Consolidated Edison’s (NYSE: ED) earnings rose 22.3% to $1.35 billion ($3.86/share) last year on higher electric, gas and steam revenues, the company reported last week.

The company earned $224 million ($0.63/share) in the fourth quarter, compared with $43 million ($0.13/share) in the same period a year earlier, after winding down a loss related to its investment in the Mountain Valley Pipeline.

“Once again in 2021, our employees continued to provide safe, reliable service to our customers throughout the unprecedented challenges of the pandemic, and our focus on delivering investor value remains strong,” CEO Timothy Cawley said in a statement. “Our expanded clean energy commitment reflects our dedication to lead the transition to renewables, gives our customers greater control over their energy use, and builds a more resilient grid.”

Con Edison said it aims to invest in, build and operate innovative energy infrastructure, advance electrification of heating and transportation, and transition away from fossil fuels to a net-zero economy by 2050.

The company last month released an investment plan targeting capital investments this year of about $4.6 billion, and $11 billion in aggregate capital investments over 2023-24.

Con Edison also last month submitted to the New York Public Service Commission a rate case for an 11.8% increase in electric rates and higher gas rates to become effective next January (22-E-0064).

The timing of the rate hike request proved awkward, as within two weeks many city customers were shocked to see sharp increases in their monthly Con Ed bills.

Gov. Kathy Hochul asked Con Edison to review its billing practices; she also announced increased relief efforts to reach low-income New Yorkers, making millions of dollars in aid available.

“Even though the spikes we are seeing in electricity, natural gas and fuel prices were predicted and are due to severe winter weather, I am calling on Con Ed to review their billing practices because we must take unified action to provide relief for New Yorkers, especially our most vulnerable residents,” Hochul said.

Con Edison also must resolve several regulatory concerns before being authorized to build a new $4 billion substation complex in New York City dedicated to interconnecting offshore wind projects. (See Con Ed to Refine $4B Offshore Tx Plan for NYC.)

In October, Con Edison subsidiary Orange and Rockland Utilities (O&R) entered a joint proposal for new electric and gas rate plans for the three-year period through 2024, subject to regulatory approval.

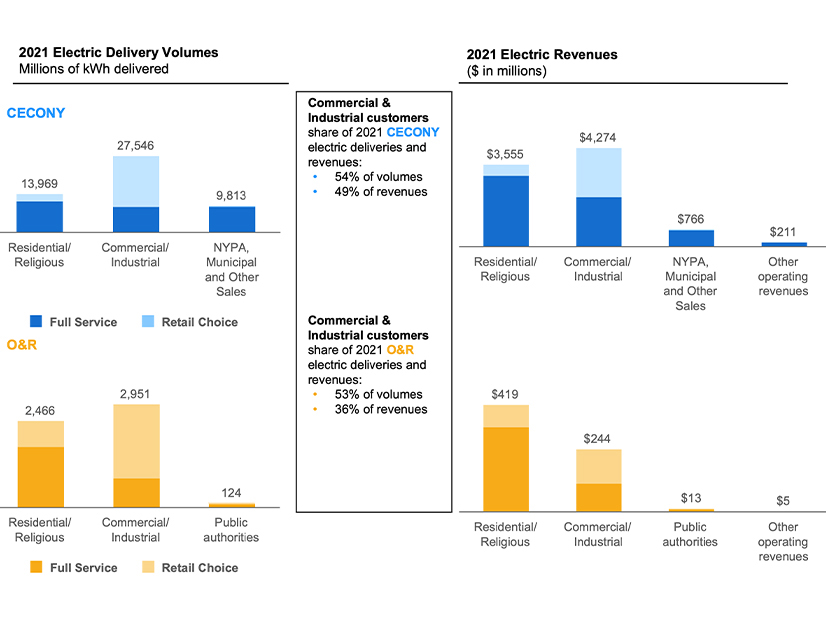

Con Edison is one of the country’s largest investor-owned utilities, with approximately $12 billion in annual revenues and $63 billion in assets. CECONY is its regulated utility providing electric, gas and steam service in New York City and Westchester County, New York, while O&R serves customers in a 1,300-square-mile-area in southeastern New York and northern New Jersey.