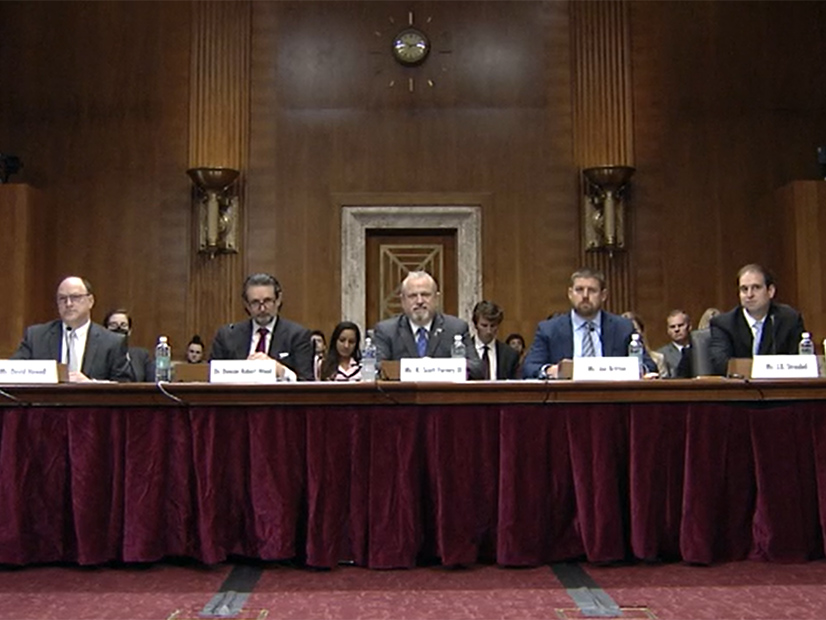

The witnesses before the Senate Energy and Natural Resources Committee on Thursday were unanimous.

The ability of the U.S. to meet President Biden’s clean energy goals will depend on how quickly the country can stand up a domestic supply chain for the critical minerals — such as lithium, cobalt and nickel — that are essential to the manufacture of a range of clean technologies.

But while the need for a domestic supply chain “is now firmly embedded in the mindset of policymakers … the urgency of the situation is still not understood by many,” Duncan Wood, vice president for strategy and new initiatives at the Woodrow Wilson International Center for Scholars, told the committee. “Policymakers must embrace the painful truth that the highly worthy targets set for the energy transition can only be met by a combination of public policy incentives and massive investment now by the private sector, here in the United States and abroad, in new mining activities.

“What is needed today is a whole-of-society approach that incorporates all levels of government, private sector, research and educational institutions, and end users of critical minerals,” Wood said. “This means adopting a holistic, open-minded approach to the issue, embracing the development of new resources, new forms of extraction and processing, new technologies, energy efficiency models, and recycling and waste reduction. Ignoring any one of these elements makes it impossible to build a new energy model and maintain it.”

Unlike Biden’s clean energy targets ― a 100% clean grid by 2035 and a net-zero economy by 2050 ― the critical mineral supply chain is an issue on which the often adversarial Democrat and Republican members of the committee appeared to find common ground Thursday. The demand for these minerals and other rare-earth elements is massive, and the U.S. is largely dependent on China for much of its clean energy supply chain, both Committee Chair Joe Manchin (D-W.Va.) and Ranking Member John Barrasso (R-Wyo.) stressed in their opening statements.

Barrasso pointed to reports from the International Energy Agency and the World Bank predicting exponential increases in critical mineral demand. For example, he said, the IEA report estimates the demand for lithium could grow more than 4,000% by 2040.

Manchin expressed “grave concerns about moving too quickly towards an [electric vehicle]-only future when it comes to the EV battery supply chain. China is responsible for 80% of the world’s battery-material processing, 60% of the world’s cathode production, 80% of the world’s anode production and 75% of the world’s lithium-ion battery cell production,” he said, citing figures from Securing America’s Future Energy. “With numbers like these, it is frustrating to hear calls for a swifter transition to electrify transportation to reduce our dependence on foreign oil. We cannot replace one unreliable foreign supply chain with another and think it’s going to solve our problems.”

Developing clean hydrogen as an alternative fuel should also be pursued, he said.

‘Heading Toward a Cliff Edge’

Joe Britton, executive director of the Zero Emission Transportation Association (ZETA), a trade group representing companies across the EV supply chain, acknowledged the complexity of the challenge, “but turning away in the face of these obstacles only means conceding to foreign commercial interests.”

“American companies are working hard to onshore their supply chains, but they need federal support through predictable permitting, battery, vehicle and charging tax incentives and a whole-of-government approach to drive transportation electrification,” Britton said.

He noted that a number of ZETA members are developing lithium and cobalt production facilities in the U.S., such as Lithium Americas’ Thacker Pass strip mining project in Nevada and Jervois’ Idaho cobalt project.

At the other end of the supply chain, J.B. Straubel, founder and CEO of Redwood Materials, said his company is developing recycling processes that will create “a fully closed-loop domestic supply chain for lithium-ion batteries.” At present, the company is receiving and recycling enough end-of-life batteries to manufacture 60,000 EVs, he said.

Straubel, who was formerly chief technology officer at Tesla, estimated that building out a complete domestic supply chain for EVs could take five to 10 years, while David Howell, acting director of the Department of Energy’s Office of Manufacturing and Energy Supply Chains, projected a 2040-2050 time frame.

Wood argued that any estimate would be unrealistic. “We’re heading toward a cliff edge,” he said. “When you look at just the amount of materials that are going to be needed to reach 50% of the vehicle fleet being electric in the next decade or so, there just aren’t enough being produced globally.”

Part of the challenge, he said, is that “whereas traditional hydrocarbon-based energy generation systems are fuel-intensive, renewable energy systems are material- and, specifically, mineral-intensive. To give one example, an onshore wind block requires nine times more mineral resources than a gas-fired power plant.”

Sen. Catherine Cortez Masto (D-Nev.) countered that the clean energy transition is America’s current “moonshot.”

“It’s important for the administration to stake a goal for all of us to marshal our resources,” she said. “Whether we achieve that goal can always be in question, but at least we are moving in the same direction. … Now we can sit here and armchair quarterback everything about it, but without an administration and a focus, we will never get there.”

Straubel also chimed in, noting that the comparison of petroleum and lithium is skewed because unlike the fossil fuels used to power a generator or a car, lithium-ion batteries are not consumed. “We refine it; we put it into inventory in the fleet; and it’s there for many decades,” he said. “It’s essentially infinitely reusable. … We can refine it back to new quality every single time.”

A National Battery Reserve

Thursday’s hearing was the second of two the committee has held on critical mineral supply chains and the urgent need for federal action to develop domestic sources in the wake of delays and price increases triggered by the combined impacts of the COVID-19 pandemic and the war in Ukraine. Beyond oil and gas, Russia is a major supplier of nickel.

Both Democrats and Republicans on the committee had previously called for President Biden to invoke the Defense Production Act (DPA), which he did March 31, even as the committee held its first critical mineral hearing.

Originally passed in 1950 as part of a federal effort to ramp up production of key materials needed for the Korean War, the DPA was most previously invoked by Biden to increase manufacturing of medical supplies during the pandemic. To increase production of critical minerals, Biden called on Defense Secretary Lloyd Austin to “create, maintain, protect, expand or restore sustainable and responsible domestic production capabilities of such strategic and critical materials.” (See Biden Invokes the Defense Production Act for Critical Minerals.)

Howell pointed to a recent memorandum of agreement between DOE and the departments of State and Defense to create “a critical mineral stockpile process to support the U.S. transition to clean energy and national security needs.” The three departments will partner on acquiring and recycling “selected materials for technologies that range from grid-scale batteries to wind turbines,” he said.

But building critical mineral supply chains and reserves often depends on demand, Britton said. The U.S. did not previously develop critical mineral processing “because there wasn’t a critical mass of battery cell production,” he said. “So, there’s a through-line where we are creating these products here; we’re building these battery cells and building these vehicles. It then has follow-on impacts where we’re justifying additional investment and processing.

“Every vehicle that we bring to America or that we make here and manufacture, it becomes part of a national battery reserve,” he said.

Wood also stressed the need for both urgent action and a long-term strategy. Biden’s invoking of the DPA was only a first step, he said. Building a critical mineral supply chain “is not something that we’re going to resolve with a one-and-done solution. … It’s not an either/or; it’s an all-of-the-above. The fact is we need recycling; we need new resources; we need tax credits. We need massive investment in human capital.

“The danger here is that if we take our eyes off the prize because we’ve done something, then we miss ultimately achieving that goal,” he said.