SPP’s Market Monitoring Unit is “strongly” recommending that transmission congestion rights’ (TCRs) funding shortfall be considered a high-priority item, according to its latest quarterly market report.

In the fall report, covering September through November, the MMU said the TCRs’ funding percentage varied over the trailing 12 months, ranging between 71 and 115%. It said the underfunding was down by more than $97 million when compared to fall 2020; TCR funding was it its lowest in October at 71%, driven by significant outages not included in the TCR model.

The Monitor said an item has been initiated in SPP’s roadmap process to correct the issue. Staff and stakeholders collaborate in this process to identify, educate, prioritize and approve new and existing initiatives for development over the next two to five years.

“Given the magnitude of the issue, we strongly recommend this item be considered as a high-priority item,” the MMU said in its report.

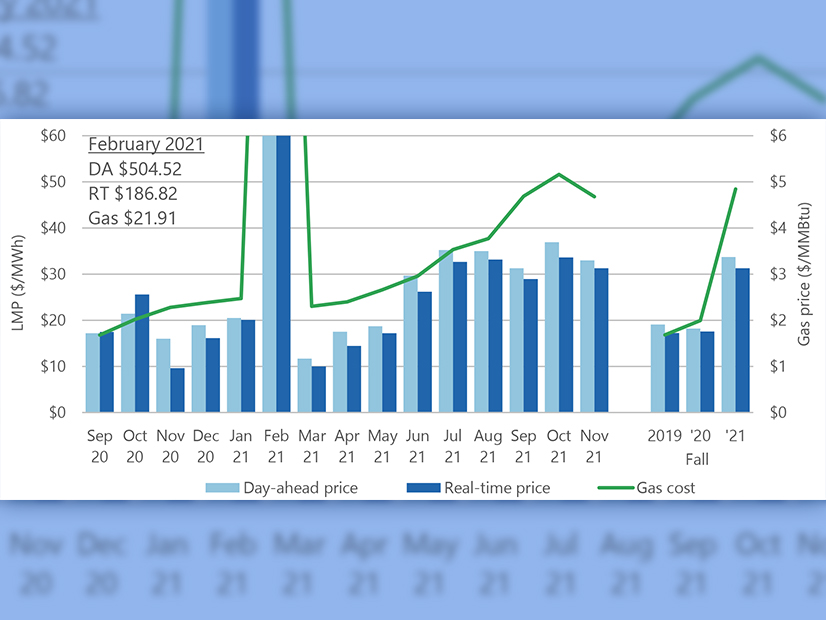

The report also found the average gas price at the Panhandle Eastern hub increased to $5.16/MMBtu in October, the highest price since March 2014 outside of last February 2021. The average gas price was up 143% from $1.99/MMBtu the previous fall.

Electricity prices also increased from 2020 to last fall, although at a lower rate. Day-ahead prices rose from an average of $18.21/MWh in 2020 to $33.72/MWh in 2021, an increase of 85%. Real-time prices increased from an average of $17.57/MWh to $31.27/MWh over the same period, up 78%.

The MMU said wind generation was the primary fuel type during the quarter, accounting for 38% of total generation, up 4 percentage points. Coal generation increased from 31% of production to 35%.

A webinar has been scheduled for Monday to allow stakeholders to discuss the quarterly report with MMU staff.

The Monitor has also released its latest quarterly report for the same period on SPP’s Western Energy Imbalance Service (WEIS) market.

It said the market’s average hourly load for September and November was about 2.3 GWh but was down slightly to 2.18 GWh in October. Coal remained the predominate fuel source, the report said, with 66% of total generation in September and decreasing to 62% by November. Hydroelectric generation was the second largest energy source, averaging 22% of total generation in September before trending downward to 17% by November.

The report found that average load and generation energy prices remained consistent with August pricing at slightly over $35/MWh until November, when there was an approximate decrease of 35%.

The market was averaging 1,692 MWh of hourly exports when September began, but they declined to about 1,500 MWh in October and November, the MMU said. Hourly imports averaged 626 MWh in September and increased throughout the quarter to 1,078 MWh by November.

The MMU said the WEIS market continues to struggle with ramp availability and short-term system flexibility, despite an abundance of online capacity. Many dispatchable resources are offered with minimal available dispatchable and/or ramp-able capacity, it said.

Economic limit parameter changes that force additional ramp needs, load forecast changes and changes in net schedule interchange also continue to drive market struggles to supply sufficient ramp. Market participants are also reluctant to offer additional resources because of risks associated with recovering costs when prices drop.