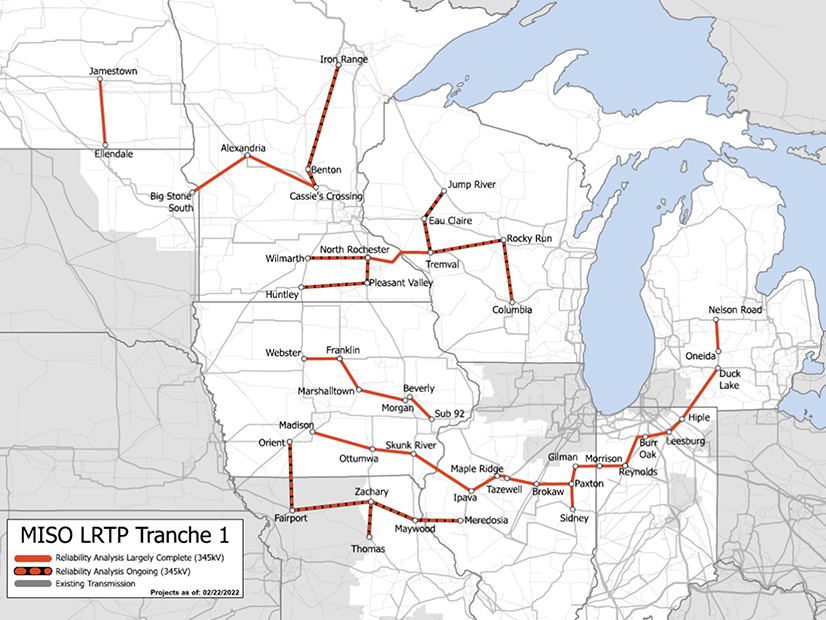

MISO will complete a draft portfolio of billions of dollars’ worth of long-range transmission projects by the end of March, although two recommended projects bump up against its interregional planning effort with SPP to clear backlogs in their respective generator interconnection queues.

“We’re shoring up business cases to proceed,” Jarred Miland, senior manager of transmission planning coordination told stakeholders during a special workshop Friday on the long-range plan’s Midwestern portion.

MISO will add a two-day workshop in late March to focus on the 345-kV projects’ technical analysis and business cases. The Planning Advisory Committee will conduct an advisory vote on the package during its mid-April meeting. (See MISO Promises Long-range Tx Project Reveal Soon.)

Stakeholders expressed discomfort during the workshop with the project’s overlap of routes being pursued in MISO’s and SPP’s Joint Targeted Interconnection Queue (JTIQ) study. They pointed out that the long-range plan’s recommended lines in the Dakotas and Minnesota echo two JTIQ solutions. (See MISO, SPP Roll out $1.755B Joint Tx Portfolio.)

The proposed projects, Ellendale to Jamestown in southern North Dakota and a line from Big Stone South, S.D., to Cassie’s Crossing, Minn., will solve thermal overloading issues and ease congestion on the existing system. MISO planners said solving those reliability issues has been on their radar for some time.

Miland said staff will recommend the two joint projects under the RTO’s regional planning process. He said the projects might be in the distant future because the grid operators don’t have a cost-allocation process in place.

“With the JTIQ, cost allocations are still in discussion, and it probably has a much, much longer time ahead of it,” Miland said.

Aubrey Johnson, executive director of system planning, said MISO stands to benefit more than SPP from the two projects. He also said the long-range transmission plan takes precedence over the JTIQ effort in MISO’s hierarchy of transmission planning.

“It is appropriate for the MISO customers to carry these costs,” Johnson said.

The RTO’s director of resource utilization, Andy Witmeier, said the JTIQ cost-allocation talks are in their “infancy.” He said it would be “imprudent” to sit on beneficial projects while lengthy joint cost-sharing negotiations take place.

“It’s a little unfortunate that not all the beneficiaries will be paying for these projects,” Wolverine Power Supply Cooperative’s Tom King said, referring to SPP members.

When asked, Johnson said MISO has not yet projected in-service dates for either the long-range plan or JTIQ projects.

However, staff said they intend to have the long-range projects in service as quickly as permitting and construction allow. Witmeier said the RTO envisions in-service dates within seven or eight years because of the immediate need for new transmission.

“Essentially, all of these projects have as-soon-as-possible in-service dates,” he said.

Billions in Costs, More Billions in Benefits

MISO said preliminary analysis of its first cycle of long-range projects “indicates total economic benefits significantly exceed cost.” However, staff hasn’t yet attached specific costs to individual projects or the portfolio. Johnson said a $12-$16 billion cost range contained in a MISO presentation was an “illustrative example” that “represented real numbers.” Staff said they have more work ahead analyzing project alternatives before they can narrow costs.

Should FERC approve MISO’s filed cost allocation for long-range projects, the cost splits will be based on postage stamp rates limited to either the RTO’s Midwest or South regions.

The grid operator’s analyses show that the first Midwestern projects can facilitate 20 GW in capacity additions and could save MISO Midwest $16.6 billion in congestion and fuel costs over the transmission projects’ first 20 years.

Decarbonization benefits could range from $2.25 billion to almost $11.5 billion over a 40-year project lifespan, MISO said. It also said it could achieve $1 billion in savings because the first long-range projects would increase transfer capabilities between local resource zones, thereby lowering capacity-clearing requirements.

MISO said the projects might also prevent a few billion dollars’ worth of load shed over 40 years, and significantly more if it raises its value of lost load beyond the current $3,500/MWh. Many stakeholders say that figure is an underestimate.

The RTO also said it continues to see value in including a massive 345-kV project corridor that would span Iowa, Illinois, Indiana and Michigan and not branch out into smaller city-to-city segments.

The grid operator said it could avoid about $760 million in additional transmission work by using a portfolio package instead of chasing standalone, incremental fixes.

“Past experiences with transmission studies like the multi-value projects indicate that a regional approach will be more cost effective than a purely local buildout,” staff said.

The Midwestern long-term projects come as MISO state regulators face federal pressure to focus on new energy infrastructure.

The U.S. Department of Energy’s Pat Hoffman appeared during a Feb. 14 Organization of MISO States (OMS) meeting to request that regulators concentrate on infrastructure buildout. Hoffman asked the audience to speak with “one voice” on how grid investment should look.

“It’s going to take off, and I’m worried the system is not prepared on what’s to come,” Hoffman said of the MISO footprint. She said the industry is poised to shift rapidly due to fossil fuel plant retirements, integrating renewable energy, and extreme weather changes.

“You do a good job of walking that fine line between optimism and terror,” OMS President Sarah Freeman said after Hoffman’s presentation.