Supply chain delays and rising prices could cut U.S. solar market growth this year by almost 20% below prior projections, but demand remains strong and the petroleum price shocks caused by Russia’s invasion of Ukraine could help drive an industry recovery in 2023, said Michelle Davis, a principal analyst at Wood Mackenzie.

While the impacts of the war may not be felt immediately in domestic solar markets, Davis said, “increases in [natural] gas prices are only going to make solar more economic … even with solar price increases of the last year.”

“The big challenge for the solar industry right now is resolving those supply chain constraints and trying to tackle various policy and trade issues,” said Davis, lead author of the Solar Market Insight 2021 Year in Review report released Thursday by Wood Mackenzie and the Solar Energy Industries Association (SEIA).

“There is more demand than current supply, which is why we expect long-term for the prospects for the market to be very strong and for recovery to begin, starting next year,” she said in an interview with NetZero Insider.

Similarly, SEIA CEO Abigail Ross Hopper stressed the key role solar can play in U.S. energy security. “In the face of global supply uncertainty, we must ramp up clean energy production and eliminate our reliance on hostile nations for our energy needs … and our nation will be safer because of it,” Hopper said.

With Democrats and Republicans in Congress calling for a major increase in U.S. fossil fuel production, Hopper said, “America’s energy independence relies on our ability to deploy solar, and the opportunity before us has never been more obvious or urgent.”

The report shows that the U.S. added a record 23.6 GWdc of solar in 2021 ― a 19% increase over 2020 ― even as prices for utility-scale fixed tilt projects rose 18%. For the third year in a row, solar added the highest proportion of new power generation on the U.S. grid ― 46% ― with panels added to more than 500,000 residential roofs, another all-time high, the report says.

Utility-scale solar was the primary driver for market growth, with 17 GWdc installed in 2021, but an uncertain pipeline lies ahead, the report says.

“About one-third of the capacity slated to come online during Q4 2021 was delayed by at least a quarter. For the 2022 pipeline, developers have postponed at least 8% and canceled at least 5% of planned capacity,” the report says

Even so, Davis sees the sector as strong. “There are a lot of utilities across the country who are increasingly including way more procurements and mandates for solar in their own utility-specific targets,” she said. For example, she pointed to the Tennessee Valley Authority’s 227-MW Muscle Shoals project in Alabama, which helped catapult the state from 51st to 18th place in the report’s state rankings for new solar installed last year.

Utility-scale projects also put Texas at the top of the state rankings for the first time, with more than 6 GW of new projects, pushing California’s 3.6 GW to the No. 2 spot.

Triple-B and the NEM Effect

The market impacts of federal and state policy surface as another key theme in the report. With no change in current federal policies, Wood Mackenzie is projecting the U.S. solar market will expand from its current 120 GWdc to 464 GWdc by 2032. But with the 10-year extension of the federal investment tax credit in the stalled Build Back Better Act, the report says the 10-year outlook for solar could grow an additional 66% to nearly 700 GW.

Even at that level, the nation would fall short of the deployments needed to meet President Biden’s goal of a 100% clean energy grid by 2035, Davis said.

“We still see growth in the solar industry, even if the various clean energy incentives that are included in the triple-B Act don’t get passed,” Davis said, referring to Build Back Better. “If we care about hitting some of those decarbonization goals, you really need a catalyst like the clean energy incentives in the triple-B Act, to even hope to get partially there.”

SEIA is also pushing hard for the act’s tax credits for advanced manufacturing to accelerate the buildout of a domestic solar supply chain that would wean the U.S. industry off its dependence on China.

“If we want to have a greater level of energy security in this country, if we are going to build a U.S. solar manufacturing supply chain that is robust, that will be here 20 years from now, we as a nation need to make a stronger commitment to it,” Dan Whitten, SEIA’s vice president of public affairs, said at a March 3 industry event.

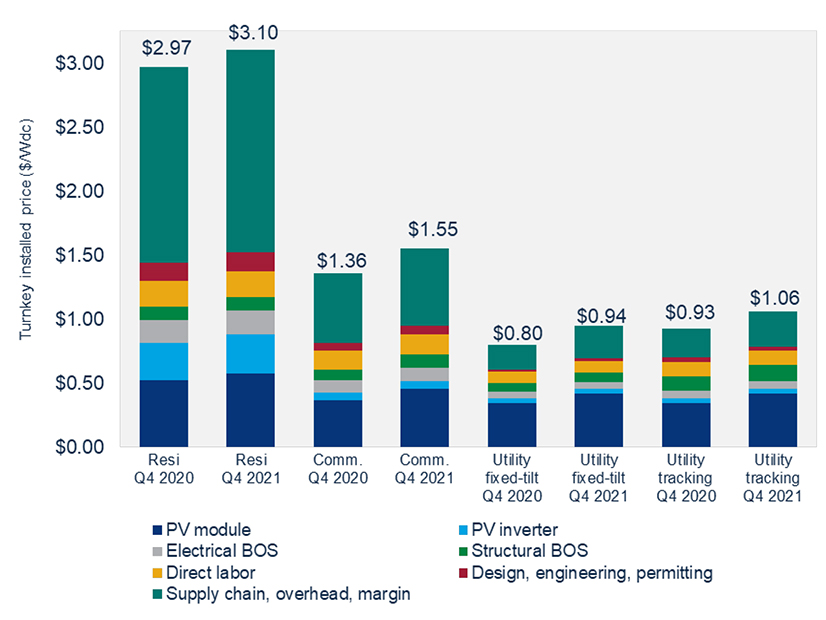

Panel prices and supply chain issues lie at the heart of the cost increases being seen across all sectors of the U.S. solar industry, from residential and commercial to utility-scale. For example, the report shows installed system costs in the commercial sector rising from $1.36/w at the end of 2020 to $1.55/w at the end of 2021 – with panels and supply chain accounting for about 75% of the increase.

In this context, supply chain is an umbrella term covering shipping and freight costs and “a lot of things that are not necessarily broken out in all the other categories,” Davis said. “Every developer is going to differ a little bit in how they’re passing along costs. Some of them are going to absorb some of those cost increases … some of them are going to pass along those costs to customers.”

On the state policy side, all eyes are on California as the state’s Public Utility Commission wrestles with the third version of its net metering regulations (NEM 3.0). The proposed revisions to the state’s current net metering plan would slash the compensation rates solar owners receive for the power they put back on the grid, from present rates of 20 cents to 30 cents/kWh to around 5 cents/kWh, according to Wood Mackenzie. Solar owners would also have to pay a “grid participation fee” of up to $40 per month. (See California PUC Proposes New Net Metering Plan.)

Alice Reynolds, the commission’s new president, has put the revisions on hold, pending further review, but Wood Mackenzie estimates that if enacted, NEM 3.0 could cut California’s residential and commercial solar markets in half. “And since California remains the largest distributed solar market in the U.S., these reductions result in nationwide market contraction for both segments starting in 2023,” the report says.

Hybrid Storage

One key development not discussed in the report is the growing number of projects that combine solar with battery storage. The 2022 Sustainable Energy in America Factbook by the Business Council for Sustainable Energy and BloombergNEF noted the trend, especially for the utility-scale sector. (See BNEF: 2021 a ‘Blockbuster Year’ for Clean Energy Investment.)

Acknowledging the omission, Davis agreed, “Utility-scale, in-front-of-the-meter solar installations are overwhelmingly attached with storage today.”

Speaking at a launch event for the Factbook on March 4, Jack Thirolf, head of public policy and institutional affairs for renewable developer Enel North America, said building a solar project without a battery “is going to be an oddity going forward.”

Enel is planning “a ton of projects,” Thirolf said. “And the use case absolutely appears to focus on not just on the energy but carbon reduction as part of energy.”

“It also gives us so much more resilience. Thinking about changes in electricity markets, pricing and structures and fundamentals today are not going to be what they are in 15 years,” he said. “We need to be able to build in flexibility to be able to adapt; we’re building our projects so we can add more storage and different kinds of storage.”