x

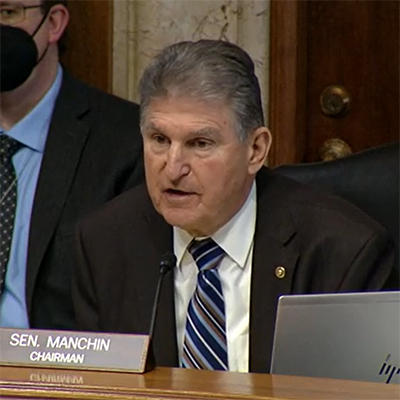

Sen. Joe Manchin (D-W.Va.) | Senate ENR

Sen. Joe Manchin (D-W.Va.) | Senate ENRThe Senate Energy and Natural Resources Committee kicked off its 2022 schedule with a hearing on hydropower characterized by uncommon agreement among its often adversarial Democrats and Republicans.

Lawmakers on both sides of the aisle agreed that the nation’s hydropower projects provide renewable, flexible baseload power that is undervalued in power markets and under-incentivized in federal policymaking. They also agreed that hydro is at risk because of long, expensive permitting and relicensing processes, as well as the ongoing drought in the West, which has threatened water levels and power supplies at major federal projects.

About a third of all nonfederal hydropower projects, representing 14 GW of capacity, will be up for relicensing between now and 2030, said Sen. Joe Manchin (D-W.Va.), committee chair, in his opening statement at Tuesday’s hearing. “Between low hydroelectricity prices and the high capital cost of maintenance and retrofits required for relicensing, there is a real possibility these plants could face closure,” Manchin said.

Sen. John Barrasso (R-Wyo.), the committee’s ranking member, stressed the importance of hydro’s use as a black start resource and the need for changes to permitting, both for the relicensing of existing facilities and for adding hydro to nonpowered dams.

Noting that only 3% of the nation’s 90,000 dams produce electricity, Barrasso said, “The glacial pace of permitting is a significant barrier to private sector investment in hydropower. It reduces the likelihood of investment in upgrading existing hydropower facilities such as installing turbines in nonpowered dams.”

Citing a Department of Energy study, Barrasso said that installing turbines on nonpowered dams could add 12 GW of power to the nation’s grid.

‘Just a Down Payment’

Federal support for hydropower was one of the selling points of the bipartisan Infrastructure Investment and Jobs Act (IIJA), signed by President Biden in November. The law included $125 million to add hydropower to nonpowered dams and another $75 million for efficiency improvements at existing hydro facilities, such as installing new low-head turbines that can produce power at lower water levels.

Jennifer Garson, acting director of the Department of Energy’s Office of Water Power Technologies, which is administering the IIJA funds, said they “will have an immediate impact on the U.S. hydropower sector and help address some of the critical capital gaps the industry faces.”

Garson was one of four federal and industry officials at the hearing. Malcolm Woolf, president and CEO of the National Hydropower Association, said the federal dollars, while vitally needed, are “just a down payment.”

“That money will stretch to cover investments in perhaps 150 to 200 facilities across the nation, but there are about 2,200 [hydro projects] in the U.S.,” Woolf said.

He also called for a streamlined permitting process that would allow “facilities that do not have significant environmental issues” to be approved in about two years, such as closed-loop or off-river pumped storage projects or nonpowered dams that have already gone through environmental reviews.

“We need some process discipline in order to be able to make sure that the deadlines established are honored, and the second thing we need is to rein in the agency over-run,” Woolf said, pointing to permitting requirements that may not be directly related to a project, such as building community facilities or providing grazing for livestock.

Woolf and others called for FERC to take a stronger role in the permitting process. It is currently the lead agency on hydropower permitting but is often “reluctant to make decisions when there are conflicts between agencies or between the developer and the agency,” Sen. Angus King (I-Maine) said. “It basically says, ‘Go work it out, and then we’ll bless what you agree to.’ … FERC has to be ready to make those decisions on a timely basis.”

Hydropower ITC

On the incentive side, Sens. Maria Cantwell (D-Wash.) and Lisa Murkowski (R-Alaska) both promoted SB 2306, which would provide a 30% federal income tax credit for hydropower upgrades that improve grid resilience by, for example, providing ancillary services or helping to integrate other renewable resources. The bill also includes a direct-pay option that would allow public power utilities and cooperatives to use the credit.

The credit would also be available for smaller, run-of-river projects that, Murkowski said, would have a major impact for remote communities in her state.

“When you take a village off diesel, you are making an extraordinary difference in the quality of life and sustainability of that community,” Murkowski said. “We can do more to demonstrate to the public that projects like this are safe; that they can be constructed without detriment to the environment [and] without impact to our fisheries.”

Sen. Maria Cantwell (D-Wash.) | Senate ENR

Sen. Maria Cantwell (D-Wash.) | Senate ENRBut Scott Corwin, executive director of the Northwest Public Power Association, cautioned that incentives needed to be backed up by changes to electricity markets. “One challenge for hydropower is that traditional energy markets were not designed to provide proper price signals for its value, like ramping capacity and ancillary services,” Corwin said. “We need more market mechanisms that create price formation to compensate hydropower, so it’s available for dispatch when needed most.”

The 500+ Plan

But the greatest threat to hydropower right now is the drought in the Western states, which Sen. Martin Heinrich (D-N.M.) said has passed the point where it can be labeled as a temporary condition.

Sen. Martin Heinrich (D-N.M.) | Senate ENR

Sen. Martin Heinrich (D-N.M.) | Senate ENR“There’s substantial evidence that what we’re experiencing now in New Mexico and other parts of the West … may be more accurately termed aridification. In other words, it’s a permanent impact of the changing climate,” Heinrich said. “We’re simply not seeing the snowpacks and the precipitation that we used to see, and it doesn’t look like it’s coming back.”

Camille Touton, commissioner of the Bureau of Reclamation, provided an overview of the “unprecedented” impacts of the ongoing drought on hydropower dams in the Colorado River Basin. Both Lake Mead at the Hoover Dam and Lake Powell at the Glen Canyon Dam are at the lowest levels since they came online, Touton said. Lake Mead is currently at 1,066 feet above sea level, uncomfortably close to the 950-foot level at which power could not be produced at the dam.

“When you look at hydropower, there are two components to it,” Touton said. “The elevation of the reservoir, or the head, [and] the flow rate or the amount of water that goes to the turbine. What we’re seeing in the Colorado River is record low capacity.”

Camille Touton, Bureau of Reclamation | Senate ENR

Camille Touton, Bureau of Reclamation | Senate ENRTo mitigate the impact of low water levels at Lake Mead, the bureau replaced five of the dam’s 17 turbines with wide-head turbines that produce power at lower water levels, Touton said.

At Lake Powell, recent forecasts show the possibility of the lake dropping below 3,525 feet by next month, she said. “This elevation is critical because it is just 35 feet above the minimum power pool elevation of 3,490,” resulting in “new and unpredictable operational conditions,” Touton said.

In response to the drought, Reclamation and the lower basin states of California, Nevada and Arizona launched the 500+ Plan in December to conserve 500,000 acre-feet of water a year, both in 2022 and 2023, to prop up water levels at Lake Mead, Touton said.

Reclamation will provide $100 million in federal funds — partly from the IIJA — and Touton said the states are also stepping up with financial support.

In yet another unprecedented move, the bureau recently announced it would for the first time “adjust” the water releases from Lake Powell, she said. “The volume stays the same in how much goes out, but we varied how much between months to be able to protect critical times in the power pool.”

Sen. John Hickenlooper (D-Colo.) noted that his state is currently seeing an above-average snowpack, providing some relief for both downstream dams, but it’s not a permanent solution.

Touton agreed that while the snow was welcome, “it’s one data point. It’s like not getting money into your bank account for a year and then all of a sudden getting a paycheck. We’re still at extreme deficits.”