PJM energy prices last year surged to their highest levels since 2014, more than making up for declines from the pandemic-driven economic downturn in 2020, according to the Independent Market Monitor’s annual State of the Market report, released Thursday.

The RTO’s average load-weighted real-time LMP ricocheted to $39.78/MWh, up 82.8% from 2020’s record low of $21.77. While the increase was perhaps to be expected, real-time load only increased by 3.6%, returning to pre-pandemic levels after falling by 4% in 2020.

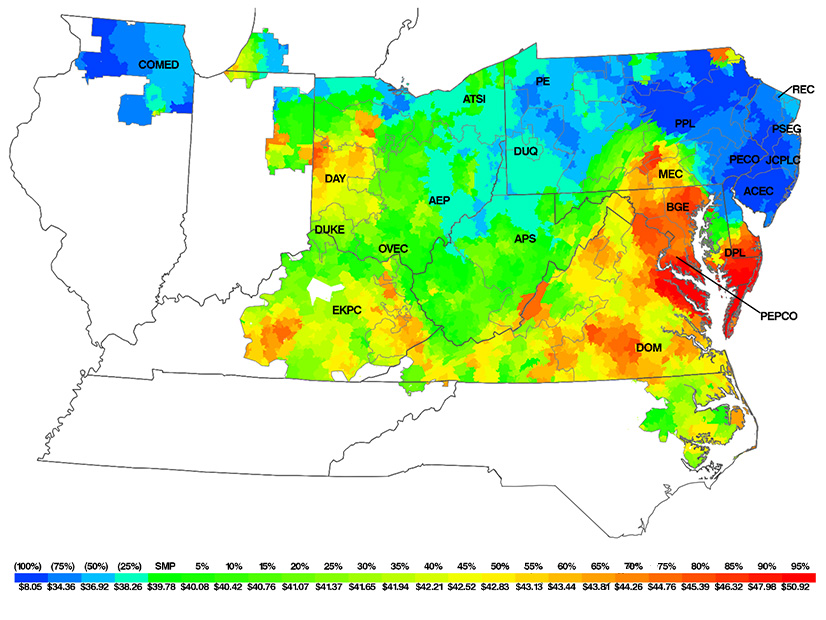

Average short-run marginal costs in PJM since January 2014 | Monitoring Analytics

Average short-run marginal costs in PJM since January 2014 | Monitoring AnalyticsThe increase in energy prices was mostly a direct result of increased fuel costs for generators, including higher natural gas prices. In a press conference Thursday presenting the report, Monitor Joe Bowring said that among the factors driving the increase in gas prices was reduced production in 2020 and severe weather events, including the February 2021 winter storm.

The Monitor did not measure the impacts of the storm on PJM separately, but Bowring said “it definitely had an effect, especially in the Midwest.” It also raised a concern that the Monitor has about the gas market.

“There’s no logical reason to have gas prices be $2,000/dekatherm, or even $1,000/dekatherm,” he said. “So we’re very concerned about market power on the gas side … during extreme conditions. That’s outside our purview, but it’s at least partly within FERC’s purview, so we think that needs to be looked at.”

In its report, the Monitor wrote, “The role of gas-fired generation highlights the importance of ensuring that PJM has real-time, detailed and complete information on the gas supply arrangements of all generators and that PJM consider rules requiring capacity resources to have firm fuel supplies. It is also essential that FERC consider and address the implications of the inconsistencies between the gas pipeline business model and the power producer business model and the issue of market power in the gas commodity market under extreme weather conditions.”

Return of the King

While gas remained the dominant fuel source in PJM, coal-fired generation shot up last year.

Electricity generation from coal rose 17.8%, compared to a 2.4% decrease in gas-fired output. Coal also made up 22.2% of the fuel mix in 2021, compared to 19.3% in 2020. Oil-fired generation rose 11.5%.

Coal prices likely increased on the back of rising gas prices. But as coal mines continue to shutter unabated, supply continues to thin. “The changes in relative fuel prices slowed but did not change the long-term decline in the share of coal and the increase in the share of gas,” the Monitor wrote.

The Monitor’s report came after the International Energy Agency reported Tuesday that energy-related global CO2 emissions increased by 6% in 2021, mostly from the use of coal-fired generation.

“The recovery of energy demand in 2021 was compounded by adverse weather and energy market conditions — notably the spikes in natural gas prices — which led to more coal being burned despite renewable power generation registering its largest ever growth,” the IEA said.

While solar nearly doubled its output last year, increasing by 91.6% to 7,412.2 GWh, it still only makes up less than 1% of the fuel mix in the RTO. Renewable output — including solar, wind, waste, hydro and biofuel — only rose by about 10.2% and just barely increased its share of the fuel mix, mostly because of the increase in solar.

REC Market

The Monitor included 13 new recommendations for PJM in its report, but Bowring singled out an old one, dating back to 2010, in his presentation: a single PJM-operated forward market for renewable energy credits.

The recommendation has perhaps taken on more urgency as some states aggressively increase their renewable portfolio standards each year up to 2030.

“Given that states are going to continue to subsidize renewable energy through RPS standards and through RECs, the markets would work better for everybody” with a single market for RECs, Bowring said, with an agreed-upon definition for what qualifies for credits and a single clearing price. “Of course, all of that would be dependent on the states wanting to do it and agreeing to do it. But we think that would be a way to make the provisions of those subsidies … significantly more efficient.”

The Monitor still recommends a single, PJM-wide carbon price as the most efficient way to reduce emissions, but a single REC market would be the next best thing, it wrote. Such a market “would provide better information for market participants about supply and demand and prices, and contribute to a more efficient and competitive market and to better price formation. This could also facilitate entry by qualifying renewable resources by reducing the risks associated with lack of transparent market data.”