CLCPA goals and analysis of the same subject by NYISO.

The letter signed by Leonard Rodberg referred specifically to a presentation of clean energy integration scenarios and analysis provided by NYSERDA and consultancy Energy and Environmental Economics (E3) at the Oct. 1 meeting of the Climate Action Council, and to the Climate Change Impact Phase II study conducted by Analysis Group on behalf of NYISO in September 2020. (See New Analysis Sets Low-carbon Focus for NY Climate Plan.)

“In our view, both analyses reveal an unrealistic buildout of intermittent, low-energy-density, low-capacity factor sources and related infrastructure that warrants the consideration of alternatives if New York hopes to meet its climate goals,” Rodberg said. “We also recommend better coordination between agencies involved in crafting energy policy and entities charged with maintaining the reliability of New York’s electric grid.”

Rodberg said in the letter that since Oct. 1 he had written three times to Carl Mas, NYSERDA’s director of energy and environmental analysis, and received no reply to his questions.

One question concerned NYSERDA’s estimate of up to 126,047 GWh annual solar generation by 2050, which Rodberg said corresponds to a capacity factor of “almost 22%. However, the capacity factor of solar PV in New York is poor, only 14% for fixed panel and only 20% for tracking panels. How does NYSERDA explain this discrepancy? … Did NYSERDA inadvertently use capacity factor data for a different state?”

In response, NYSERDA told RTO Insider that it has provided an “unprecedented” level of transparency around the Integration Analysis presented to the Climate Action Council, with the most up-to-date inputs and key drivers published on the CAC resource website. The analysis team has conducted an in-depth study of the performance and cost of solar-PV technology specific to New York, the agency said.

NYSERDA said the state’s solar PV capacity factors range from 13 to 21%, depending on the NYISO Zone (based on variation in solar irradiance by geography) and installation configuration, with large utility-scale tracking projects able to harness more power than fixed roof-mounted systems.