PJM is requesting input from stakeholders on a course of action after a member defaulted on its portfolio in the financial transmission rights market, potentially leaving members having to cover millions of dollars.

At Wednesday’s Markets and Reliability Committee meeting PJM’s Chief Risk Officer Nigeria Poole Bloczynski reviewed the timeline of events that led to the default of Hill Energy Resource & Services, a member of the RTO since 2012.

“We are committed to transparency, and we’re just as committed to providing as many opportunities as we can to provide feedback,” Bloczynski said.

Hill Energy’s portfolio value in PJM at the time of default. | PJM

Hill Energy’s portfolio value in PJM at the time of default. | PJM

New rules in PJM initiated after the GreenHat Energy default in 2018 were designed to provide more information to members on defaults in the financial markets. GreenHat acquired the largest FTR portfolio in PJM between 2015 and 2018 but defaulted on the portfolio in June 2018, leaving PJM stakeholders to cover more than $179 million in the market. When the company defaulted, GreenHat had only $559,447 in collateral on deposit with PJM. (See Doubling Down — with Other People’s Money.)

Timeline

Nigeria Poole Bloczynski, PJM

” data-credit=”© RTO Insider” data-id=”7656″ style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: left; width: 200px;” alt=”Bloczynski-Nigeria-Poole-2020-02-20-RTO-Insider-FI” data-uuid=”YTAtMTI2NDM=” align=”left”>Nigeria Poole Bloczynski, PJM | © RTO Insider

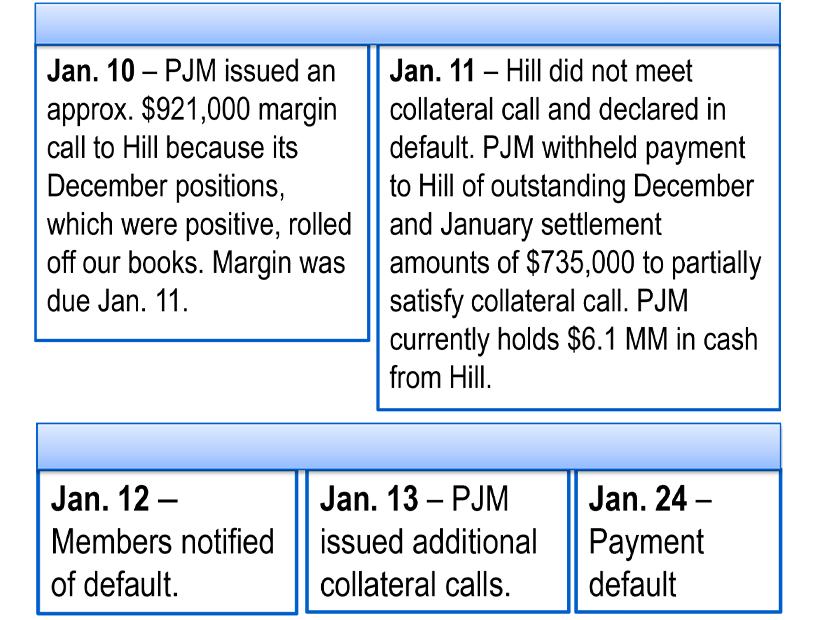

Bloczynski said PJM issued an approximate $921,000 margin call on Jan. 10 to Hill because its December positions, which had a positive value, rolled off the RTO’s books. The margin call was due by 4 p.m. on Jan. 11; Hill did not make it and was subsequently declared in default.

PJM withheld payment to Hill of outstanding December and January settlement amounts totaling $735,000 to partially satisfy collateral call. The RTO currently holds $6.1 million in collateral cash from Hill against the defaulted portfolio.

An additional margin call went unmet on Jan. 13, and Hill defaulted on a payment on Monday.

Bloczynski said Hill has been in good standing since it joined the RTO in 2012 and has been adequately collateralized. PJM completed a “Know Your Customer” (KYC) procedure and background check on Hill in 2021 with no adverse findings.

Its FTR portfolio represented 0.3% of PJM’s overall FTR market transactions as of Dec. 31. “It was a relatively small portfolio considering the overall size of the FTR market,” Bloczynski said.

Prior to the Dec. 22 FTR auction, Bloczynski said Hill had a “substantial amount of excess collateral” posted with PJM. After the auction, Hill requested a return of excess collateral, leaving $5.4 million in place against a requirement of $5.1 million. Its portfolio had a positive mark-to-auction value and an FTR credit requirement of $5.1 million, including a $4.1 million FTR requirement and $1 million in additional restricted collateral.

The portfolio goes through May 2025. The company only participated in the FTR market and did not serve any load.

“There were no red flags identified and no previous payment or collateral default history within PJM or what we uncovered through the KYC and background check,” Bloczynski said.

Evaluating the Exposure

Following default, PJM began an analysis of open positions of Hill’s portfolio to assess exposure. The initial analysis showed a subset of the portfolio experiencing “volatile congestion losses” in January because of a short position on the Greys Point-Harmony Village constraint in the Dominion zone. Work started on the line at the beginning of January and is expected to go until December 2023.

As of Monday, PJM had issued about $83 million in collateral calls related to the volatility on the constraint. Approximately 20 impacted companies satisfied the calls, but not Hill. The company’s short position across the constraint path extends from this month through May 2023 for a total of approximately 174 GWh, Bloczynski said, creating risk of “significant degradation” of portfolio value from the December mark-to-auction values. PJM is reviewing other portfolios that may be experiencing losses and issuing collateral calls.

Bloczynski said there are already known losses of $2.8 million from the beginning of the month through Jan. 20 on the defaulted portfolio. Depending on market conditions of day-ahead prices, the final January dollar numbers could be “more or less.”

PJM anticipates an estimated loss of $300,000 from February through May based on the latest February FTR auction for the balance of the planning year and a $4.6 million loss from June through the end of the FTR portfolio in May 2025.

That brings the total of estimated losses to $7.2 million in losses, against the $6.1 million PJM holds in collateral.

“It’s very likely the amount that we have will be inadequate given the unusual congestion patterns we’ve seen so far,” Bloczynski said.

Options

Tim Horger, PJM

” data-credit=”© RTO Insider LLC” data-id=”4651″ style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: right; width: 200px;” alt=”Horger | © RTO Insider – pjm miso pseudo-ties” data-uuid=”YTAtMzAzODk=” align=”right”>Tim Horger, PJM | © RTO Insider LLC

Tim Horger, director of PJM’s forward market operations and performance compliance department, provided some of the options available in the RTO’s “toolbox” to deal with the default, as required under Schedule 1 of the Operating Agreement. They include allowing the positions to go to settlement, or liquidating the positions by offering them for sale in an upcoming auction.

Horger said the January and February positions in the portfolio will go to settlement because of the timing of the default. But “there could be a combination of different ways to handle” the other positions, he said.

The OA language was adopted by stakeholders last year, and PJM is still waiting to hear from FERC on approval of its filing (ER22-797). (See PJM Stakeholders Endorse Initial Margining Proposal and Stakeholders Endorse PJM ARR/FTR Market Changes.)

Horger said the first option is to allow the positions to go to settlement against day-ahead prices for a certain period or throughout the life of the portfolio through May 2025. He said if the positions are allowed to go to settlement, it could result in a “significant loss” depending on how the congestion on the line in the Dominion zone materializes over the next three years.

“It might not be practical to let them go to settlement for these longer-term positions because at that point the membership will be at risk of potentially higher costs,” Horger said.

The positions can be liquidated in a normal or special FTR auction. Offering the portfolio for sale in a normal FTR auction allows the market to determine the value of the portfolio, Horger said, and it also removes the risk of future exposure because the positions are being taken off the books.

A special auction, Horger said, would be conducted in almost a “silent auction” fashion with only individual paths in the defaulted portfolio being bid on instead of being inserted into the larger FTR market.

Horger said PJM is interested in how much advance notice stakeholders would want before liquidating the portfolio in an auction. “The goal is to minimize losses to members.”

Legal Update

Chris O’Hara, PJM

” data-credit=”© RTO Insider” data-id=”9388″ style=”display: block; float: none; vertical-align: top; margin: 5px auto; text-align: left; width: 200px;” alt=”Chris O’Hara, PJM” data-uuid=”YTAtNTQzMDU=” align=”left”>Chris O’Hara, PJM | © RTO Insider

PJM General Counsel Chris O’Hara gave an update on the legal procedure in the default.

The RTO believes Hill was “adequately capitalized” and had “sufficient” capital to satisfy the margin calls, O’Hara said. It filed a complaint and request for expedited discovery against the company and its principal Lijin Chen, who had notified it that the company does not currently have sufficient funds to cover the defaulted portfolio.

O’Hara said PJM filed the court case in Texas to “eliminate personal jurisdiction issues” with Chen. Claims in the lawsuit include breach of contract, taking actions to avoid credit obligations and “piercing the corporate veil/alter ego.” The RTO is pursuing an injunction to “seek to secure funds in the amount of the unsatisfied collateral calls,” he said.

PJM CFO Lisa Drauschak said section 15.2.2 of the OA establishes a default allocation assessment formula to be used at the direction of the board. Ten percent of the default would be charged to every PJM member with a $10,000 annual cap, and 90% of the allocation is based on gross market activity, itself based on three months of gross billings. For the Hill default, the factor would include gross billings from November, December and January.

PJM will discuss the proposed settlement timetable at the Feb. 24 MRC meeting. A special session of the Members Committee is also scheduled for Feb. 2 to further discuss the approach to the default with stakeholders.