The reliance on imports in the West could prove problematic during times of high demand or in years with low hydropower production, WECC analysts said Wednesday in a stakeholder call to discuss the reliability organization’s Western Assessment of Resource Adequacy (WARA), released in December.

“We cannot rely on imports to be available when we need them to be available, especially during times that are different from the expected demand and resource availability,” Victoria Ravenscroft, WECC’s senior policy and external affairs manager, said.

The electric industry needs to change how it counts imports when gauging resource adequacy, “both in how we look at imports, [for example] firm versus non-firm … but also just the actual energy that is available,” Ravenscroft said. “What we’ve seen in the past couple of years with broad West-wide heat waves is that the import capability and imported energy that we were counting on may not have been available. Our thoughts and planning around imports really needs to be evaluated and changed.”

In the energy emergencies of August 2020, imports from the Pacific Northwest that CAISO was counting on during a severe Western heat wave did not materialize because of transmission constraints. (See CAISO Issues Final Report on August Blackouts.) Similar circumstances occurred on July 9, 2021, when major transmission lines between Oregon and California were derated because of wildfires. (See CAISO Declares Emergency as Fire Derates Major Tx Lines.)

For the WARA, WECC tested imports and exports across the Western Interconnection under three scenarios: an “expected” case in which supply and demand conformed to likely conditions; a high-demand case in which severe weather conditions strained supply; and a third in which drought caused hydropower production to plummet.

The final scenario envisioned losing all power from the Hoover and Glen Canyon dams on the Colorado River because of low water levels, as nearly happened last summer. The Desert Southwest remains in a decades-long drought that has jeopardized the West’s traditional reliance on Colorado River water. (See Feds Invoke First-ever Colorado River Water Restrictions.)

If both dams were lost during a period of high demand, the West gets into a situation where “imports are going crazy [and] people are trying to export what they have leftover, but there isn’t any,” Matthew Elkins, WECC manager of resource adequacy and performance analysis, said.

All three of WECC’s scenarios modeled an evening hour in late June because it “represents a time of high demand and resource variability,” the report said. (See WECC Warns West Heading for Resource Shortfalls by 2025.)

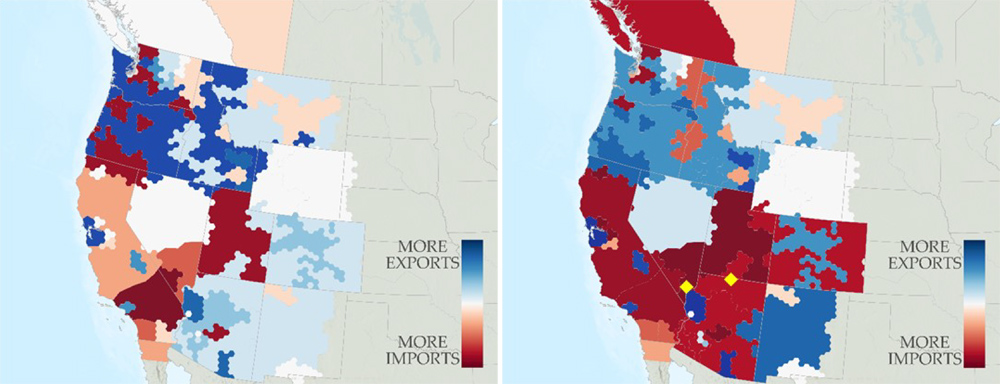

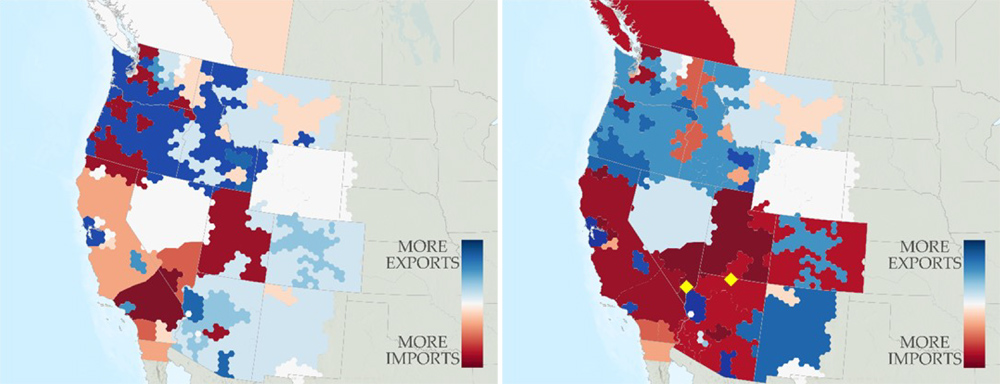

In normal conditions, excess energy generated in the north and east moves to the south and west, so energy flows out of Arizona, Montana, the Northwest and Northern California and into southern Nevada, New Mexico, Southern California and Mexico. But the deterministic analysis “showed dramatic changes in power flow … in both the high demand and drought cases,” WECC said.

During high demand, Colorado and New Mexico switch from importing power to exporting it, while Northern California must switch from exporting power to importing it to serve higher demand. The drought case puts a bigger strain on the system, with Colorado, Arizona and parts of Utah unable to export power and New Mexico having to increase exports to supply those areas.

In addition, more energy must flow out of the Northwest into California to make up for the loss of the two dams.

“These are the kinds of things that we want to be studying in the near term,” Elkins said. “[These are] definitely conversations that we need to be having until we can mitigate the risks in the [five- to 10-year] planning horizon.”

Wednesday’s call was the first of two to discuss the report; the second is scheduled for Feb. 1.

Holden Mann contributed to this report.