CAISO on Thursday published its much-anticipated proposal to add a day-ahead market to its real-time Western Energy Imbalance Market as it tries to secure a larger share of a more regionalized Western energy landscape.

The extended day-ahead market (EDAM) plan covers key components, including transmission commitment, resource sufficiency evaluation and market-power mitigation.

“EDAM is a voluntary day-ahead electricity market with the potential to deliver significant economic, environmental, and reliability benefits for participants across the West,” CAISO said in the straw proposal. It “builds upon the proven ability of the Western Energy Imbalance Market (WEIM) to increase regional coordination, support state policy goals, and cost effectively meet demand.”

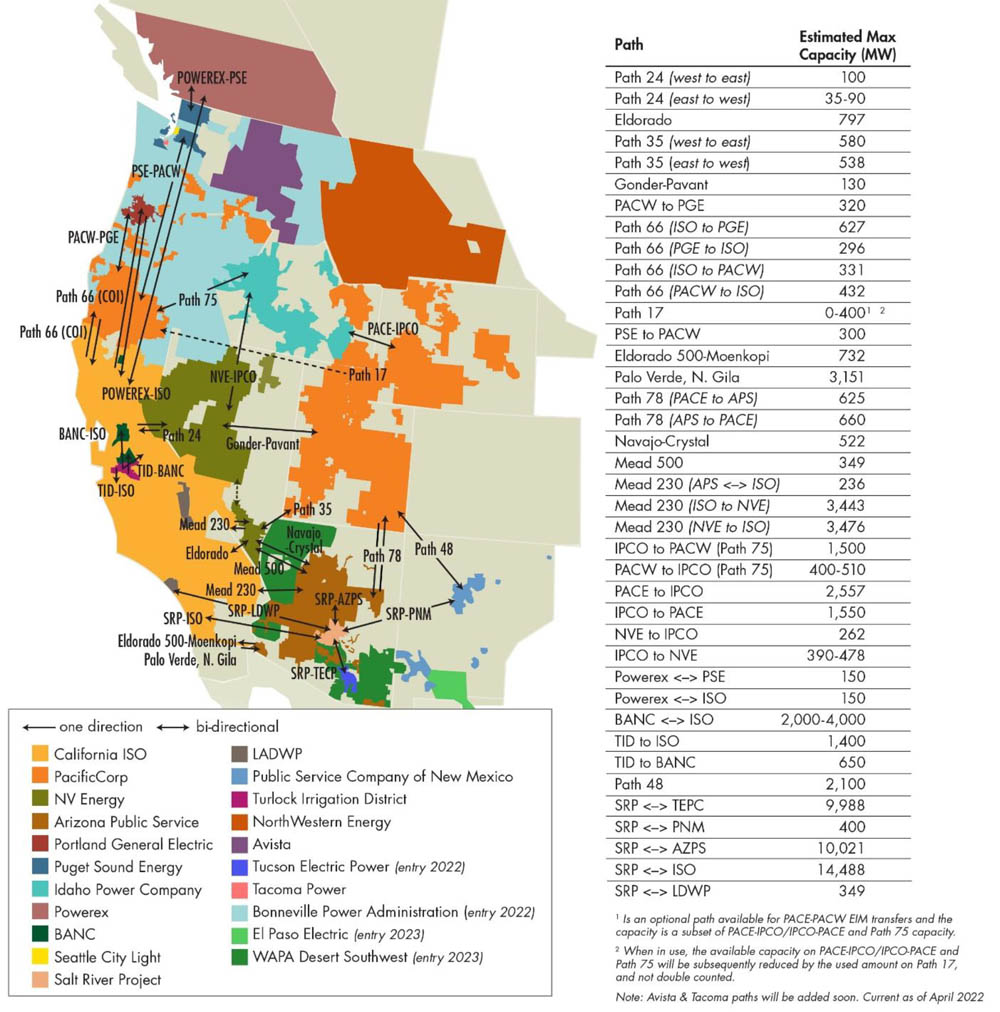

The WEIM recently surpassed $2 billion in cumulative benefits for participants since it went live in November 2014. It has 17 members and is expected to grow to 22 participants by 2023, its benefits keeping pace with participation, CAISO said. (See Western EIM Tops $2B in Benefits.)

CAISO is hoping that the WEIM’s growth record will attract new and current members to its day-ahead offering and fend off competition from SPP, which also has a real-time market — the Western Energy Imbalance Service (WEIS) — and is planning to start its own day-ahead market in the West as part of its Markets+ program, now under development. (See Western Utilities to Support SPP Market Development.)

The stakes in the CAISO-SPP day-ahead competition could be higher than in the real-time segment because real-time trades account for only about 5-10% of energy transactions in the Western Interconnection while the day-ahead market accounts for 40% or more of all transactions, according to WECC.

CAISO projects EDAM benefits, above those already seen in the WEIM, at $95 million to $400 million annually. The ability to trade greater amounts of renewable output and reduce curtailments as states transition from fossil fuels to clean energy is viewed as a primary benefit of the EDAM.

The day-ahead market will also promote reliability, a prime concern in the West, where resources have been spread thin during summer heat waves as fossil-fuel plants retire and weather-dependent wind and solar resources take their place.

“The EDAM will … enhance reliability across [its] footprint … through a robust resource sufficiency evaluation and an imbalance reserve product that accounts for a level of uncertainty … between the day-ahead and real-time [markets],” CAISO said.

The Western Power Pool’s Western Resource Adequacy Program (WRAP), covering much of the West, is aimed at the same problem — one of a number of current efforts to promote greater regional cooperation in the balkanized Western Interconnection.

Some FERC commissioners have urged the formation of one or more RTOs in the West, while CAISO and SPP have been developing their own regional market programs, including SPP’s planned RTO West. (See Changing Grid, State Policies Favor Western RTO.)

Key Components

After a pandemic hiatus, CAISO fast-tracked EDAM development starting last fall. Three stakeholder working groups met from January through mid-March to offer input on important design elements, and CAISO incorporated the groups’ results into Thursday’s straw proposal.

“First, voluntary participation is a key feature, as it is with the WEIM,” the straw proposal said. “This will allow for voluntary entry and exit, as well as resource participation.” Ensuring fair rates for EDAM participation and confidence in market transfers were additional “threshold features” determined by the stakeholder groups, CAISO said.

Transmission commitment was another must-have, the ISO said.

“An EDAM entity and its transmission customers will need to make transmission available for the market to commit supply optimally within the EDAM [balancing authority areas] and identify transfers between EDAM BAAs,” it said. “The proposal retains the transmission bucket concept previously put forward by WEIM entities, where high-quality firm or conditional firm transmission is made available to support transfers between EDAM BAAs.”

The proposal requires participants to pass a day-ahead resource sufficiency evaluation (RSE) to show they have enough supply to meet internal demand and reserve requirements to avoid “leaning” on the market for additional supply. Failure to pass the RSE could lead to transfer limits or an opportunity for the entity to cure the deficiency through residual supply for a fee.

Other elements of the straw proposal include:

- Integrated forward market (IFM) and residual unit commitment (RUC) would be “two primary processes of the day-ahead market,” CAISO said. “The IFM balances supply and demand, which results in optimized supply commitment schedules and identification of market transfers. The RUC process runs after the IFM and will procure incremental or decremental capacity, as a backstop to the IFM, to ensure there is sufficient physical capacity to meet demand in real-time.”

- Market power mitigation tools would ensure that, when supply is limited, “suppliers cannot exercise market power to influence prices at arbitrarily high levels,” it said. “As a starting point for consideration, we propose to extend the WEIM market power mitigation methodology for EDAM but seek stakeholder input on the need for potential enhancements to evaluate market power across groupings of BAAs, instead of individual BAAs [in the WEIM], to better account for dynamic constraints affecting the groupings.”

- Convergence bidding would allow submission of financial bids in the IFM that do not represent physical supply or demand, CAISO said. “Convergence bidding is a common feature of forward electricity markets and is designed to improve price convergence between the day-ahead and real-time market,” it said.

- External resource participation would let resources outside of the EDAM footprint offer supply into the market. “These resources may be pseudo-tied or dynamically scheduled into an EDAM BAA,” CAISO said. “We propose that economic bids and self-schedules continue to be supported in the EDAM.”

- Transfer revenue is the “settlement difference between the revenue paid to the import transfers and the cost charged to the export transfers,” CAISO said. “The ISO will distribute the transfer revenue to the EDAM entity that made the transmission available to the day-ahead market. The distribution of the transfer revenue between BAAs depends on the type of transmission used to facilitate the transfer at the transfer point. We are proposing a transmission settlement method to ensure each EDAM BAA is equitably compensated for releasing transmission capacity at each transfer point that is optimized in the day-ahead market.”

- For greenhouse gas (GHG) accounting and reporting, the EDAM proposal recommends two potential options: a “resource-specific bidding and attribution approach, an extension of the WEIM framework for GHG accounting, and the zonal approach, which allows resources to be reflected as internal to a GHG regulation area or utilizes a hurdle rate for transfers.”

“We are considering deploying the resource specific approach at the onset of EDAM because it is more developed and better aligned with the WEIM design,” CAISO said.

The 37-page straw proposal goes into greater detail on these elements and more. A stakeholder meeting on the proposal is scheduled for May 25-26, both in-person at CAISO headquarters, in Folsom, Calif., and via a virtual option.