NYISO made it through last winter without any problems — and without any power from coal generation or the Indian Point nuclear plant, ISO officials reported to stakeholders last week.

But the ISO is focusing intensely on coordinating with natural gas system operators for next winter as prices remain high while the Russo-Ukrainian War rages on.

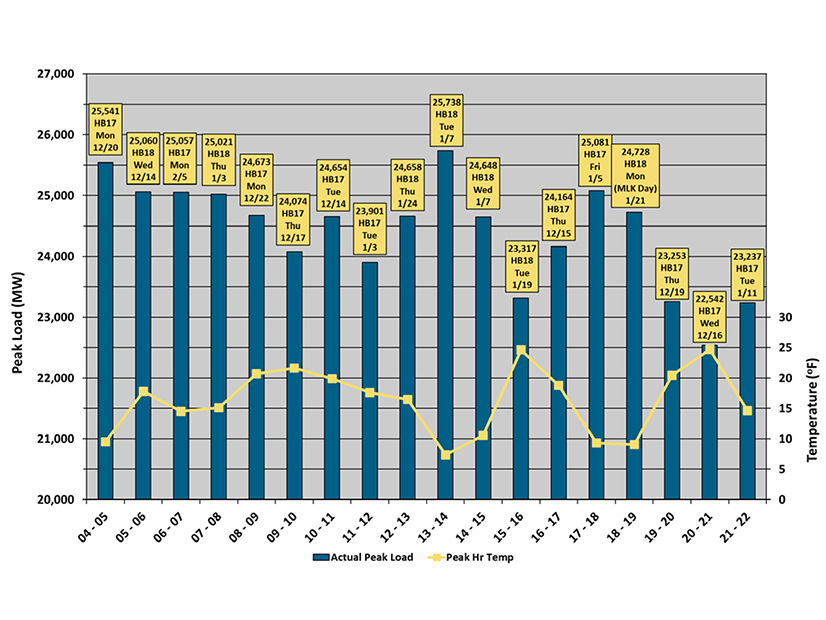

New York experienced several cold snaps in January — before the Russian invasion began and prices spiked — including one late in the month that included heavy snow. NYISO forecast a peak load of 24,025 MW for the season; the actual peak came in at 23,237 MW on Jan. 11, a mostly sunny day but extremely cold, with the high temperature upstate not breaking 20 degrees Fahrenheit.

NYISO fuel prices cratered during the onset of the COVID-19 pandemic, and they have skyrocketed since Russia’s invasion of Ukraine. | NYISO

NYISO fuel prices cratered during the onset of the COVID-19 pandemic, and they have skyrocketed since Russia’s invasion of Ukraine. | NYISO

Wes Yeomans | NYISO

Wes Yeomans | NYISO

During a presentation to the NYISO Management Committee on Wednesday, Wes Yeomans, the ISO’s vice president of operations, said if that cold weather had come earlier in the month “when there was more load from lighting, I absolutely believe we would have hit” the forecasted peak. Jan. 11 was not the coldest day, but there was still significant lighting load that day, he said.

January’s average temperatures were 3 to 4 degrees lower than normal. The lowest temperature recorded during the season was -9 F on Jan. 22 and 30 F in Syracuse.

Despite the sometimes extreme cold, the grid performed well. NYISO did not have to use any emergency procedures or call on demand response resources; all inter- and intrastate gas pipelines remained in service; and behind-the-meter solar contributed more than expected.

Yeomans was especially complimentary of the state’s gas system, which he said was “very tight, but … it worked very well.”

“We’re laser-focused, in light of the Texas events of February 2021, on the performance of the gas system,” Yeomans said.

Local distribution companies and interstate pipeline companies issued many operational flow orders (OFOs) throughout the winter, Yeomans said. OFOs tell gas producers that they need to carefully balance their supply with demand on a daily or even hourly basis within a specified bandwidth; during winter, they’re most likely to be used to meet increased demand.

“Oh, this is good,” Yeomans said in reading off a bullet point in his presentation, which noted that in many cases, the notices were “‘issued with enough lead time before the day-ahead market closed to properly account for the impacts in the day-ahead market solution.’ So in other words, we greatly appreciate the gas industry to the extent that they predict very tight conditions or they think they’re going to declare hourly OFOs. … If they can get those out to their gas customers prior to the close of the day-ahead, that really helps our generators understand what the fuel situation is.”

Energy efficiency also helped. During his presentation, Yeomans displayed a graph showing that peak loads have trended downward even with comparable winter temperatures. For example, the peak loads during both the winter of 2007/08 and last winter occurred with temperatures around 15 F, but the peak load this year was nearly 2,000 MW lower.

New York is heavily dependent on gas generation. The state’s last coal plant shuttered March 31, 2020, and Indian Point closed a year later.

According to NYISO COO Rick Gonzales, gas prices for March 2022 were nearly double those of March 2021, while diesel prices were more than double, at $4.47/MMBtu and $27.02/MMBtu, respectively.

Those prices coincided with a near doubling of locational-based marginal prices for electricity: $56.78/MWh this March compared to $28.59/MWh last year. Energy sendout was only slightly higher compared to March 2021: 390 GWh/day compared to 381.

A stakeholder noticed that NYISO saw a spike in LBMPs during the last days of March. Yeomans said that the state experienced some unusual cold weather, “but you know, this Ukraine-Russia war … I think that was beginning to be impactful on LNG and oil prices, and it may be that gas prices followed.”

Fond Farewell to Yeomans

The MC meeting was the last for Yeomans, who retired at the end of last week. He was replaced by Aaron Markham, the former director of grid operations who was promoted in late February.

There are “very few times in life when you come across a person who is perfectly matched for the position that he or she held,” committee Chair Chris Wentlent, of the Municipal Electric Utilities Association of New York State, told Yeomans. “And in my mind, you fit that picture perfectly.”

The next MC meeting on May 25 will be held in person. Wentlent also reminded attendees to “book your hotel reservations” for the joint meeting of the committee and the Board of Directors on June 13.