Members Approve $1.04B 2021 ITP, Withhold $409M Project’s NTC

SPP stakeholders last week endorsed the grid operator’s latest transmission planning assessment, but not before withholding construction approval of a 345-kV, double-circuit project in West Texas.

The Markets and Operations Policy Committee on Jan. 10 agreed with a pair of working groups’ earlier recommendation to not issue notifications to construct (NTCs) to the 150-mile Crossroads-Phantom project.

The committee also withheld NTCs to a pair of transformer projects in New Mexico.

The 2021 Integrated Transmission Planning (ITP) report found the double-circuit project would provide twice the capacity of a single circuit, while “incrementally” increasing the engineering and construction (E&C) cost from $330.2 million to $409.9 million, a 23.9% increase. According to the 10-year assessment, the project would provide a low-resistance, parallel path for delivery of low-cost energy to Southwestern Public Service’s SPS South load pocket.

“For an additional cost increase, you’re getting two times the capacity and reserving some future options a little more effectively,” said ITC Holdings’ Alan Myers, chair of the Transmission Working Group (TWG).

The project is meant to address one of two targeted areas in the 2021 ITP where SPP found voltage-stability issues because of isolated load and above-average load projections, both related to oil and gas exploration: the Permian Basin in West Texas and eastern New Mexico, and the Bakken Formation oil fields in North Dakota.

However, load-projection errors, related to how load was allocated to individual substations, were discovered late in the process. Myers said the error was found in the 2022 ITP models, too late for staff to do a full impact analysis.

“So there was no time for staff to do like a full redo, if you will, of the analysis,” he said. “It was disproportionately, I believe, impactful to the loads down on that southern portion of the system.”

Myers said the TWG and Economic Studies Working Group spent a total of 7.5 hours in December discussing the NTCs for Crossroads-Phantom and the New Mexico transformers. Both groups endorsed the ITP in January but recommended the NTCs not be issued.

Staff, on the other hand, said they believe the Crossroads project is the best overall solution for the region. They requested the project still be considered for an NTC with conditions.

MOPC tabled and then un-tabled the proposal before finally approving the 2021 ITP by a vote of 56-5, with four abstentions. It recommended further evaluation of the Crossroads-Phantom project and that it be brought back to the committee during its July meeting.

The ITP portfolio includes 28 new projects and 380 miles of new 345-kV lines at an E&C cost of $1.04 billion. Staff said the projects would solve 185 system needs with a 5.3 to 5.7 benefit-to-cost ratio.

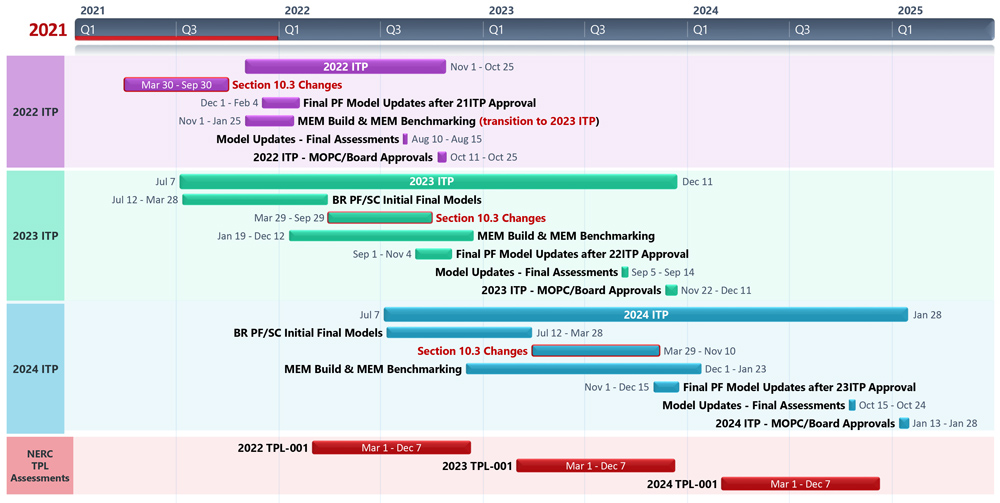

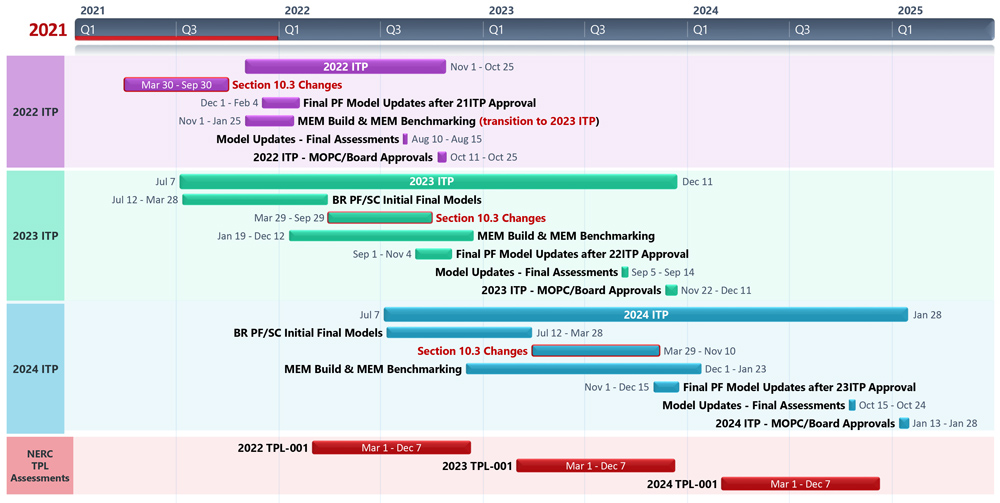

The committee also approved staff’s recommendation to re-baseline the delayed 2022 ITP by performing a reliability-only assessment, resuming full studies with the 2023 and 2024 ITPs.

MOPC directed staff to work with the ESWG and TWG to review the tariff and scope documents to find further improvements to ensure timely completion of current and future ITP assessments. Staff are currently working on three ITPs, for 2021, 2022 and 2023. The 2022 plan is already behind schedule because of 2021 ITP constraints, and 2023 is at risk because of the previous two assessments’ delays.

SPP engineer Nick Parker said a task force that developed recommendations to improve the planning process “did a good job getting us close” and that staff were only a few months off, despite remote work during the COVID-19 pandemic and their other transmission-related requirements. (See SPP Strategic Planning Committee Briefs.)

“Certain stuff hit us all at once,” Parker said, adding that SPP has since added manpower to help manage the workload.

Casey Cathey, SPP’s system planning director, reminded members that ITP studies are on 27-month cycles so that a full assessment can be brought to MOPC every October.

“We did so in 2019 and 2020. The process is not broken,” Cathey said. “It’s really a 30-month process because of the contingencies that happen. Things happen. COVID happened, and that pushed things to where they’re at. Worst-case scenario, we do nothing and we have a 30-month process squeezed into a 27-month process, and you end up skipping an ITP once every four calendar years.”

MOPC also endorsed the 2021 ITP assessment report as having met the tariff’s requirement to complete the planning process.

Storage Accepted as Transmission

Stakeholders moved to accept storage resources as transmission assets in endorsing a recommendation (RR476) from the Electric Storage Resource Steering Committee (ESRSC).

The measure adds another acronym to SPP’s lexicon by defining the assets as “storage as transmission-only assets” (SATOAs). It requires SATOAs to register as market storage resources in the Integrated Marketplace to account for their injections and withdrawals. They will not be dispatched in the market and are only to receive charges and credits for the energy and over-collected losses; revenue or losses from the injections and withdrawals will be added back to the SATOA’s annual transmission revenue requirement.

EDP Renewables’ David Mindham said that while RR476 installs guardrails that prevent the assets from having an “overly burdensome” effect on the market, it “missed an opportunity.”

“By automatically assigning [SATOAs] to transmission owners, the developers could have provided a lot of experience in bringing these assets online,” Mindham said. “They could have provided this as a service and a competitive process probably more cheaply, especially for the limited uses that they’re intended for.”

He asked whether local issues outside the transmission-planning process would prevent the storage assets from coming online through the process.

“I don’t think that this process would prevent it from being put together,” SPP’s Joshua Pilgrim said. “The general consensus, since the device is only meant to run for post-contingency situations, is that their impact on local dispatch profiles would be minimal. They’re not designed to be run all the time. Most of the time, they’re waiting.”

MOPC Chair Denise Buffington, who also chaired the ESRSC, said storage devices’ multiple uses will demand a future conversation between staff and stakeholders.

“We need to get a baseline understanding out there for what the asset can do,” she said. “Once we get that baseline, we can start building on it. Part of the problem with some of the discussions we’ve had about the model is where do you start? Then, it starts to get circular.”

MOPC passed the measure by a 53-3 margin, with 10 abstentions. The Regional State Committee will have to weigh in on RR476’s rate sections.

The committee also endorsed an ESRSC policy paper that sets the methodology for accrediting hybrid generating facilities that qualify as capacity, SPP’s first such policy. The paper proposes that hybrid components (primarily wind, solar and storage) be studied and allocated separately, with four-, six- and eight-hour duration products. The proposal will consider a facility’s investment tax credit and its ability to charge from the grid, beginning with the 2023 summer season.

SPP defines a hybrid facility as two or more resources behind the same interconnection point, where at least one of the resources is not classified as storage.

Golden Spread Electric Cooperative’s Natasha Henderson, chair of the Supply Adequacy Working Group, said there are currently no hybrid facilities on the system, but they are expected to become more prevalent over the next five years. Given their multiple configuration possibilities, she said, the SAWG worked to ensure the facilities are not over or under accredited.

The stakeholder group will now work on criteria and develop tariff language. “That’s when we will debate the issue,” Henderson said.

“The policy’s basically been debated already,” American Electric Power’s Jim Jacoby said. “If people go out and make business decisions based on [the paper] and then you change the rules on them, they’re not going to be happy.”

Still, members approved the policy paper 49-7, with five abstentions.

Order 2222 Compliance Filing Endorsed

MOPC endorsed a revision request (RR468) that approves a compliance filing for FERC Order 2222 as SPP prepares to allow distributed energy resource aggregators to participate in its markets.

Members approved the measure by a 58-3 margin, with five abstentions, with some noting that did not mean they approved of FERC’s order itself.

“Our vote to approve is understanding that this is a compliance filing in response to a FERC order and not … endorsing the FERC order itself,” Oklahoma Gas & Electric’s Usha Turner said.

DeWayne Todd, with the Advanced Energy Management Alliance, said his organization remained concerned about the compliance proposal because “it does not really address some of the requirements of 2222 relative to reducing barriers [to DER participation].” He cited imposed telemetry requirements for every aggregation’s size, restrictions to single nodes and a registration process “that doesn’t provide a lot of value” because it’s duplicative to subsequent steps in the registration and participation process.

The compliance filing allows a DER aggregator to register its aggregation as a valid resource type if it meets technical and operational requirements, with the aggregator subject to the same service provision rules as other resources within that type. Aggregations must be at least 100 kW and can include a single DER. The aggregations must include real-time telemetry and settlement quality metering.

In what may be a nod to further pushback at FERC, SPP plans to keep alive the task force responsible for RR468’s tariff modifications until it receives the commission’s response. Assuming approval, staff plan to implement the tariff changes in early 2024.

The compliance filing was originally due last July, but FERC, noting the absence of opposing intervenors, granted SPP an extension until April 28 this year (RM18-9). (See FERC OKs Delay on Order 2222 Compliance.)

The committee also easily approved RR480, which gives the industry expert panel evaluating responses to SPP’s competitive transmission process the option to use incentive points in scoring the proposals. Members raised concerns that the expert panel could select a project other than the highest-scoring proposal, but they still gave the measure 93% approval.

JTIQ, Tx Value Staff Reports

David Kelley, SPP’s director of seams and tariff services, said the RTO’s collaborative work with MISO addressing their overflowing interconnection queues has identified a project portfolio that can relieve constraints on either side of the seam. Thirty-three of those constraints are in MISO’s footprint, and the other 17 are in SPP’s.

The grid operators began their joint targeted interconnection queue (JTIQ) study in September 2020, hoping to find interregional transmission projects to alleviate queues filled with renewable resource requests.

“The key theme was the development of generation along our seams and the difficulties many generation developers have found in accomplishing that,” Kelley said. “We happen to be very blessed in our part of the country with low-cost renewable generation; … the transmission system is at capacity along the seam.”

Kelley said the “optimized” portfolio has a preliminary combined load-adjusted-production-cost (APC)-to-cost ratio of 0.45. A report is being drafted for stakeholder review by the end of the month. The RTOs will schedule meetings with stakeholders to review the full results before seeking board approval for the plan.

A cost-allocation methodology is under development, Kelley said, and will reflect input from load-serving entities and generation developers. “We should reasonably assign those costs to those who will benefit,” he said.

Cathey told MOPC that an update to 2016’s value of transmission analysis determined that the $3.35 billion of installed transmission from 2015 to 2019 resulted in $27.2 billion in net present value of quantified benefits over 40 years and a 5.24 benefit-to-cost ratio.

The earlier study, dubbed by the Brattle Group as a “path-breaking effort,” found a net present value of $16.6 billion in benefits from projects installed from 2012 to 2014, a benefit-to-cost ratio of 3.5. (See SPP Begins Promotional Campaign to Tout Transmission Value.)

“I think that’s pretty reasonable if you think about what’s gone on in the last five years, especially with all the wind [resources] in our region,” Cathey said.

The new study simulated 57 days of production, compared to 38 in the earlier study, and captured benefits from line rebuilds and transformer additions in addition to the new infrastructure. Operations and engineering staff, “squeezing” in the analysis along with their other work, evaluated APC savings, reliability and resource adequacy benefits, increased wheeling revenues, reduced on-peak losses, and optimal wind generation development.

Cathey said the report is 95% complete. Staff will share the study and findings with other stakeholder groups before seeking endorsement from the Strategic Planning Committee in April. The report will then be shared with a wider audience.

Engineering Humor

A comedy routine (Or was it a comedy of errors?) broke out during MOPC’s final four-hour segment. Cathey, an engineer by trade, took advantage of a momentary pause before one of his presentations to try out his standup chops.

“Two investors were talking and one asked the other, ‘What do you think about this solar craze?’” Cathey said. “The other said, ‘Well, it’s not going to happen overnight.’”

Greeted by silence, he moved on. Cathey’s listeners, punch-drunk after hours of virtual conversation, didn’t.

“You just can’t hear all the laughter,” Lincoln Electric System’s Dennis Florom said in the virtual meeting app’s chat function.

Others chimed in with their own versions of “dad jokes.” Energy consultant Simon Mahan tweeted to SPP to “please let Casey know Energy Twitter loves him.”

MOPC’s New Faces

MOPC welcomed several new members, including two representing SPP’s newest members: Ray Bergmeier, with Sunflower Electric Cooperative’s competitive Konza Transmission, and Matt McCoy, with Southern Star Central Gas Pipeline. The pipeline company joined the RTO late last year as its 107th member. (See Southern Star Gas Pipeline Joins SPP.)

The committee’s other new members stepped in for their companies’ previous representatives. They are Western Area Power Administration’s Steve Sanders for Lloyd Linke; AEP-Southwestern Transmission Co.’s Brian Johnson for Chad Heitmeyer; Exelon’s Jason Barker for Chris Lyons; Walmart’s Jim Staggs for Holly Rachel Smith; Northeast Texas Electric Cooperative’s Ron Ray for Rick Tyler; and Mor-Gran-Sou Electric Cooperative’s Trisha Samuelson for Robert Kelly.

$73M Tab for 161-kV Rebuild

Members unanimously approved the consent agenda, which included the Project Cost Working Group’s recommendation to re-baseline the 31-mile, 161-kV Neosho-Riverton rebuild project’s costs from $48.3 million to $73.1 million. The line is historically SPP’s highest congested path, but rising steel costs and delivery issues threaten its in-service date of October 2023.

The agenda’s approval also resulted in MOPC’s endorsement of the Transmission Owner Selection Process (TOSP) Task Force’s suggestion to sunset next January. The TOSPTF has been evaluating improvements to SPP’s competitive transmission process, several of which were among the eight revision requests on the consent agenda:

- RR450: provides guidance for using operating guides in the planning horizon.

- RR469: corrects the Integrated Marketplace protocols’ settlements language defining the variables RtDesiredEn5minQty and RtOrigLmp5minPrc to clarify that the real-time desired energy five-minute quantity (RtDesiredEn5minQty) uses the dispatchable LMP and the real-time original locational five-minute price (RtOrigLmp5minPrc) uses the LMP.

- RR470: corrects settlements language in the Marketplace protocols by removing an erroneous “minus” in section 4.5.9.35 (Real-Time Ramp Capability Non-Performance Amount) and correcting the variables in section 4.5.12 (Revenue Neutrality Uplift Distribution Amount).

- RR471: automatically suspends the TOSP if a re-evaluation is approved equal to the days the re-evaluation requires.

- RR472: requires that the TOSP’s industry expert panel Direction to Respondents document be created and published during a request for proposals response window.

- RR473: cleans up the TOSP’s governing documents to more accurately capture their intent and execution.

- RR478: adds flexibility to the resource planning process by allowing alternative methods outside of software, as required by the ITP manual.

- RR479: clarifies staff’s steps when reviewing submitted detailed project proposal and determining if they qualify for incentive points under SPP’s competitive transmission process.