Six companies offered a record $4.37 billion for 5.6 GW of offshore wind capacity in the New York Bight Friday after three days of fierce bidding.

The bids for the six sites, in one case topping $1 billion, even exceeded previous federal auctions for offshore oil and gas leases, according to the Interior Department’s Bureau of Ocean Energy Management (BOEM). The average cost per acre for the auction — $8,837 — was more than eight times the $1,083/acre average in BOEM’s 2018 auction for three sites off the Massachusetts coast, which totaled $405 million.

Interior Secretary Deb Haaland hailed the auction results as evidence that “the enthusiasm for the clean energy economy is undeniable, and it’s here to stay.”

The auction sites in the Bight — a bend in the coast of New York and New Jersey — vary from 20-69 nautical miles from shore, with minimum depths of 31 to 50 meters and maximum depths of 46 to 63 meters.

Covering more than 460,000 developable acres, the six sites have the potential to generate more than 19 million megawatt-hours of electricity per year, enough to power close to 2 million homes, based on BOEM’s estimate of 3 MW/sq km. The 5.6 GW of capacity represents more than one-sixth of the 30 GW of offshore wind President Joe Biden wants online by 2030.

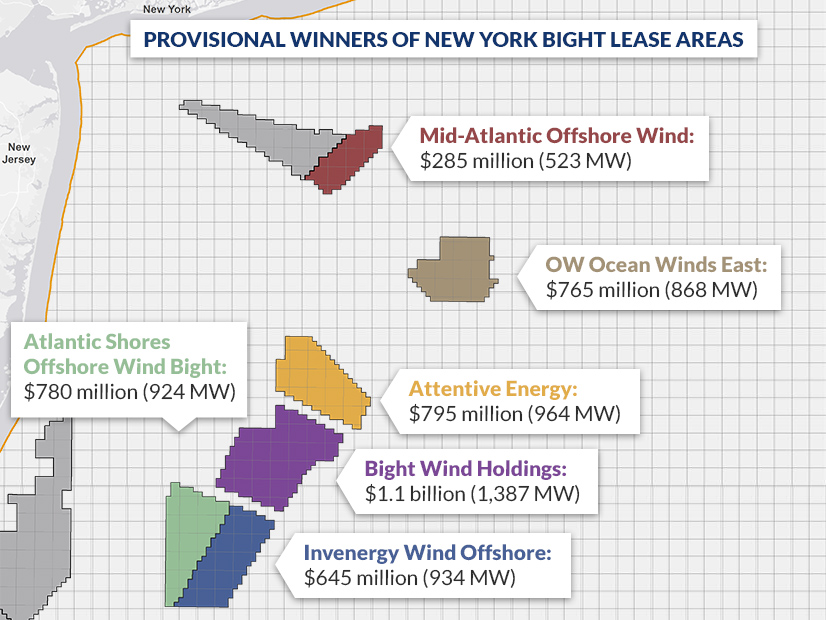

In descending order, the provisional winning bidders and bids are:

-

-

- Bight Wind Holdings | $1.1 billion | 1,387 MW

- Attentive Energy | $795 million | 964 MW

- Atlantic Shores Offshore Wind Bight | $780 million | 924 MW

- OW Ocean Winds East | $765 million | 868 MW

- Invenergy Wind Offshore | $645 million | 934 MW

- Mid-Atlantic Offshore Wind | $285 million | 523 MW

-

The online auction, which began Wednesday with 25 eligible bidders, was a rollercoaster ride for the nascent industry, with bids on some sites climbing precipitously in a matter of hours. Bidding on the largest site — labeled OCS-A 0539 — started at $12.6 million on Wednesday morning, hit $900 million on Thursday and broke $1 billion an hour after bidding opened on Friday morning. At different times during the auction, as many as six companies were vying for the lease, with bids jumping $15 million to $30 million between rounds.

According to BOEM, the next step in the leasing process for the provisional winners is an anti-competitiveness review of the auction, to be conducted by the Department of Justice and Federal Trade Commission. The companies will also be required to pay up on their winning bids and provide financial assurance to BOEM.

The New York Bight auction is the first of seven potential offshore wind auctions the DOI is planning over the next three years, according to a plan Haaland outlined in October. (See BOEM to Auction Six New Lease Areas in NY Bight.) The second auction, scheduled for later this year, will be for a single lease off the coast of North Carolina.

BOEM is also evaluating sites in Central and Northern California, the Gulf of Mexico, the Mid-Atlantic, Oregon and the Gulf of Maine. BOEM has identified three call areas off Oregon with a total capacity potential of 17 GW, according to a presentation the agency made at a Feb. 25 meeting of its Oregon Intergovernmental Renewable Energy Task Force. (See related story, Energy Bar Weighs OSW in Oregon, California.)

Investors Confident in OSW

Bidders and other clean energy stakeholders celebrated the results and the infrastructure, supply chain and jobs it will create.

Prior to the auction, the U.S. offshore wind market had drawn in $6.7 billion in leases and other investments, according to the Business Network for Offshore Wind, an industry trade group. A report from the Special Initiative on Offshore Wind, another industry group, estimates it will require $109 billion in investments to create the supply chain needed to reach Biden’s 30-GW goal.

Liz Burdock, CEO of the Business Network, said the auction reflected “the pent-up demand for new lease areas.”

“The New York Bight benefited from clear political support, an emerging yet robust local supply chain and a years-long preparation window, which should allow the winning bidders to quickly begin the permitting process and put steel in the water by the end of the decade,” she said.

New Jersey Gov. Phil Murphy has set a goal of developing 7,500 MW of offshore wind by 2035, and to date, the state’s Board of Public Utilities (BPU) has held two solicitations, awarding three projects totaling 3,758 MW. New York’s offshore wind goal is 9,000 MW by 2035. The state has five offshore projects in development, for a total of more than 4,300 MW.

In 2020, consulting firm Wood Mackenzie predicted lease auctions in 2020-2022 in the New York Bight, California, North Carolina and South Carolina could “support 28 GW of offshore wind development and generate $1.2 billion in U.S. Treasury revenue” — an estimate that turned out overly conservative.

Aaron Barr, one of the authors of the report, told Grist the high bids were “a clear signal that offshore wind developers and investors are convinced of the sound business case for offshore wind in the United States.”

Indeed, RWE Renewables, one of the companies behind Bight Wind Holdings, said winning the $1.1 billion lease for the largest site in the bight is “an important step on the road to tripling our offshore wind capacity to 8 GW by 2030.”

RWE Renewables, the U.S. subsidiary of German utility RWE, is partnering with National Grid on the project, reflecting the strong European interest in the U.S. market. OW East is a partnership between Global Infrastructure Partners, an infrastructure fund manager, and the offshore developer Ocean Winds, a joint venture between EDP Renewables, the U.S. subsidiary of Spain’s EDP Renovavéis, and ENGIE, the French multinational utility.

According to a report on offshoreWIND.biz, an industry trade publication, other winning bidders with strong European ties include Attentive Energy, a joint venture of EnBW (Germany) and TotalEnergies (France), and Mid-Atlantic Offshore, which is owned by a Danish firm, Copenhagen Infrastructure Partners. Shell and EDF Renewables are the companies behind Atlantic Shores Offshore Wind.

‘Too Much, Too Fast’

Strong business support notwithstanding, local environmental groups had mixed reactions to the auction results. Doug O’Malley, director of the Environment New Jersey Research and Policy Center, said the auction’s “eye-popping valuations send the market a clear signal that offshore wind is poised to become the key driver of clean, renewable energy on the East Coast.

“Once we tap offshore wind, we’ll be able to green our region’s electric grid and cut the cord with fossil fuels,” he said.

But Clean Ocean Action, a New Jersey-based coalition of fishing, recreation and other community groups, criticized the auction as “too much, too fast.”

“The fast tracking of offshore wind puts marine life and a clean ocean economy at risk,” the group said in a statement released on the first day of the auction.

“There are unanswered questions with this newly proposed industry, especially at the magnitude, scale, and speed of development currently proposed,” the group said. “The leasing of these half million acres is too premature given the current gaps in scientific literature concerning the impacts of offshore wind turbines and related infrastructure on marine species and their habitats.”

The Atlantic Coast fishing industry has also raised concerns that BOEM’s requirements may not ensure that winning companies will seek and act on input from local business, community and environmental groups. (See Fishing Industry Concerned About NY Bight OSW Plan.)

Local Economic Impact

New Jersey and New York have been investing heavily in offshore wind, with their own state-level auctions and investments in local infrastructure.

Both states are also providing financial incentives for offshore wind development and are planning port facilities, spurring an emerging supply chain of local businesses. For example, New Jersey has approved $350 million in tax credits linked to offshore wind-specific facilities in the state. New York has tied its awarding of offshore wind renewable energy credits (ORECs), in part, to economic benefits projects provide, including supply chain buildout, benefits to disadvantaged communities and workforce development programs.

The impact of offshore wind development in both states has already been significant. In its 2022 U.S. Offshore Wind Market Report, the Business Network for Offshore Wind analyzed its database of potential supply chain companies, finding that Massachusetts leads the East Coast with 387 firms listed, but New Jersey (361 companies) and New York (287 companies) are close behind. An analysis of the database also found that close to half of the companies listed are small businesses with fewer than 100 employees.

BOEM has similarly incorporated economic development into the leasing process for the New York Bight, requiring lessees to describe their plans for contributing to the development of a domestic supply chain. As outlined in the January final notice on the auction, lessees that “meaningfully and substantially” assemble or manufacture major components in the U.S. could qualify for a 50% reduction in the “fee rate” for five years, which would cut the fee rate from 2% to 1%.

The operating fee will be based on a proxy for the wholesale market value of the power generated from each project. The proxy will assume a 40% capacity factor for the first six full years of commercial operations, with potential adjustments based on actual generation in future years. BOEM will use the simple hourly average of the spot price for NYISO’s Zone J in New York City. At a wholesale power price of $40/MWh, the annual 2% fee for a 1,028-MW facility, would be $2.9 million.

Officials from the BOEM and the two states have created a supply chain working group that will meet quarterly to coordinate their efforts.

The Transmission Imperative

Capitalizing on OSW’s economic potential will require the states to develop efficient transmission to deliver power to customers.

In its final notice for the NY Bight Auction, BOEM urged strategic planning of transmission, noting that the agency is considering “the use of cable corridors, regional transmission systems, meshed systems, and other mechanisms.” It said it may condition approval of construction and operations plans “on the incorporation of such methods where appropriate.”

The National Renewable Energy Laboratory is partnering with the Pacific Northwest National Laboratory on an Atlantic offshore wind transmission study “to evaluate multiple pathways to offshore wind goals through coordinated transmission solutions.” A final report is expected late in 2023, according to the study webpage.

PJM last year opened the first transmission-only solicitation for the U.S. offshore wind industry at the request of the New Jersey BPU. PJM is currently reviewing the 80 proposals received. Under PJM’s state agreement approach, New Jersey would commit to paying 100% of the cost of the transmission but could seek to allocate some costs to other generation projects that use the additional capacity. (See PJM, NJ Seek FERC OK for OSW Tx Process.)

The Business Network anticipates even broader collaboration, not just between states, but between ISOs and RTOs in “concentric circles of transmission coordination,” especially as offshore wind is developed on the West and Gulf coasts.

“The offshore wind transmission conversation is steadily expanding outwards in terms of complexity, geographic area covered and level of coordination needed by planning frameworks,” the network’s 2022 market report said. “All U.S. regions seeking to integrate offshore wind into their grids face a similar challenge — the electricity transmission system tends to be less robust in coastal areas.”