Dominion Energy expects to invest $73 billion in clean energy by 2035, “nearly all of which will qualify for regulated cost of service recovery,” CEO Robert Blue said during the utility’s fourth-quarter 2021 earnings call Friday. “It is, as far as we can tell, the largest regulated decarbonization investment opportunity in the industry.”

Green investments made within regulated markets, ensuring a 9% return on equity and stable profits for shareholders, were among the top-line takeaways from the call. The company reported fourth-quarter net income of $1.3 billion ($1.63/share) — nearly double that of the same quarter in 2020 — off revenues just short of $3.9 billion. It also reported a $3.3 billion profit for 2021, compared to a $401 million loss in 2020.

The call’s other major bullet point was the announcement that Dominion was expanding its net-zero goals, going beyond its own emissions to push reductions by its suppliers and customers.

The company has previously committed to net-zero emissions by 2050, but “we now aim to achieve net zero by 2050 for all Scope 2 and for Scope 3 emissions associated with three major sources,” Blue said. Scope 2 emissions come from the electricity Dominion uses for its own operations but does not generate itself. For Scope 3 emissions, Dominion will target its local natural gas distribution companies (LDCs), Blue said, as well as fuel and other power suppliers.

The utility has LDCs in South Carolina, Ohio and Utah, and a pipeline company, Dominion Energy Questar Pipeline. According to Dominion’s website, it has a total of 22,770 miles of pipeline in North and South Carolina and 2,500 miles serving Utah, Wyoming and Colorado.

In another Friday press release, Dominion announced it has signed an agreement to sell its West Virginia LDC, Dominion Energy West Virginia (also called Hope Gas), to Ullico Inc., a labor-owned insurance and investment company.

Dominion has already cut its emissions 42% over 2005 levels and is targeting a 70 to 80% reduction by 2035, Blue said.

“In 2005, more than half of our company’s power was from coal-fired generation; by 2035, we project that to be less than 1%,” he said. By 2030, the utility’s generation in South Carolina will be coal-free, while it will “have only two remaining facilities in Virginia,” Blue said.

As part of its efforts to tackle Scope 2 and 3 emissions, Blue said, Dominion supports federal regulation of methane emissions. “We’re working towards procurement practices that encourage and enhance disclosures by upstream counterparties on their emissions and methane-reduction programs,” he said. “Further, we encourage suppliers to adopt a net-zero commitment, and we have started to receive quotes for responsibly sourced gas.”

Blue did not provide further details on the company’s plans, but spokesperson Aaron Ruby said Friday’s “announcement provided the vision and goals we need to advance toward net zero. In the coming months, we’ll continue gathering information, refining our goals and analyzing potential pathways to achieve them.”

Further details will be provided in Dominion’s 2022 Climate Report, Ruby said.

Recoverable Investments

Under the Virginia Clean Economy Act, Dominion is required to generate 100% of its power from carbon-free sources by 2045. According to its earnings presentation, the company projects that by 2035, 76% of its power will be carbon free.

Currently solar accounts for 2% of Dominion’s generation mix, with nuclear, hydropower and biomass adding another 31% of low- or no-carbon power, according to company figures.

Blue touted the company’s aggressive solar and wind investments and Virginia’s “common sense approach to energy policy and regulation” as the main drivers for grid decarbonization in the state. Under state law, the State Corporation Commission reviews Dominion’s base rates every three years, while ongoing capital investments for new construction and other generation are recovered through rate adjustment clauses, often referred to as riders.

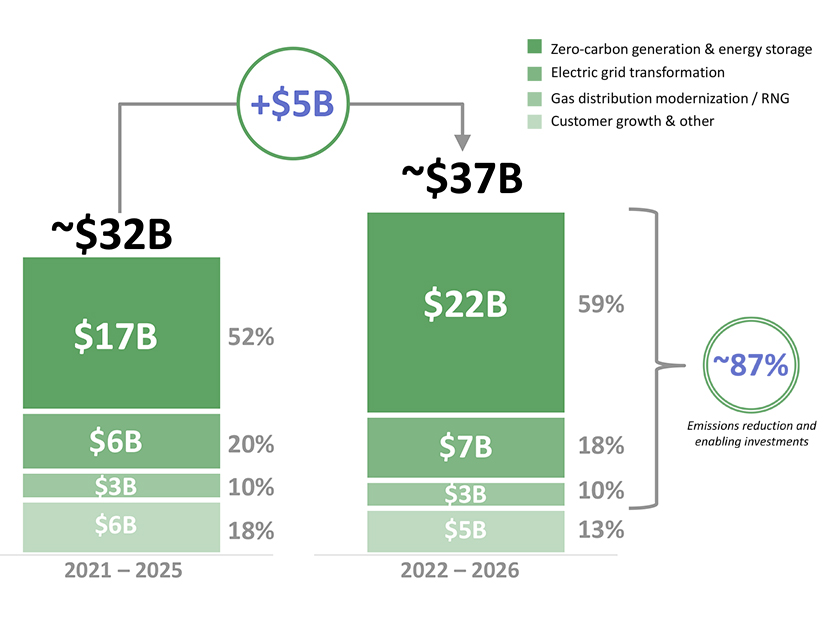

About 75% of Dominion’s $37 billion in planned investments over the next five years will be recoverable through riders, with an average 9% return on investment, according to company figures. The utility’s capital investments will increase to $73 billion by 2035.

By 2035, Dominion projects that 76% of its generation will be carbon-free, with a corresponding cut in emissions over 2005 levels of 70% to 80%. | Dominion Energy

By 2035, Dominion projects that 76% of its generation will be carbon-free, with a corresponding cut in emissions over 2005 levels of 70% to 80%. | Dominion Energy

For example, Blue reported that the utility had submitted its application for a rider for its 2.6-GW Coastal Virginia Offshore Wind project in November and expects a decision from the SCC by August. During Dominion’s third-quarter earnings call, Blue had said the cost for the project had increased from about $8 billion to close to $10 billion.

During Friday’s call, he said the project is on schedule to be completed by late 2026. In response to analysts’ questions about potential supply chain delays or price increases, he said the company had already contracted for materials with “experienced” suppliers.

Similarly, Dominion has about 400 MW of solar currently online and another 980 MW under contract. CFO James Chapman reported that all 2022 projects “remain on track.”

Dominion is also putting serious money into renewable natural gas (RNG), about $2 billion, COO Diane Leopold said. “We now have 10 projects under construction and one in service,” she said, with two that total coming online “in the coming days and weeks.”

Dominion is partnering with Smithfield Foods to produce RNG from hog farm waste and with Vanguard Renewables for RNG projects on dairy farms.

The company is also testing combining hydrogen with natural gas on its distribution system, with one pilot using 5% hydrogen successfully completed, three more under way and one in development, according to the earnings presentation.

Analysts also queried Blue on Dominion’s relationship with Virginia’s new governor, Glenn Youngkin (R), and the General Assembly, with a Republican majority in the House of Delegates.

Youngkin has been pushing to take Virginia out of the Regional Greenhouse Gas Initiative, but Blue said that energy has not been a major focus in the legislative session so far. (See Youngkin Takes 1st Steps Toward Va. RGGI Withdrawal.)

“The [2021] campaign was focused on education and taxes, and that’s what the General Assembly has been focused on,” he said, noting that the utility continues to work with both Democrats and Republicans.