Higher operating costs tied to an increase in winter storms drove down Duke Energy’s first-quarter earnings despite an uptick in revenues from increased demand for both power and natural gas.

Duke on Monday reported first-quarter earnings of $1.08/share compared with first-quarter 2021 earnings of $1.25/share. Total revenues for the quarter were $7.1 billion, a 16% increase from $6.1 billion in the first three months of 2021.

The cost of coal ash cleanup in Indiana cost the company about $250 million. Severe winter storms in the Carolinas were the primary expense drivers. The storms alone reduced earnings per share by 7 cents, the company said.

Duke fielded crews of nearly 19,000 employees to restore power to more than 1 million customers after a series of winter storms, the highest number in eight years, swept through the region.

Duke Energy CEO Lynn Good | Duke Energy

Duke Energy CEO Lynn Good | Duke Energy

CEO Lynn Good said despite the increase in expenses for storm restoration operations in the first quarter, the company is reaffirming its full-year earnings guidance range of $5.30 to $5.60/share, with a midpoint of $5.45.

“We’re also reaffirming our long-term EPS growth rate of 5 to 7% through 2026, at the midpoint of our original 2021 guidance range,” Good told analysts at the start of the company’s earnings call. “We’re monitoring economic trends and will take action if necessary as we continue to execute the important strategic work we have underway in the Carolinas, Indiana and Florida.”

Good said the company will file its long-term carbon-reduction emissions plan with the North Carolina Utilities Commission on May 16.

The plan, in accordance with legislation (H.B. 951) passed a year ago, will lay out how Duke will lower carbon emissions by 70% by 2030 compared to 2005 levels and achieve net-zero emissions by 2050. Once approved, the plan must be updated every two years.

“The plan will outline multiple portfolios to achieve the 70% carbon-reduction target, including proposals around timing of coal plant retirements and resource additions,” Good said.

“We expect substantial solar and battery additions, demand-side management and energy efficiency opportunities in every pathway. Onshore and offshore wind will be presented for consideration, as well as small modular nuclear reactors. Each portfolio has been rigorously tested for reliability and affordability for our customers.”

The company is planning to file a rate case in North Carolina, as permitted by H.B. 951.

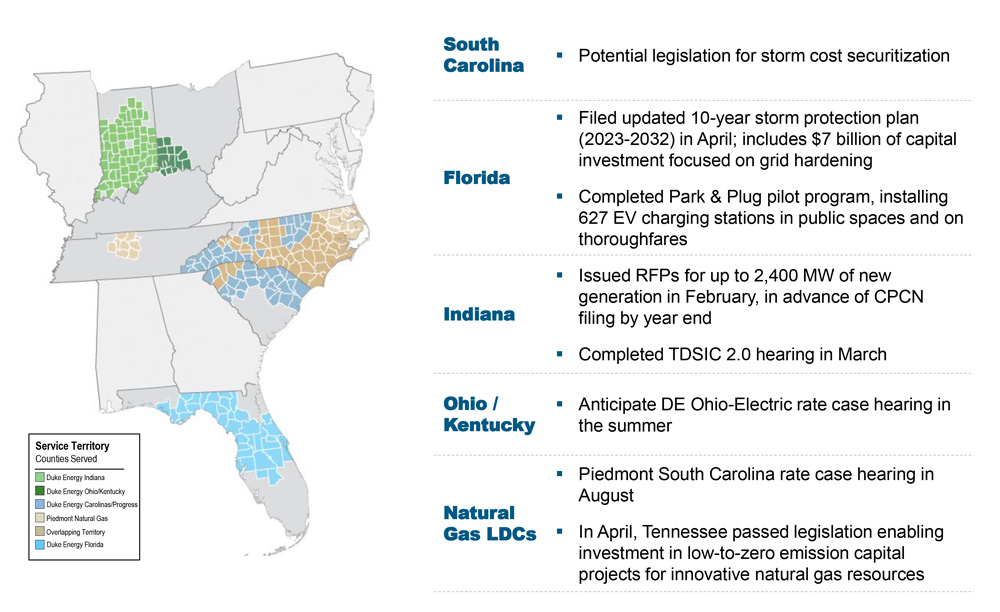

Duke Energy provided investors with a summation of upcoming regulatory issues, including a long-term $7 billion “grid hardening” investment in Florida and up to 2,400 MW of new generation in Indiana. | Duke Energy

Duke Energy provided investors with a summation of upcoming regulatory issues, including a long-term $7 billion “grid hardening” investment in Florida and up to 2,400 MW of new generation in Indiana. | Duke Energy

In Florida, Duke is committed to spending $7 billion over the next 10 years, including measures to harden the grid to resist storm damage.

And in Indiana, the company has proposed building 2,400 MW of new generation, including 1,100 MW of renewables and 1,300 MW of “dispatchable generation,” including new gas turbine power plants and batteries, before it can close its remaining coal plants.