Joined by lawmakers and other state energy officials, the California Public Utilities Commission met Monday and Tuesday to deal with the looming crisis for ratepayers saddled with billions of dollars annually for fuel costs, wildfire prevention and the state’s switch to 100% clean energy.

The two-day session on electric and natural gas rates examined ways to control costs and to pay for major projects using public revenues rather than ratepayer funds. Panelists included wildfire experts, utility executives and ratepayer advocates.

“TURN is here today to declare a state of emergency, an affordability state of emergency,” Mark Toney, executive director of The Utility Reform Network (TURN), said during a panel on non-ratepayer sources of funding for infrastructure upgrades.

Toney called for a timeout on rate increases until the CPUC can come up with alternatives to pay for soaring capital costs for the state’s three large investor-owned utilities.

PG&E electric ratepayers, for example, were hit with a $1 billion rate increase in January followed by a $1.1 billion increase on Tuesday. Together, the increases work out to a 19% rate hike in the past two months or about $28 per month for average households.

The January spike resulted from a $671 million increase in FERC-approved transmission rates and a $284 million increase in PG&E’s general rate case for program costs, the CPUC said.

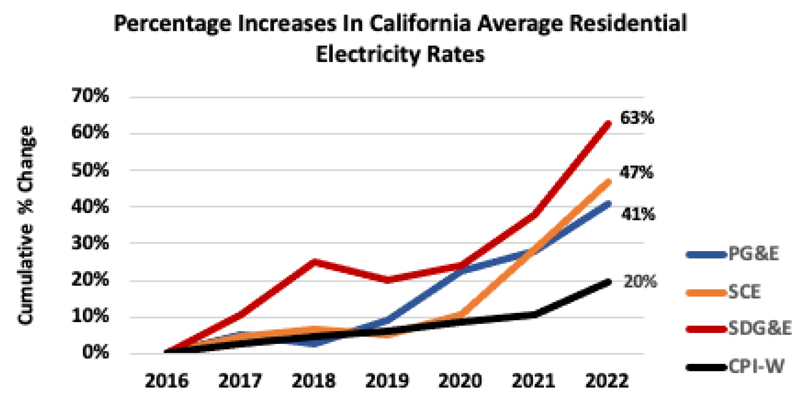

Investor-owned utility rates have soared in recent years. | The Utility Reform Network (TURN

Investor-owned utility rates have soared in recent years. | The Utility Reform Network (TURNThe additional increase this month came from natural gas prices that were $1.1 billion higher than PG&E had expected in 2021 and 2022. To cover the fuel costs, the CPUC approved a $769 million increase to PG&E’s Energy Resource Recovery Account (ERRA) and a $358 million addition for ERRA under-collection in 2021.

Southern California Edison and San Diego Gas & Electric have also seen significant rate increases

For SCE, the CPUC approved a January rate increase of 2.9%, working out to an average monthly bump of $3.99 in residential bills. The causes included the addition of $385 million to SCE’s general rate case for wildfire mitigation work, including vegetation management and installing covered conductor. Newer CPUC-approved increases for SCE, which take effect this month, reflect high natural gas prices and the recovery of $401 million in wildfire prevention costs.

Starting soon, SCE residential customers can expect an additional 7.7% bill increase, adding $11.48 a month on average. Between the January and March rate hikes, SCE residential customers will be paying nearly 11% more for electricity this year, or about an extra $12.50 per month.

San Diego Gas & Electric residential bills rose by 11.4% in January because of a $273.5 million boost to the utility’s revenue requirement, mostly based on high gas prices, and $38.5 million for transmission costs authorized by FERC, the CPUC said.

Billions of dollars more could be required to pay for infrastructure upgrades such as PG&E’s proposal to underground 10,000 miles of power lines to prevent wildfire ignitions. CAISO predicts new transmission may be needed to reach wind resources on the Great Plains and in offshore wind farms along the West Coast. Thousands of additional megawatts of solar, storage and other clean energy resources are required in coming years to achieve the state’s goal of supplying retail customers with 100% carbon-free energy by 2045, according to the CPUC and Energy Commission.

“We’re dealing with multiple imperatives right now: the imperative to decarbonize and stave off the worst impacts of climate change, the imperative to deal with some of the climate consequences that are already upon us, and the imperative to deal with rising costs,” Energy Commission Chair David Hochschild said. “We have to deal with all of those together. There’s not one we can leave off the list. This is the challenge ahead of us.”

Non-Ratepayer Funding

Among the major proposals discussed at the meeting were ways to use California’s large revenue surpluses to cover costs without adding to ratepayer bills or to pay for transportation and building electrification using fees for buying cars and homes.

“This discussion comes at an opportune time when the state general fund is experiencing large surpluses in the tens of billions of dollars,” CPUC Government Affairs Director Grant Mack said.

California has an estimated revenue surplus of $76 billion in the current fiscal year and $46 billion next fiscal year. The state received $25 billion this year through the American Rescue Plan Act of 2021, and the $1.2 trillion Infrastructure Investment and Jobs Act, signed by President Biden in November, appropriated $58 billion for clean-energy investment and energy efficiency, Mack said.

The flood of public funding could limit increases in electric rates, panelists said, though they cautioned that the surpluses may not last, based on California’s prior record of boom-and-bust fiscal years.

“I guarantee you we will not have a state budget surplus year in and year out,” Toney said.

Instead of relying on surpluses, he proposed paying for electric vehicle infrastructure and incentives with point-of-sale fees at dealerships instead of ratepayer fees. He also proposed funding building electrification in a similar way. Instead of spending hundreds of millions of dollars in ratepayer fees to electrify “10,000 homes here and there,” he recommended charging homebuyers a closing fee to pay for electric space and water heating upgrades.

In the realm of wildfire prevention, Michael Wara, director of the Climate and Energy Policy Program at Stanford University, said the state needs to better assess its spending to achieve the greatest impact.

For instance, he said, utilities are spending billions of dollars in ratepayer money to harden the grid and prevent wildfire ignition. Preventing ignitions is important but so is limiting the rapid spread of fires, he said.

Wara cited the 2018 Camp Fire, which spread so rapidly that it leveled the town of Paradise in hours, and last year’s Dixie Fire, which advanced so quickly at times that it eventually burned nearly 1 million acres.

“Wildfire risk also comes from how wildfires spread,” Wara said.

“It’s very expensive to reduce utility ignitions to zero” by installing covered conductor and burying lines “and we can only do that so quickly,” he said. “But if we get to a place where we can tolerate ignition safely [by reducing spread, for example] it might mean that we don’t have to make some of these incredibly costly, long-run infrastructure investments, because we’re managing the landscape in a way that creates safety.”

Last year, state investor-owned utilities proposed spending $8.5 billion in ratepayer funds on wildfire mitigation, he said. At the same time, the state plans to spend $1.5 billion in taxpayer revenues on fuel management and community protection and more than $4 billion on fire suppression.

To offset those costs, California could consider charging additional fees to ratepayers in high-threat fire areas because providing service there is more expensive, Wara said. While those residents could not feasibly cover their full cost of service, they could pay additional fees to cover fire prevention and suppression costs, he said.

A state fee that expired in 2017 charged many rural residents around $100 a year to help cover wildfire costs, so the precedent exists, he said. The purpose of such a fee is to protect ratepayers outside of fire zones, “particularly low-income people who do not live in high-risk areas,” Wara said.